This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Idaho Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

US Legal Forms - one of the largest collections of official documents in the USA - provides a range of legal document templates you can download or create. By using the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can locate the most recent versions of documents such as the Idaho Unsecured Installment Payment Promissory Note for Fixed Rate in no time.

If you already hold a subscription, Log In and download the Idaho Unsecured Installment Payment Promissory Note for Fixed Rate from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

If you are utilizing US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your area/state. Click the Preview button to review the form's content. Review the form description to confirm you have chosen the right form. If the form does not meet your needs, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your preferred payment plan and provide your details to register for an account. Complete the transaction. Use a credit card or PayPal account to finish the transaction. Select the format and download the form to your device. Make changes. Fill out, modify, and print and sign the downloaded Idaho Unsecured Installment Payment Promissory Note for Fixed Rate. Each template you added to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

Get access to the Idaho Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms, the most thorough collection of legal document templates.

Utilize a wide array of professional and state-specific templates that cater to your business or personal needs and specifications.

- Access the Idaho Unsecured Installment Payment Promissory Note for Fixed Rate through US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your area/state.

- Review the form's content before finalizing your choice.

- Make sure to check the form description for accuracy.

- Each template you acquire remains yours indefinitely.

Form popularity

FAQ

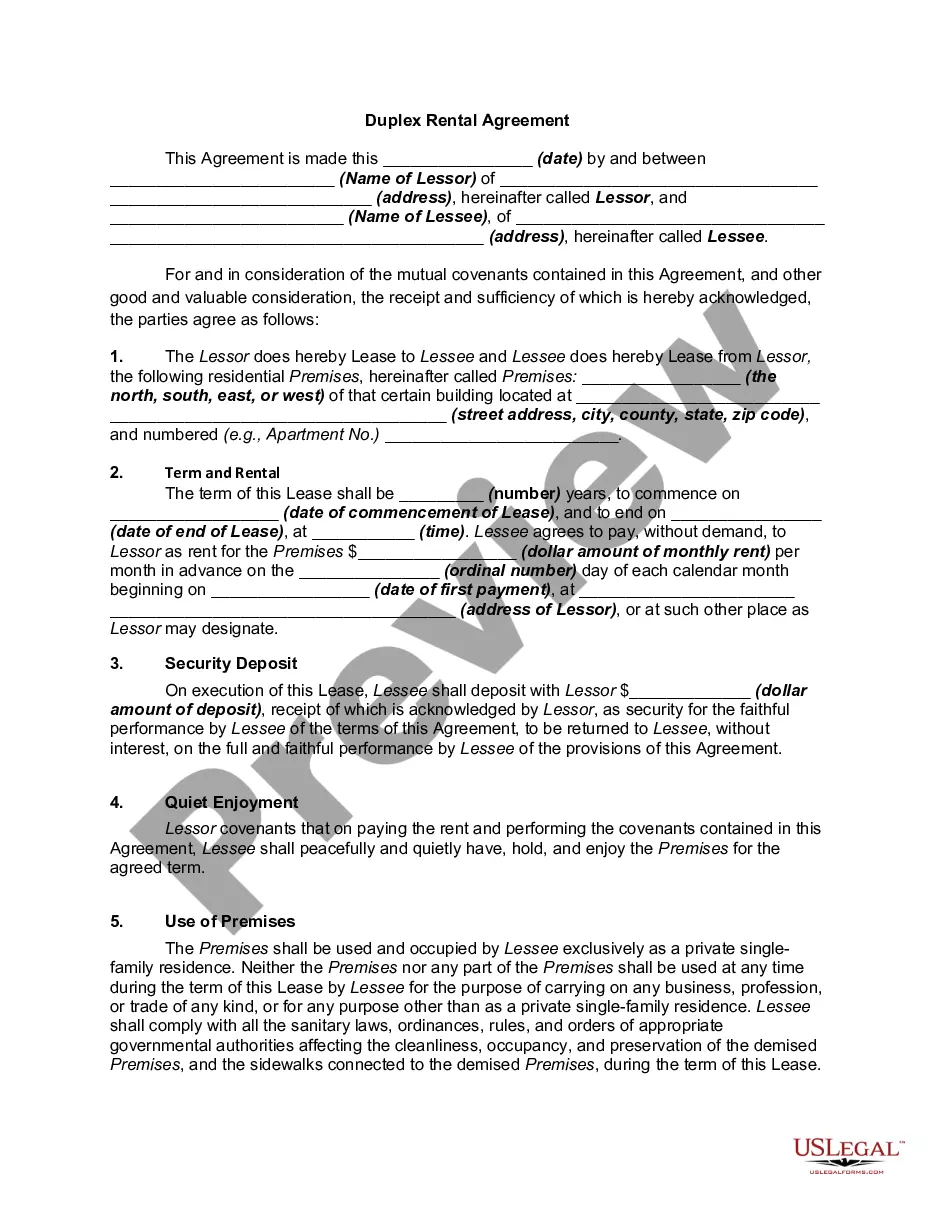

Promissory notes do not need to be secured; they can be unsecured as well. Unsecured notes allow borrowers to obtain loans without putting up collateral, making them an attractive option for many. An Idaho Unsecured Installment Payment Promissory Note for Fixed Rate exemplifies this type of agreement, offering flexibility to borrowers while still ensuring that lenders have a legally binding document.

Promissory notes can be both secured and unsecured, depending on how they are structured. A secured note includes collateral that the lender can claim if the borrower defaults, while an unsecured note does not have this provision. The Idaho Unsecured Installment Payment Promissory Note for Fixed Rate falls into the latter category, providing borrowers with options that do not tie up their assets.

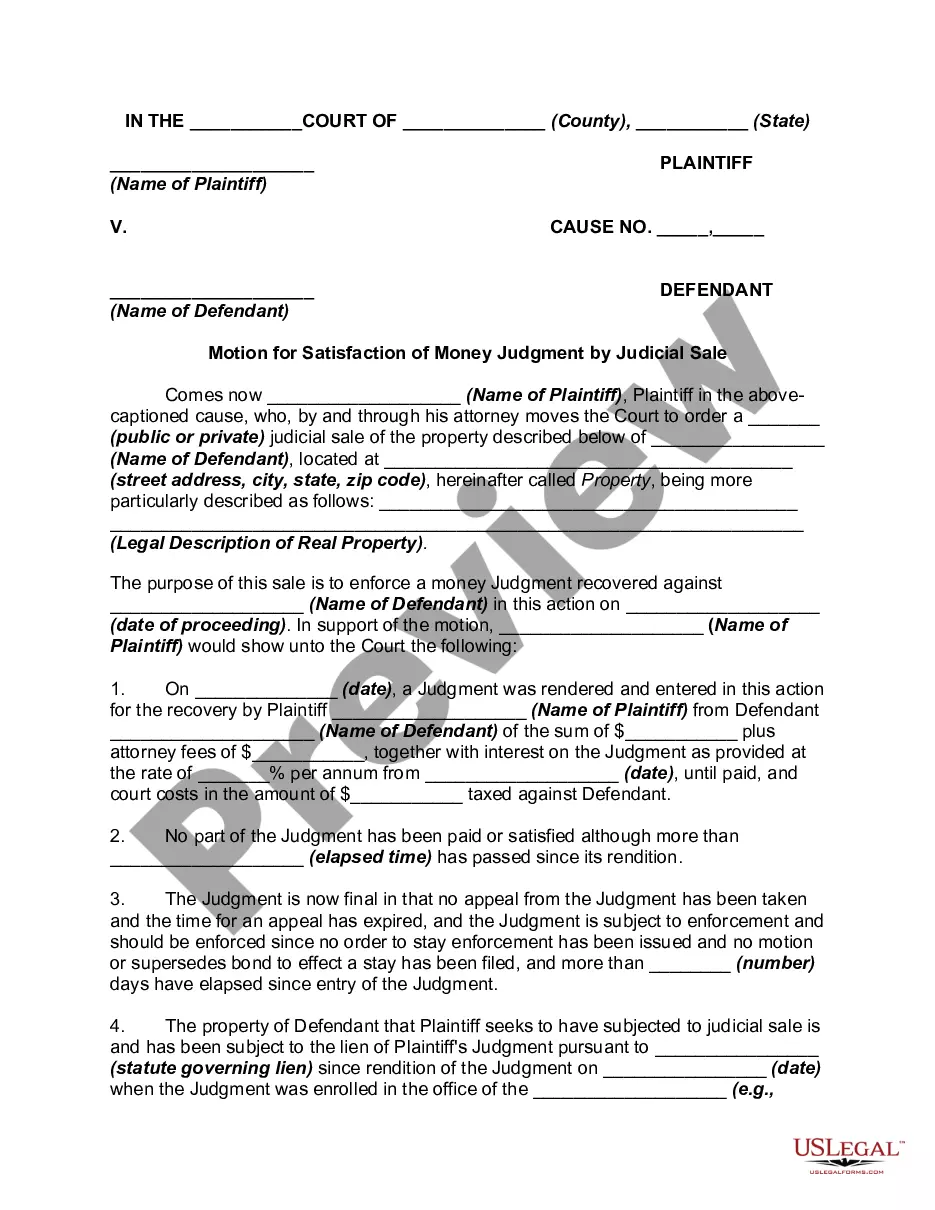

To legally enforce an Idaho Unsecured Installment Payment Promissory Note for Fixed Rate, begin by sending a formal demand for payment to the borrower. If the borrower continues to default, you may need to initiate legal proceedings in a court. Ensure you have all necessary documents, including the note itself and any correspondence. Utilizing resources from US Legal Forms can help you navigate the legal process effectively.

An unsigned Idaho Unsecured Installment Payment Promissory Note for Fixed Rate is generally not enforceable in court. A signature serves as evidence of the borrower's agreement to the terms of the note. Without a signature, it may be difficult to prove that an agreement existed. Therefore, it is crucial to obtain a signed note to ensure its enforceability.

A promissory note does not necessarily have to be notarized to be legal, but doing so can add an extra layer of protection. In the context of the 'Idaho Unsecured Installment Payment Promissory Note for Fixed Rate,' notarization can help verify identities and prevent disputes. It is advisable to consult local laws or a legal expert for specific requirements in your state. Notarization can enhance the enforceability of the agreement.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

In common speech, other terms, such as "loan", "loan agreement", and "loan contract" may be used interchangeably with "promissory note".

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.