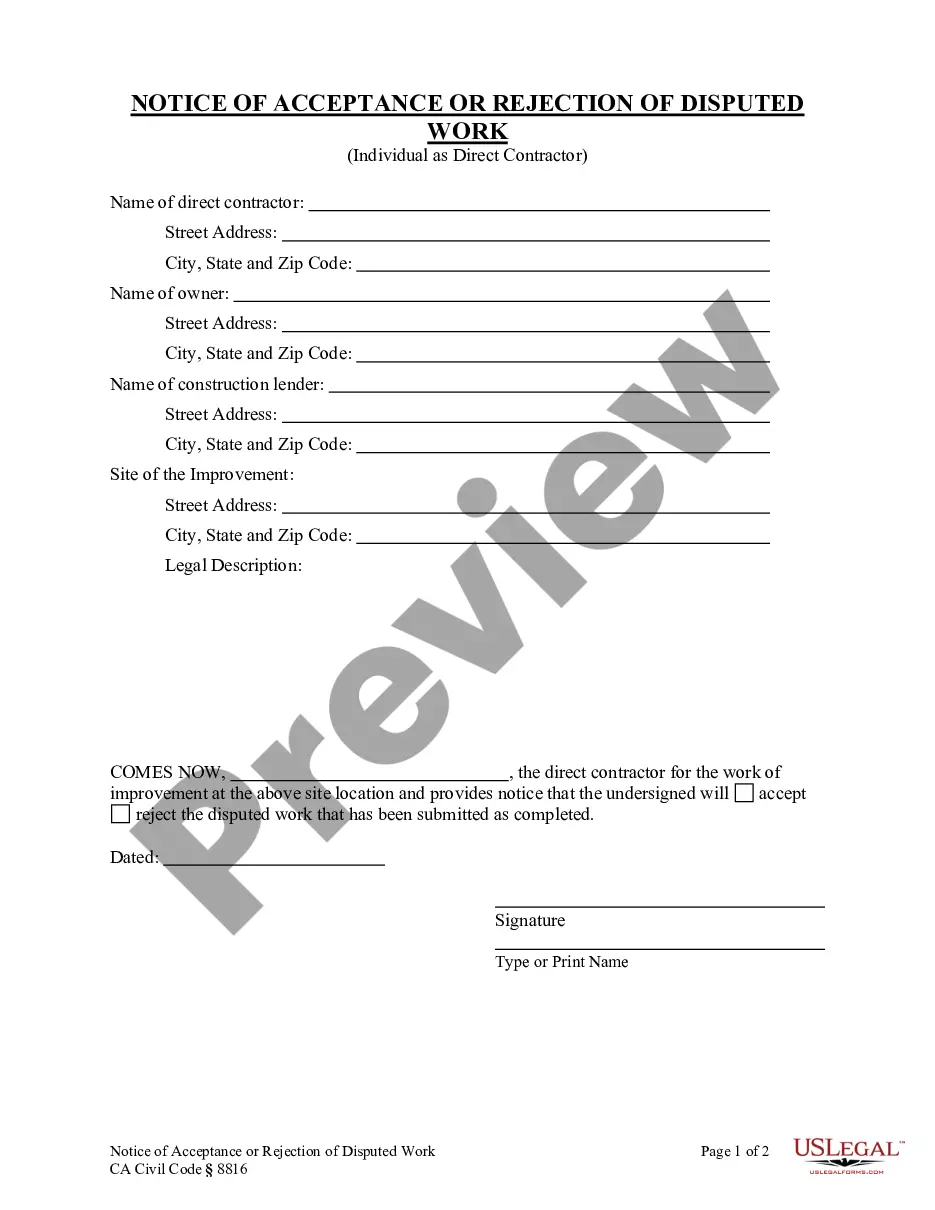

This office lease form is a tenant's letter of credit to the owner in the place of a security deposit. The letter of credit maintains effect at all times during the term of the lease following delivery thereof. A clean, unconditional and irrevocable letter of credit shall have an expiration date no earlier than the first anniversary of the date of issuance and shall provide that it shall be automatically renewed from year to year unless terminated by a bank by notice to the owner. The final expiration date of the letter of credit (including any renewals) shall be no earlier than sixty days after expiration date of lease.

Idaho Tenant Letter of Credit in Lieu of a Security Deposit

Description

How to fill out Tenant Letter Of Credit In Lieu Of A Security Deposit?

Choosing the right lawful papers format could be a have difficulties. Of course, there are a lot of web templates available on the Internet, but how will you find the lawful kind you want? Use the US Legal Forms site. The services delivers a large number of web templates, such as the Idaho Tenant Letter of Credit in Lieu of a Security Deposit, which you can use for enterprise and personal needs. All the forms are examined by experts and meet federal and state needs.

If you are previously signed up, log in in your accounts and click the Down load switch to find the Idaho Tenant Letter of Credit in Lieu of a Security Deposit. Use your accounts to check throughout the lawful forms you might have purchased in the past. Check out the My Forms tab of your accounts and obtain one more backup in the papers you want.

If you are a new user of US Legal Forms, listed here are simple recommendations that you can stick to:

- Initially, make certain you have chosen the right kind for your personal area/county. It is possible to look through the shape using the Review switch and look at the shape description to make sure this is the right one for you.

- In the event the kind will not meet your requirements, utilize the Seach area to find the correct kind.

- Once you are certain that the shape is proper, click on the Get now switch to find the kind.

- Pick the prices plan you would like and enter the required info. Make your accounts and purchase an order making use of your PayPal accounts or Visa or Mastercard.

- Select the document formatting and download the lawful papers format in your product.

- Total, change and printing and signal the received Idaho Tenant Letter of Credit in Lieu of a Security Deposit.

US Legal Forms may be the biggest catalogue of lawful forms where you can discover different papers web templates. Use the company to download appropriately-manufactured documents that stick to status needs.

Form popularity

FAQ

In many cases, a letter of credit is better for both parties since it frees up cash resources for the tenant while providing the landlord with potentially more protection in the event of a default or bankruptcy.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

Landlords routinely accept a security deposit in the form of a letter of credit in lieu of cash upon execution of a lease agreement as security for the performance by a tenant of all obligations on the part of such tenant thereunder.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

What is a Letter of Credit? A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

Ing to Idaho's security deposit law, landlords have 21 days to return tenants' security deposits once they move out. This period may be extended or shortened if both parties reach an agreement. In such cases, the period must not exceed 30 days.

One of the primary benefits of using a letter of credit as opposed to a cash security deposit is that a letter of credit allows the commercial tenant to retain money in their account. They are extremely popular with Landlords since they are backed by a major bank.

In many cases, a letter of credit is better for both parties since it frees up cash resources for the tenant while providing the landlord with potentially more protection in the event of a default or bankruptcy.