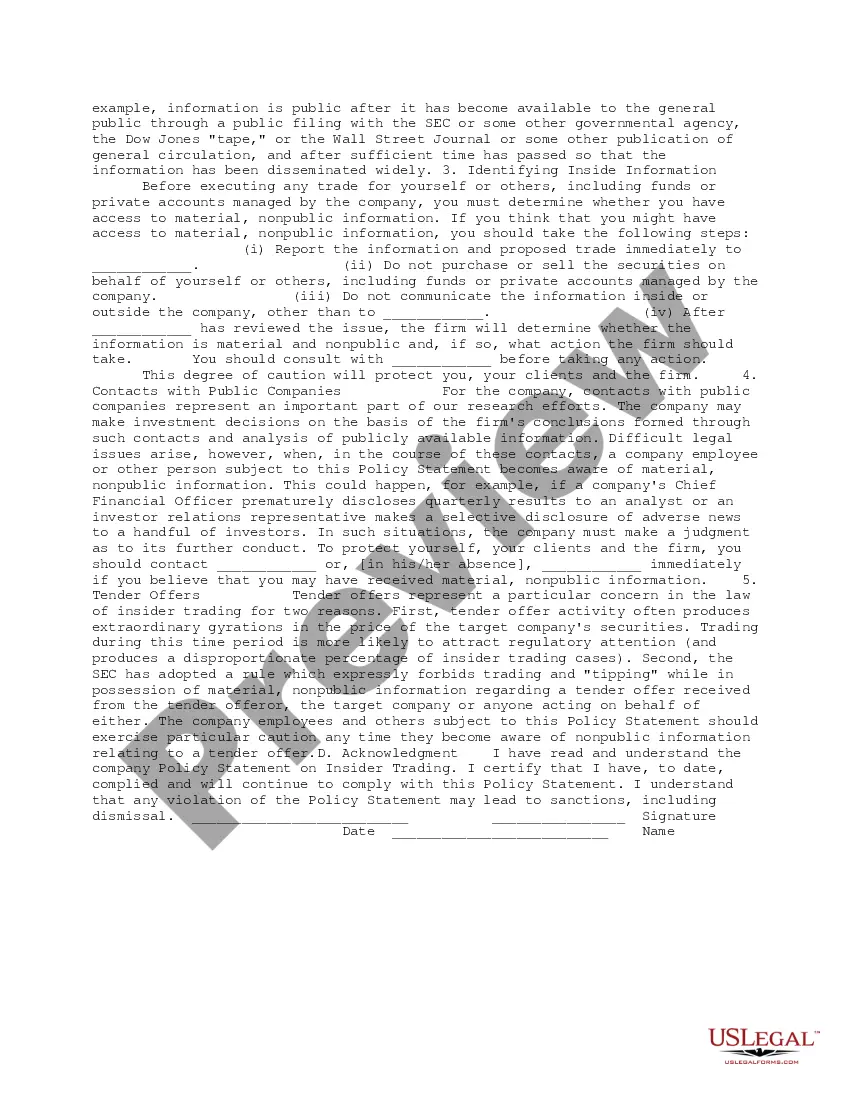

This Policy Statement implements procedures to deter the misuse of material, nonpublic information in securities transactions. The Policy Statement applies to securities trading and information handling by directors, officers and employees of the company (including spouses, minor children and adult members of their households).

Idaho Policies and Procedures Designed to Detect and Prevent Insider Trading

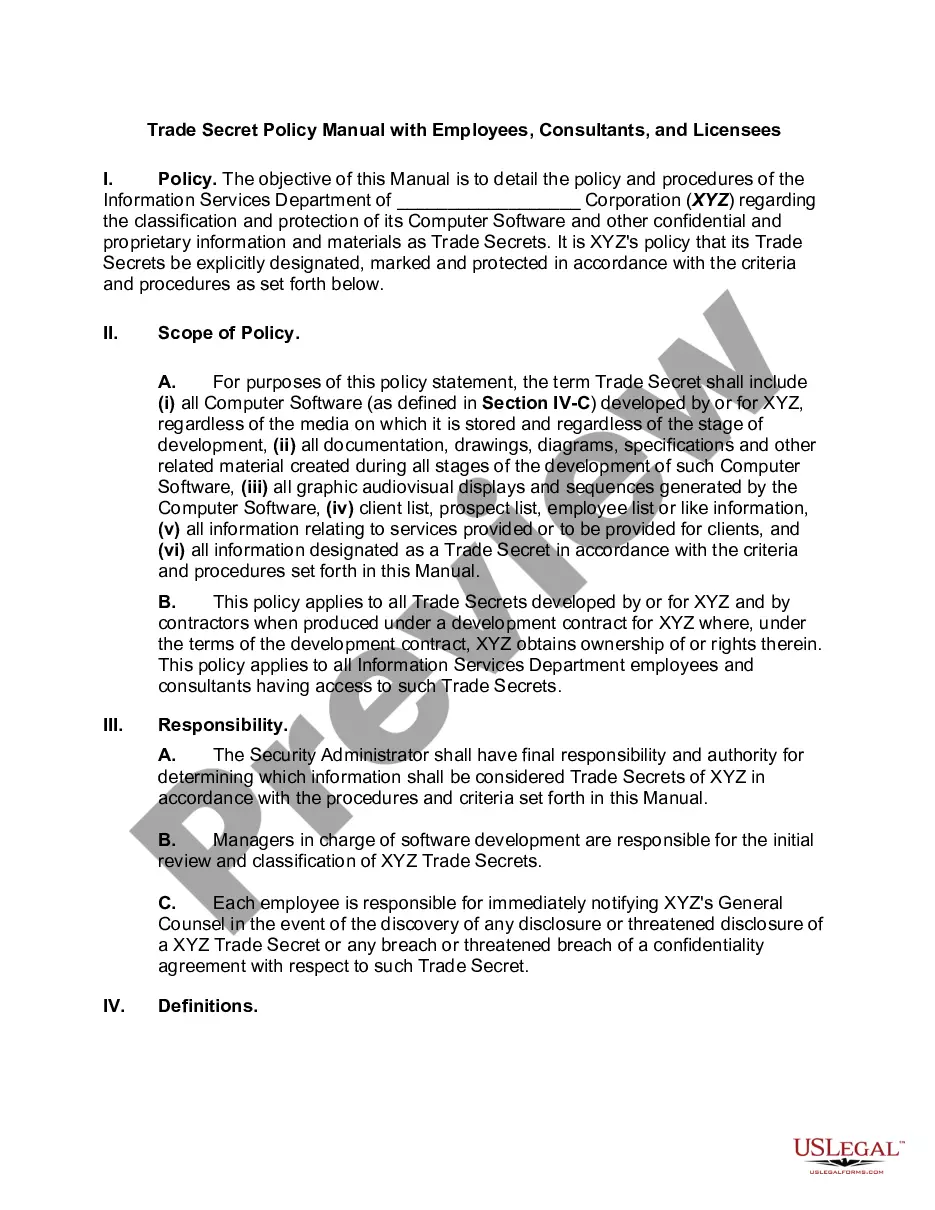

Description

How to fill out Policies And Procedures Designed To Detect And Prevent Insider Trading?

Are you currently within a situation where you need to have documents for either enterprise or person purposes just about every day time? There are plenty of legal record web templates available online, but discovering kinds you can rely isn`t easy. US Legal Forms offers a huge number of develop web templates, such as the Idaho Policies and Procedures Designed to Detect and Prevent Insider Trading, which are composed to fulfill federal and state requirements.

If you are previously informed about US Legal Forms internet site and also have a merchant account, merely log in. Next, you may down load the Idaho Policies and Procedures Designed to Detect and Prevent Insider Trading format.

Should you not provide an profile and want to begin using US Legal Forms, follow these steps:

- Discover the develop you need and make sure it is for the correct town/region.

- Use the Review key to analyze the form.

- See the information to actually have selected the correct develop.

- In the event the develop isn`t what you are looking for, take advantage of the Search industry to discover the develop that meets your requirements and requirements.

- When you obtain the correct develop, click on Purchase now.

- Opt for the rates plan you would like, complete the required information and facts to generate your bank account, and pay for your order using your PayPal or bank card.

- Select a hassle-free document structure and down load your backup.

Discover every one of the record web templates you possess bought in the My Forms food selection. You can obtain a additional backup of Idaho Policies and Procedures Designed to Detect and Prevent Insider Trading any time, if possible. Just go through the needed develop to down load or produce the record format.

Use US Legal Forms, by far the most substantial selection of legal kinds, to conserve some time and avoid blunders. The support offers skillfully produced legal record web templates which you can use for a range of purposes. Create a merchant account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

SEC Rule 10b-5 prohibits corporate officers and directors or other insider employees from using confidential corporate information to reap a profit (or avoid a loss) by trading in the Company's stock. This rule also prohibits ?tipping? of confidential corporate information to third parties.

Insider trading by a designated person or their close associates is forbidden at all times. ing to SEBI laws, a Designated Person who buys or sells any number of the company's stocks may not engage in a contrary transaction within 6 months of the date.

Federal and state securities laws prohibit the purchase or sale of a company's securities by anyone who is aware of material information about that company that is not generally known or available to the public.

Illegal Insider Trading For example, suppose the CEO of a publicly traded firm inadvertently discloses their company's quarterly earnings while getting a haircut. If the hairdresser takes this information and trades on it, that is considered illegal insider trading, and the SEC may take action.

Insider trading refers to the practice of purchasing or selling a publicly-traded company's securities while in possession of material information that is not yet public information.

If any Designated Person contravenes any of the provisions of the Insider Trading Code / SEBI Regulations, such Designated Person will be liable for appropriate penal actions in ance with the provisions of the SEBI Act, 1992. The minimum penalty under the SEBI Act, 1992 is Rs. 10 Lakhs, which can go up to Rs.

Insider trading is deemed illegal when the material information is still non-public and comes with harsh consequences, including potential fines and jail time. Material non-public information is defined as any information that could substantially impact that company's stock price.

On December 14, 2022, the Securities and Exchange Commission (the ?Commission?) adopted amendments to Rule 10b5-1 under the Securities Exchange Act of 1934 (the ?Exchange Act?), which provides affirmative defenses to trading on the basis of material nonpublic information in insider trading cases.