Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration is a process by which the court reviews the final accounting of a decedent's assets in an estate. The court reviews the accounting to ensure that the estate has been properly administered and that the assets have been properly distributed. The court must approve the accounting before the estate can be closed. There are two types of Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration: (1) full and public administration and (2) limited and private administration. In full and public administration, the court reviews the accounting and all interested parties must be given notice of the hearing. In limited and private administration, the court reviews the accounting but only those parties with an immediate interest in the estate are given notice of the hearing.

Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration

Description

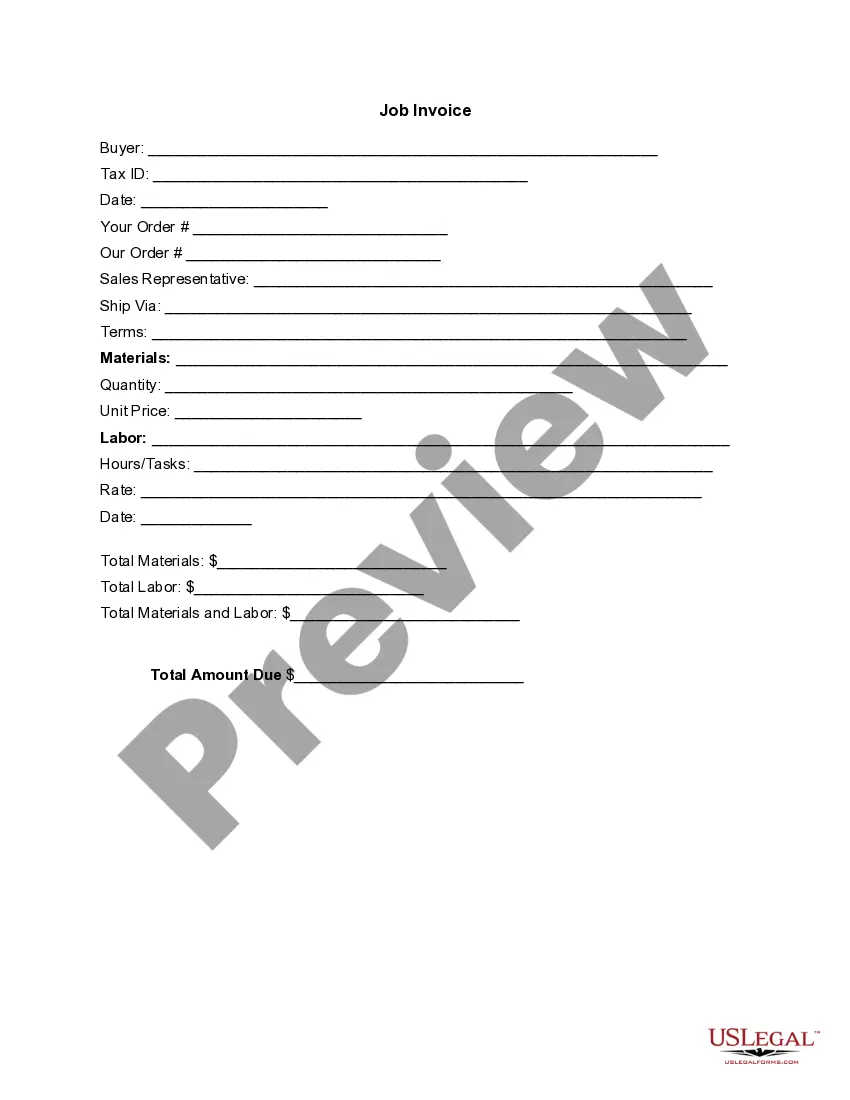

How to fill out Illinois Receipt And Approval On Closing Of Decedents Estate In Independent Administration?

How much effort and resources do you frequently allocate to crafting official documentation.

There is a superior method to obtain such forms than employing legal experts or squandering hours exploring the internet for an appropriate template.

Another benefit of our service is that you can access previously downloaded documents that you safely store in your profile in the My documents tab. Retrieve them anytime and redo your paperwork as often as needed.

Conserve time and energy preparing official paperwork with US Legal Forms, one of the most reliable online services. Join us today!

- Browse the form details to ensure it satisfies your state's stipulations. To do this, review the form description or utilize the Preview option.

- If your legal template does not fulfill your needs, search for another one using the search bar located at the top of the page.

- If you already possess an account with us, Log In and download the Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration. If not, continue to the following steps.

- Click Buy now when you locate the appropriate blank. Choose the subscription plan that best fits your needs to access our library’s complete service.

- Register for an account and pay for your subscription. You can make a payment using your credit card or through PayPal - our service is entirely dependable for that.

- Download your Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration onto your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

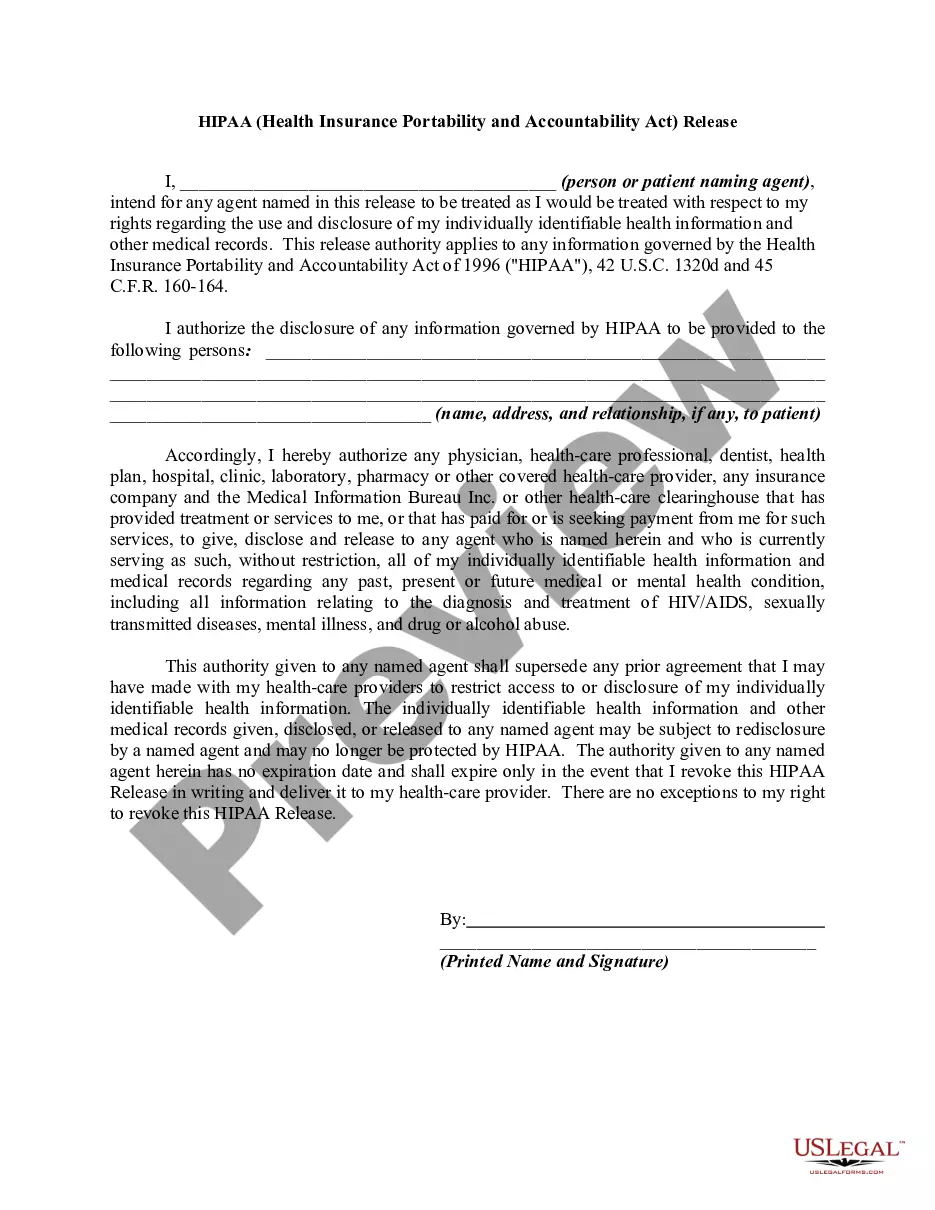

Broadly speaking, independent administration means that the executor or administrator will not have to obtain court orders or file estate papers in court during probate, unless specifically ordered to do so ? generally, because an interested person asks the court to become involved, or because the decedent's will

For example, an independent administrator can pay debts, sell assets, and transfer title to estate property without court permission. The independent administrator must, in most Illinois probate courts, retain an Illinois probate attorney to represent them in the administration process.

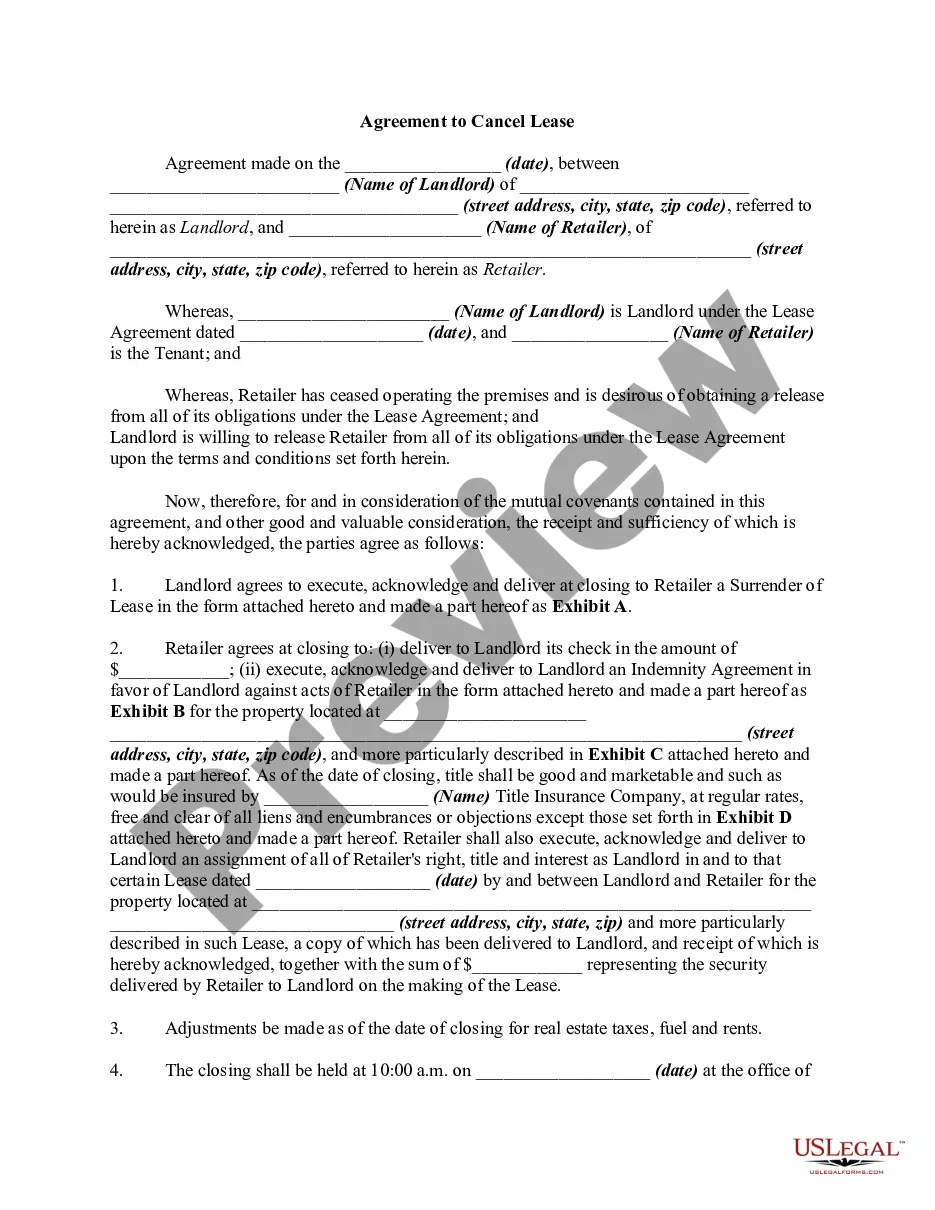

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

What is the Difference Between an Executor and an Administrator in Illinois? An Executor is the individual named in a Will to serve as the representative of the Estate. An Administrator is an interested party to an estate who petitions the Probate Court to serve as the Estate representative in the absence of a Will.

If a person dies leaving a valid will, and the will names a person who is to execute the will and administer the estate, this person is called an executor. However, when the person in charge of administering the estate is not named in a will, that person is called an administrator.

This means that the executor or administrator will not have to obtain court orders or file estate documents in court during probate. The estate will be administered without court supervision, unless an interested person asks the court to become involved.

Closing of an Illinois Probate Estate The executor must file a final accounting with the court showing how estate assets were handled. The accounting will list the assets, possible income the estate generated, the amount paid for any debts or other expenses, and the distributions made to beneficiaries.

On average, probate in Illinois takes no less than twelve months. The probate process must allow time for creditors to be notified, filing of required income tax returns, and the resolution of any disputes. Creditors must file any claims against the estate within six months of notification.