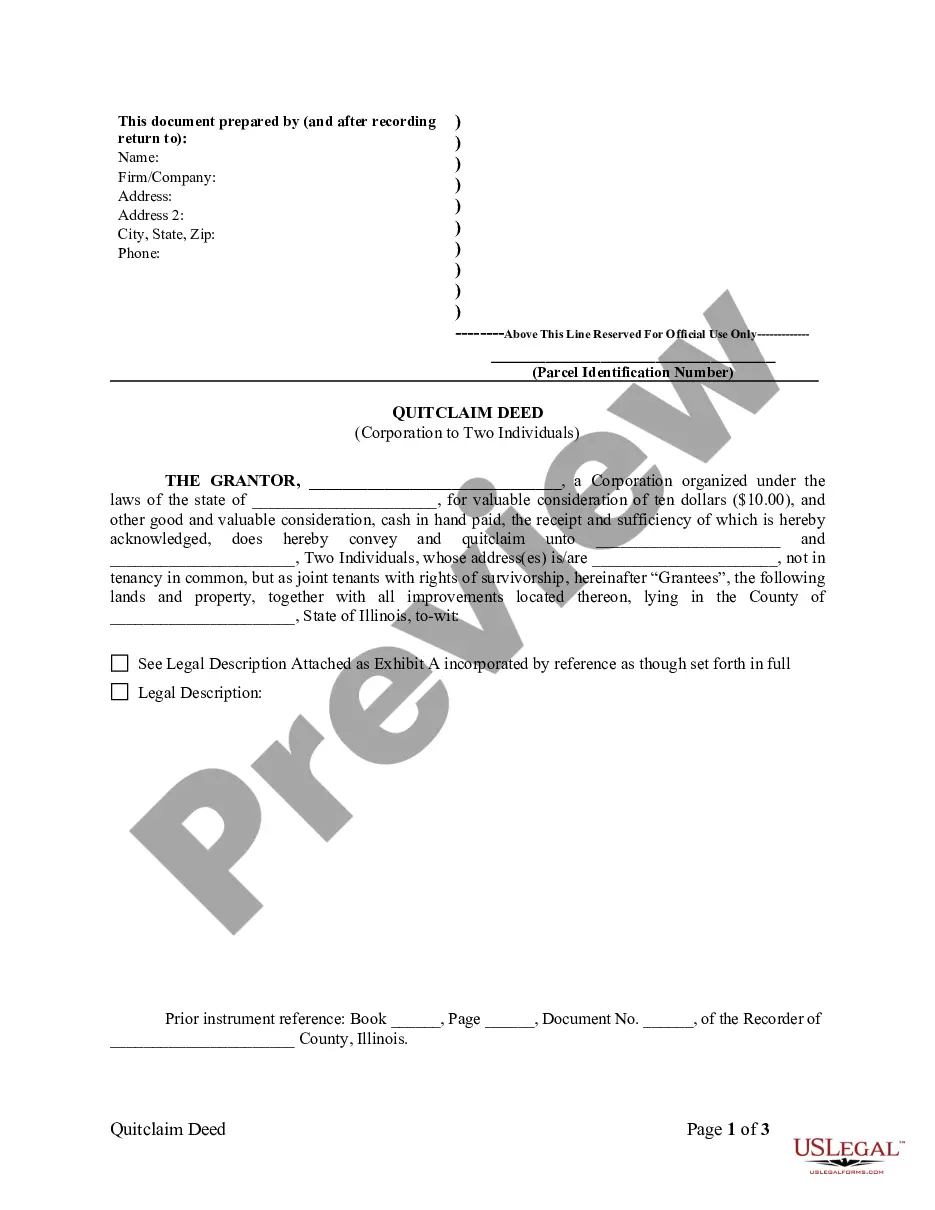

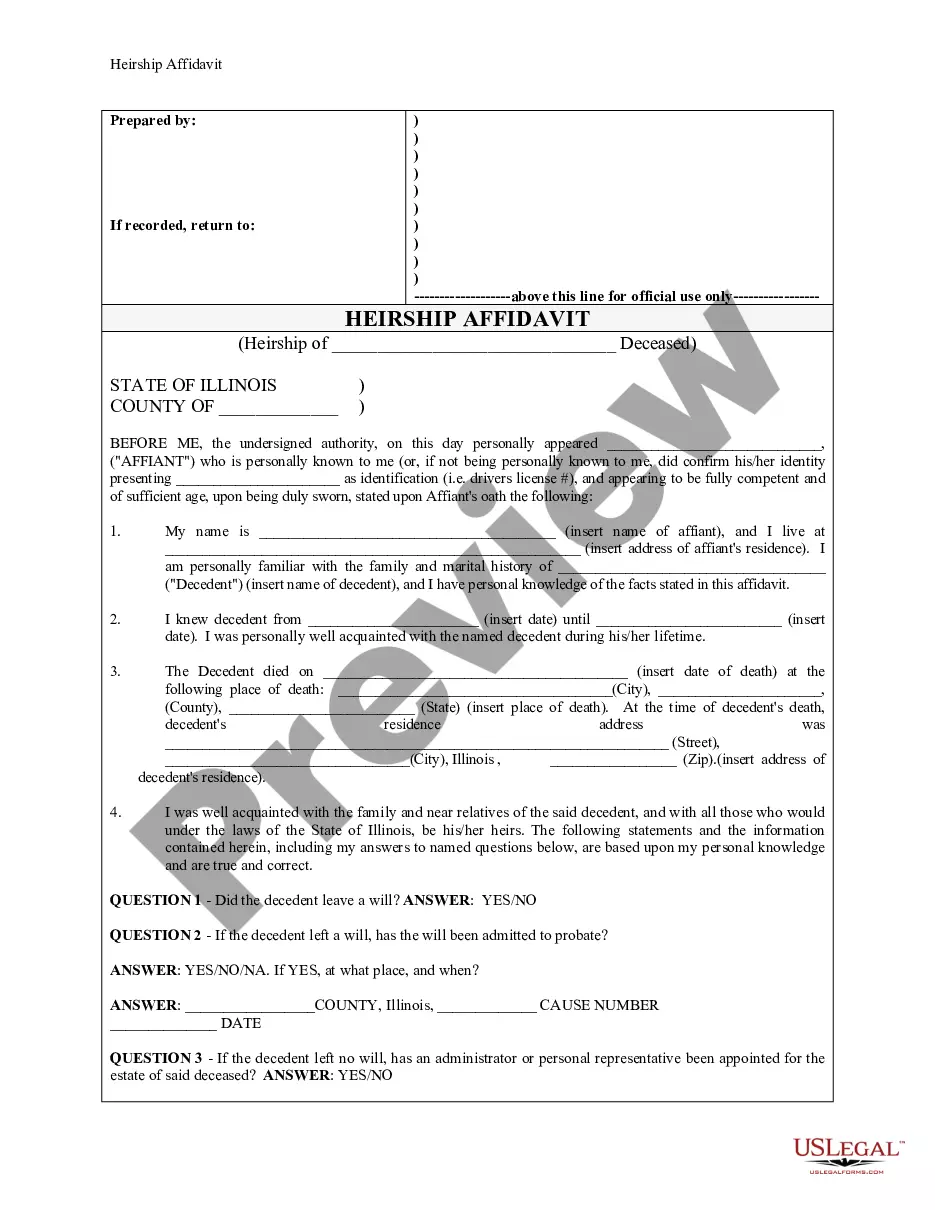

Illinois Quitclaim Deed from Corporation to Two Individuals

Description

How to fill out Illinois Quitclaim Deed From Corporation To Two Individuals?

Locating Illinois Quitclaim Deed from Corporation to Two Individuals templates and completing them can be quite challenging.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It's incredibly straightforward.

Now you can print the Illinois Quitclaim Deed from Corporation to Two Individuals form or complete it using any online editor. Don’t stress about making errors because your form can be used, submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Access your account with Log In and return to the form's section to download the document.

- Your saved templates are stored in My documents and can be retrieved anytime for future use.

- If you haven't registered yet, you must sign up.

- Follow our detailed instructions on how to obtain your Illinois Quitclaim Deed from Corporation to Two Individuals template in a few minutes.

- To acquire a legitimate template, verify its applicability for your state.

- View the template using the Preview option (if available).

- If there’s a description, read it to understand the details.

- Click on the Buy Now button if you found what you are looking for.

- Select your subscription plan on the pricing page and create your account.

- Choose your payment method by credit card or PayPal.

- Download the document in your preferred format.

Form popularity

FAQ

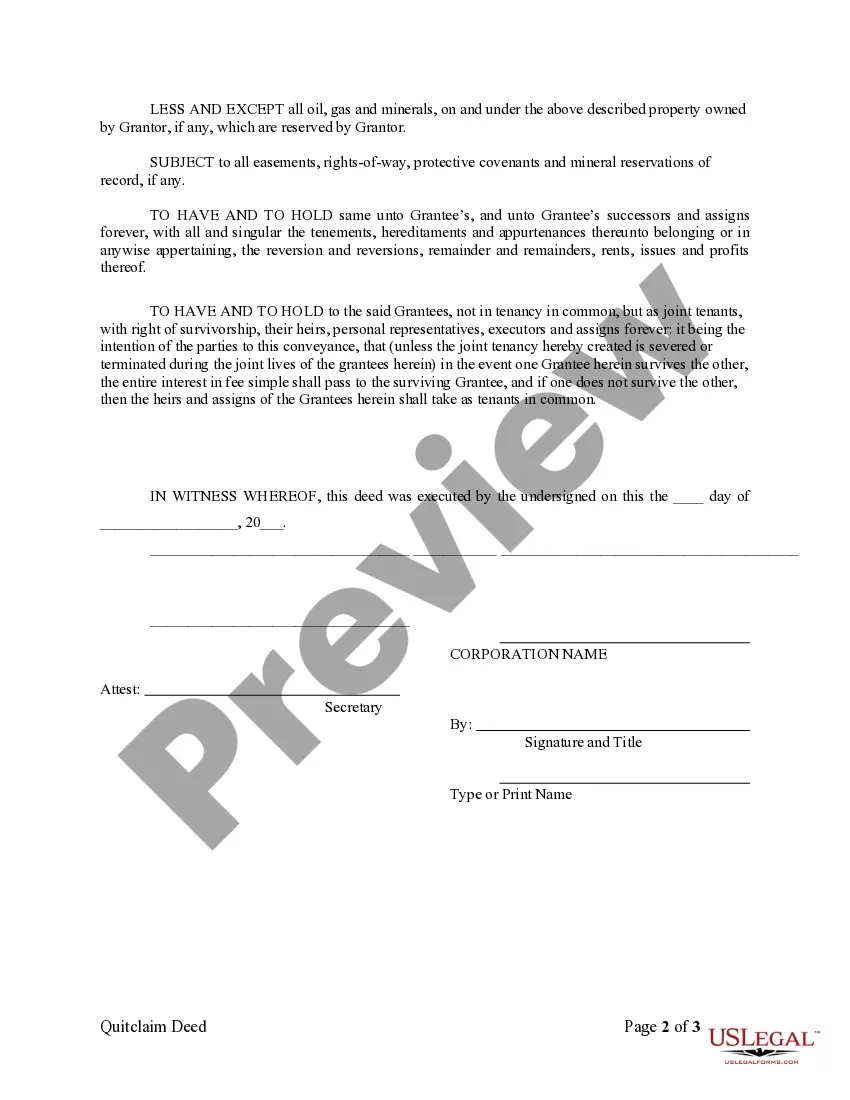

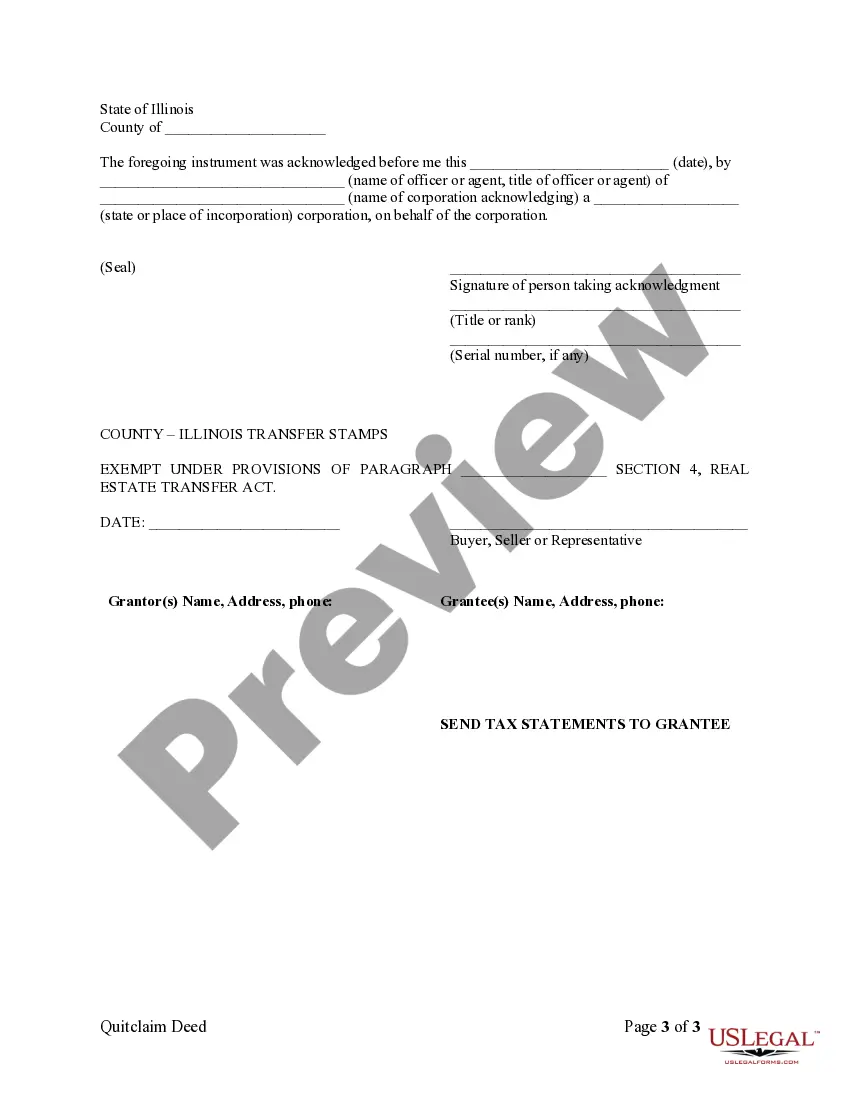

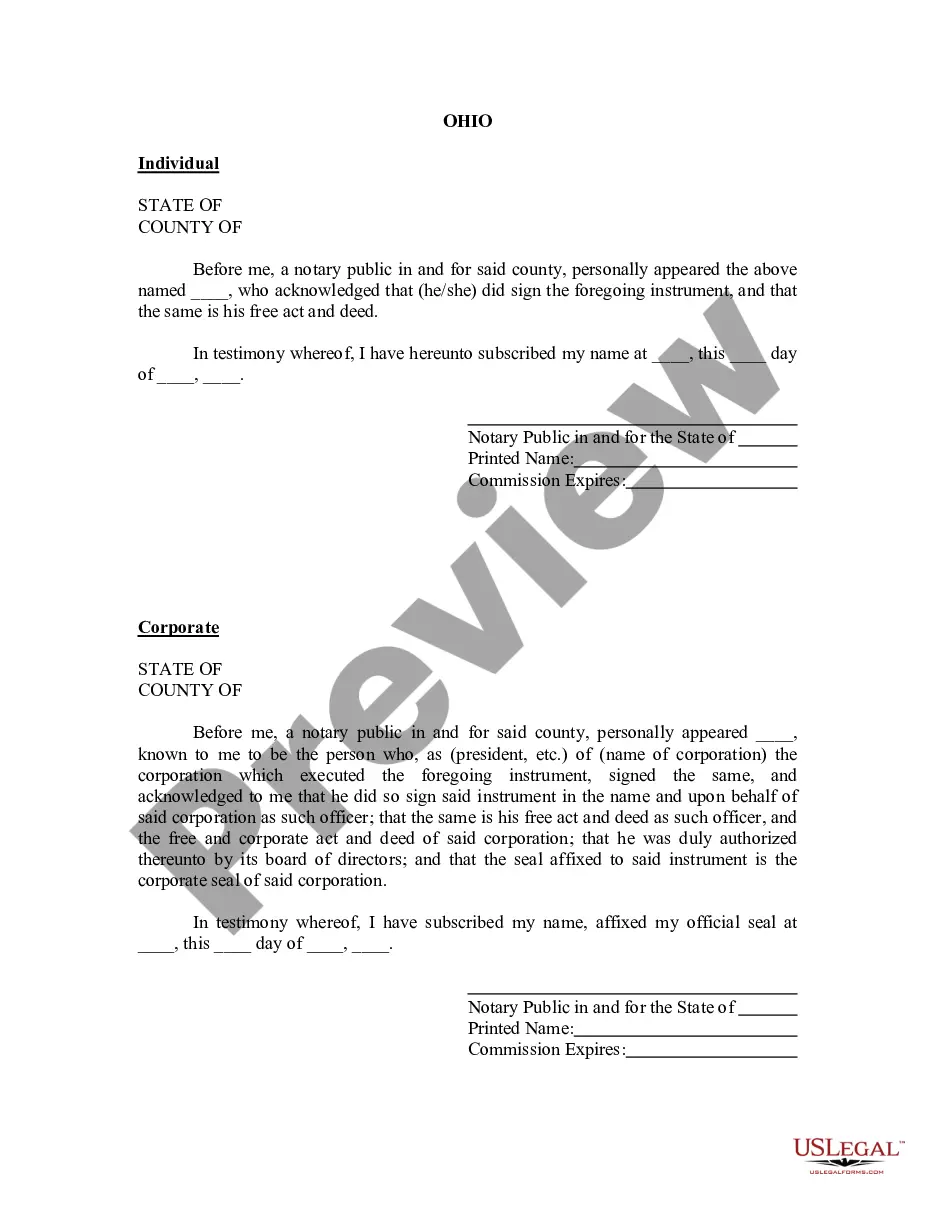

Only the party transferring the property, known as the grantor, must sign the quitclaim deed to make it valid. The parties receiving the deed, known as the grantees, do not have to sign but should acknowledge the deed for their records. This simplicity in process is one of the reasons people opt for an Illinois Quitclaim Deed from Corporation to Two Individuals.

While it is not always necessary for both parties to be present when signing a quitclaim deed, it is recommended for clarity and assurance. The grantor must sign the deed in front of a notary, but the grantees do not always have to be present. However, facilitating the process with both parties helps ensure a smooth transaction involving an Illinois Quitclaim Deed from Corporation to Two Individuals.

One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

When you need to transfer ownership of a property quickly and relatively easily, filing a quit claim deed is one option. A quit claim deed transfers the legal ownership of the property from one party to another, and doesn't require attorneys or legal help, unless you choose to consult an attorney.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

An unrecorded quit claim deed is still valid.Failure to record a deed could render transfer or mortgaging of the property impossible and create numerous legal difficulties. The purpose of the recording a quit claim deed is to give notice to the world that there has been a change in ownership.

A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.A quitclaim deed requires trust on the part of the person receiving the deed, because the person transferring it, also known as the grantor, isn't guaranteeing they actually own the property.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Once a quitclaim is signed and recorded, can the deed be challenged in court? Yes, it can. Recording your deed only provides notice of your ownership claim to the public. It does not guarantee ownership.