Illinois Notification of Cancellation or Dissolution of Business for Cook County

Description

How to fill out Illinois Notification Of Cancellation Or Dissolution Of Business For Cook County?

Searching for Illinois Notification of Cancellation or Dissolution of Business for Cook County templates and completing them can be rather challenging.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the suitable template specifically for your state in just a few clicks.

Our attorneys craft all documents, so you only need to complete them. It's truly that simple.

Now you can either print the Illinois Notification of Cancellation or Dissolution of Business for Cook County form or fill it out using any online editor. Don’t be concerned about typos because your form can be used and submitted, and printed out as many times as you wish. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Access your account via Log In and revisit the form's webpage to save the sample.

- Your downloaded templates are kept in My documents and are available at all times for later use.

- If you haven’t registered yet, you will need to sign up.

- Review our detailed instructions on how to obtain your Illinois Notification of Cancellation or Dissolution of Business for Cook County form in just a few minutes.

- To obtain a qualified example, verify its suitability for your state.

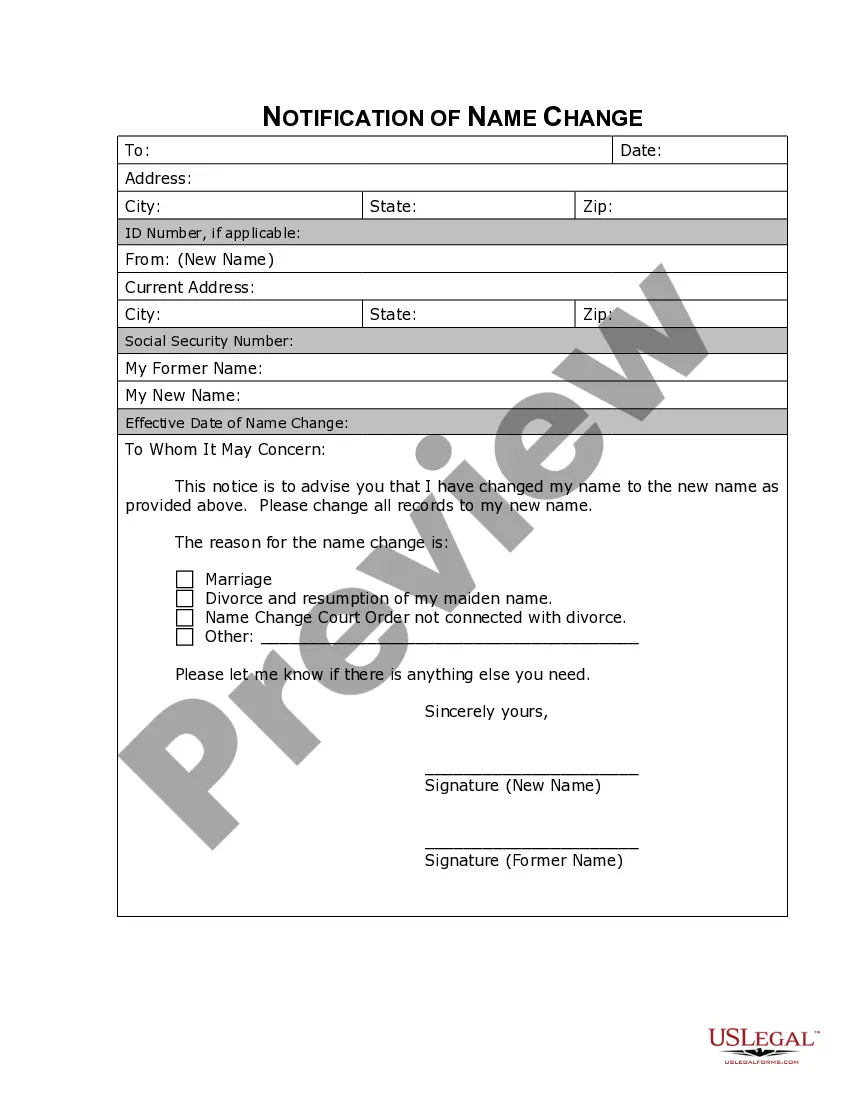

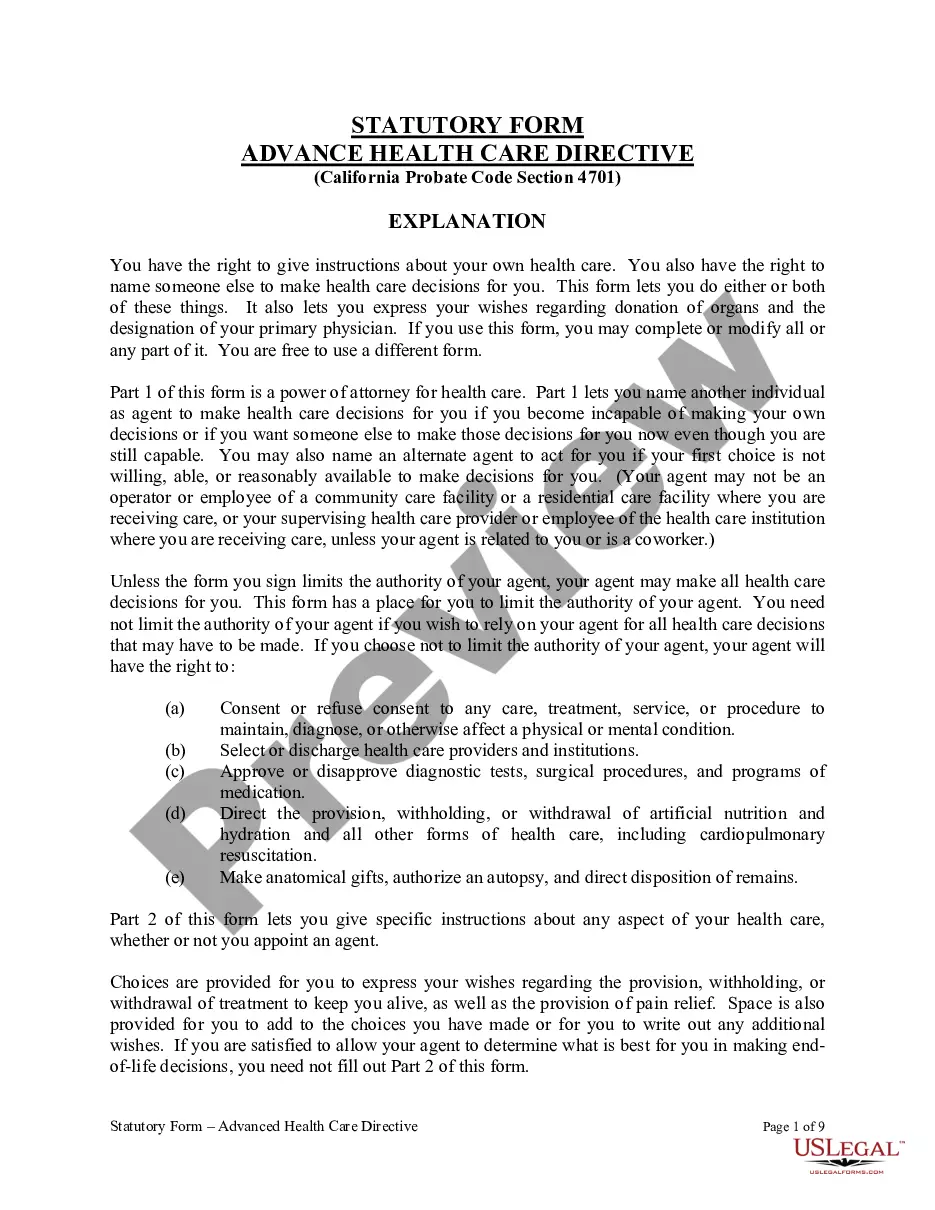

- Examine the example using the Preview function (if it’s available).

- If there’s a description, read it to grasp the details.

- Click Buy Now if you found what you're looking for.

- Select your plan on the pricing page and create your account.

- Select whether you wish to pay with a card or via PayPal.

- Download the form in your preferred format.

Form popularity

FAQ

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock.

File final tax returns and terminate your EIN. File the required dissolution documents. Settle any remaining tax liabilities and other debts. Sell any remaining inventory, property, and other assets. Cancel any remaining insurance policies, licenses, or permits.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

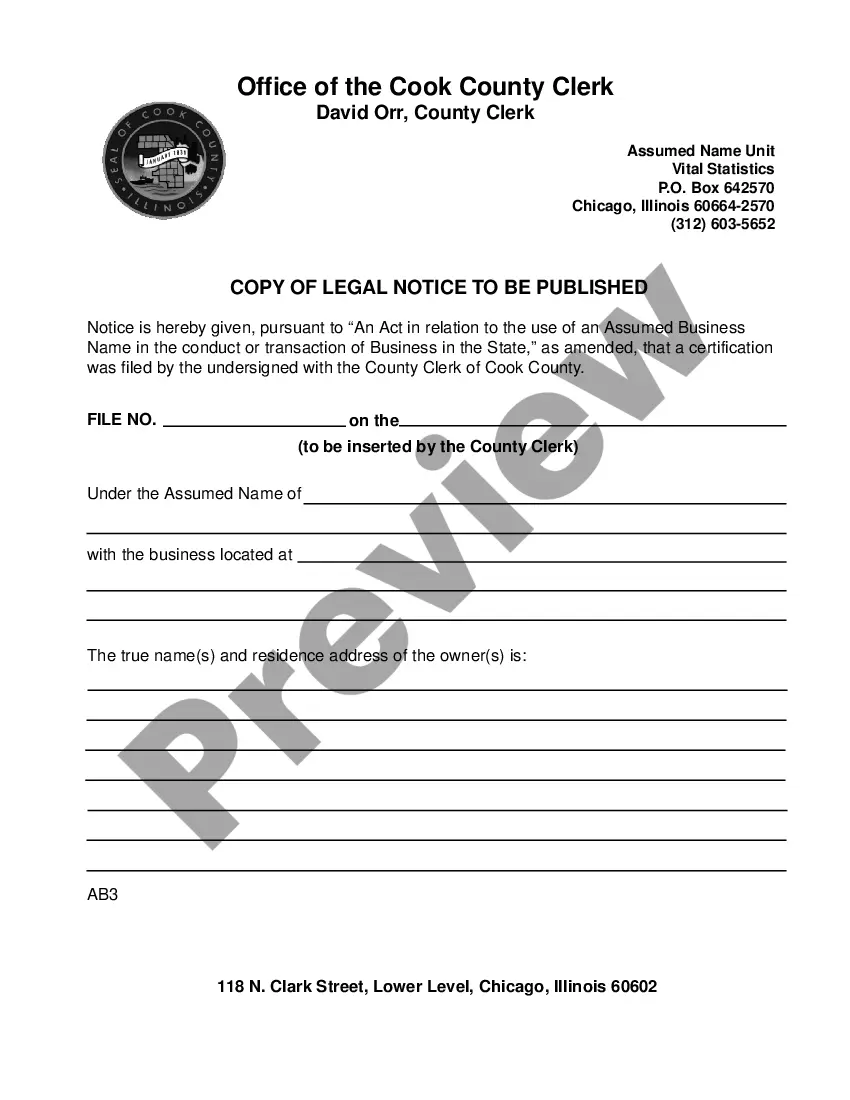

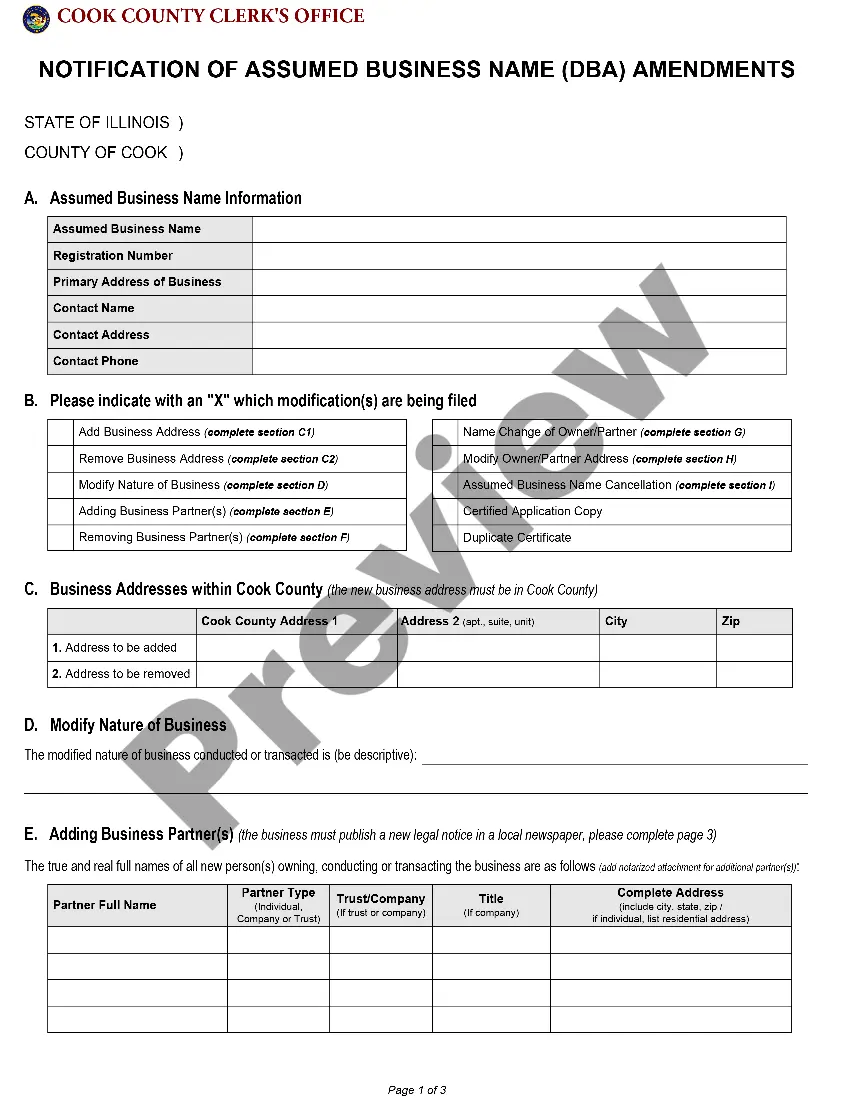

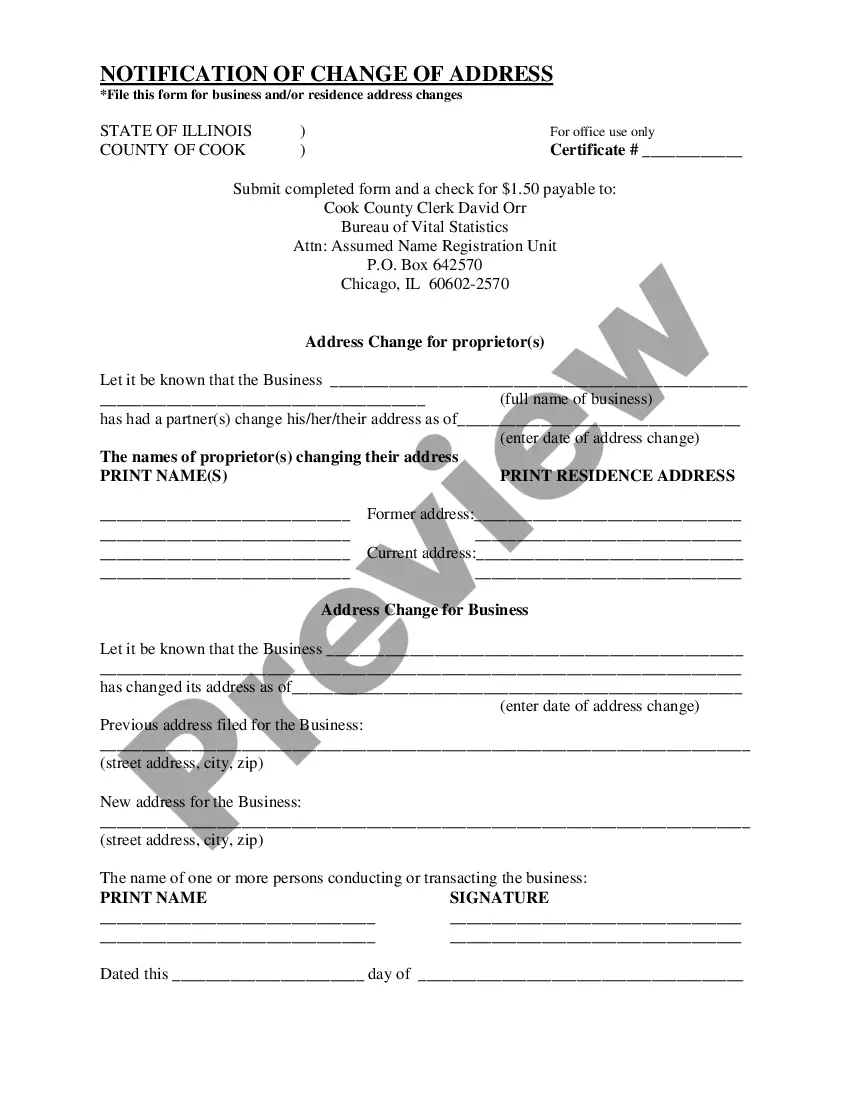

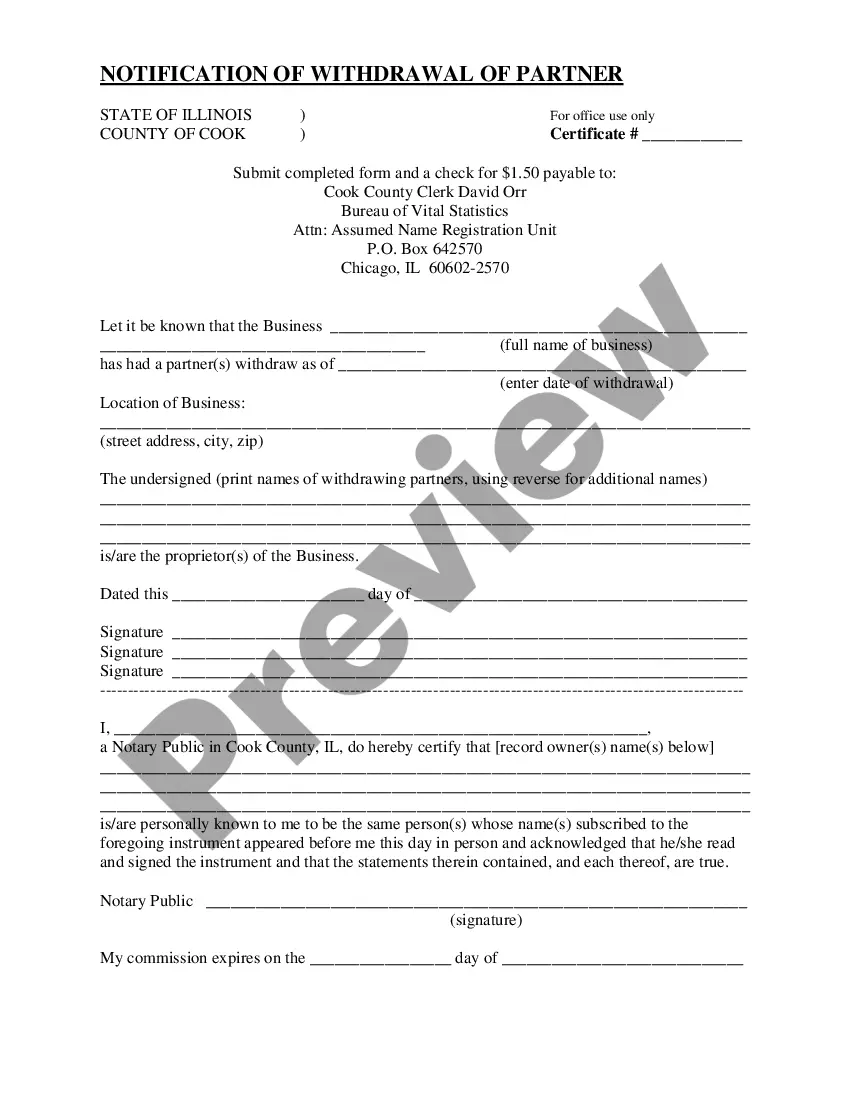

Step 1 Obtain the Form. The Assumed Business Name form is available from the County Clerk's office. Step 2 Fill out the Form. Information that is commonly requested includes: Step 3 Legal Notice Publication. Step 4 Submit Application.

Step 1: Hold a Board Meeting and Seek Shareholder Approval. Step 2: File a Certificate of Dissolution with the Secretary of State. Step 3: Notify the Internal Revenue Service and Other Taxing Authorities. Step 4: Formal Notice of Dissolution. Step 5: Settle Claims with Creditors.

File final tax returns and terminate your EIN. File the required dissolution documents. Settle any remaining tax liabilities and other debts. Sell any remaining inventory, property, and other assets. Cancel any remaining insurance policies, licenses, or permits.

File the Articles of Dissolution with the Illinois Secretary of State. Fulfill all tax obligations with the state of Illinois, as well as with the IRS. Cancel any relevant licenses and permits, along with closing your business bank account. Notify customers, vendors, and creditors of your dissolution.