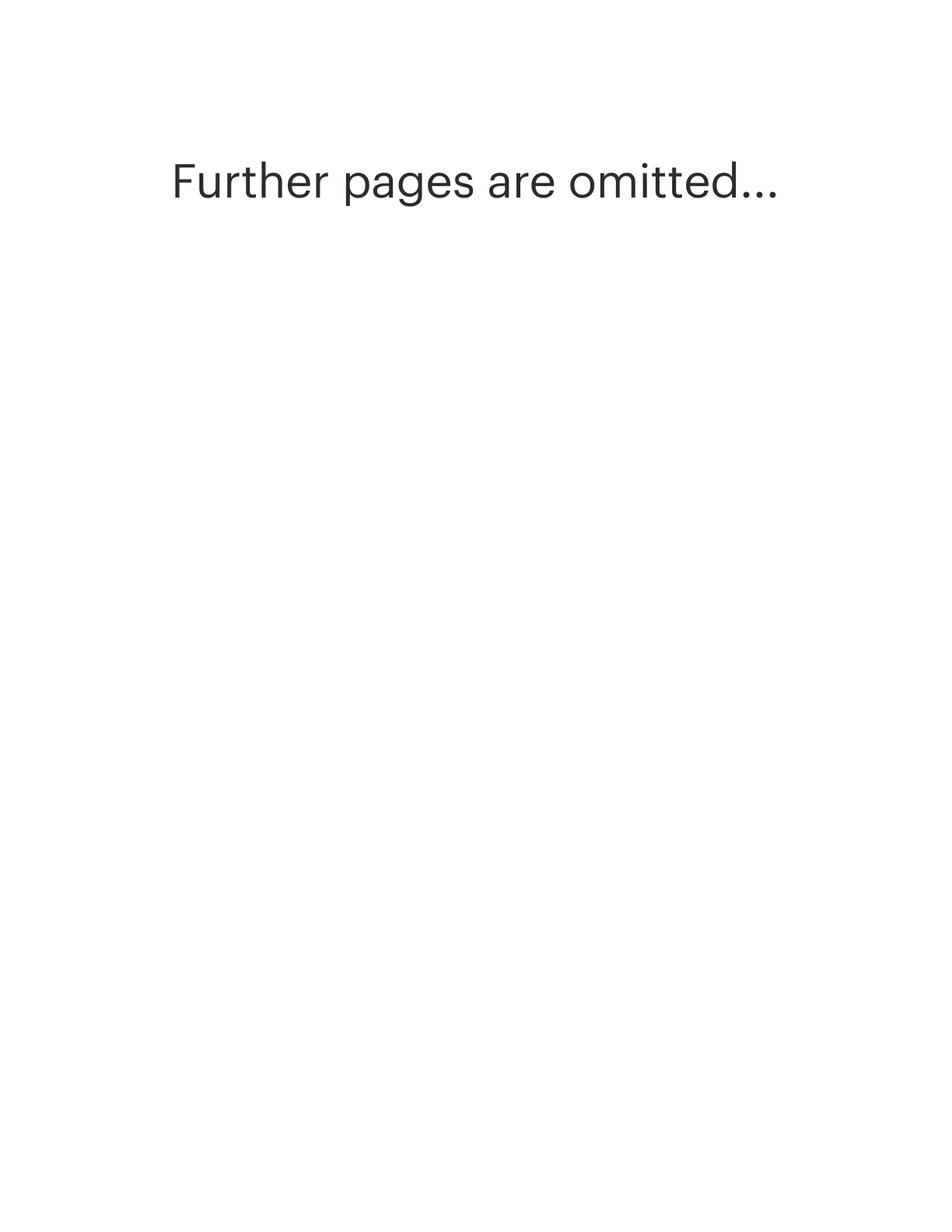

Idaho Purchase and License Agreement of Custom Software Program

Description

How to fill out Purchase And License Agreement Of Custom Software Program?

Locating the appropriate legal document template can be challenging. It goes without saying, there are numerous formats accessible online, but how will you secure the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Idaho Purchase and License Agreement for Custom Software Program, which can be used for business and personal purposes. All of the documents are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Idaho Purchase and License Agreement for Custom Software Program. Use your account to browse through the legal documents you have purchased previously. Proceed to the My documents tab of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: Initially, ensure you have selected the correct form for your specific city/region. You can review the document using the Preview button and examine the document details to ensure it is suitable for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the document is correct, click the Buy now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, and print and sign the obtained Idaho Purchase and License Agreement for Custom Software Program. US Legal Forms is the largest collection of legal documents where you can view various document formats. Utilize the service to download professionally crafted documents that meet state requirements.

Form popularity

FAQ

A EULA, or End User License Agreement, is a specific type of software license agreement that focuses on the end user's rights and responsibilities. While both documents serve to outline usage terms, a EULA is typically more user-centric. The Idaho Purchase and License Agreement of Custom Software Program can encompass various license types, including EULAs, but is broader in scope, addressing both user and creator rights.

The purpose of a licensing agreement is to protect the rights of the creator while providing a framework for users to access the product legally. It establishes the rules for using, modifying, and distributing the software. The Idaho Purchase and License Agreement of Custom Software Program exemplifies this purpose, ensuring transparency and fairness in the software usage process.

A license agreement for software outlines the legal terms under which a user can access and utilize the software. It details the rights granted to the user, such as installation, usage limits, and restrictions on distribution. The Idaho Purchase and License Agreement of Custom Software Program exemplifies this by providing a clear structure that protects both the creator and the user.

A license agreement is used to grant permission to use a product while setting boundaries for that use. In the context of software, it clarifies what users can and cannot do with the program. The Idaho Purchase and License Agreement of Custom Software Program ensures that both the developer's rights and the user's needs are met, creating a fair usage framework.

Typically, when you buy a license for proprietary software, you cannot copy or distribute it without explicit permission. Licensing agreements, such as the Idaho Purchase and License Agreement of Custom Software Program, often include clauses that restrict these actions to protect the intellectual property of the software developer. Always check the specific terms of your agreement to understand your rights.

A software license agreement serves as a legal contract between the software creator and the user. It outlines the terms under which the user can utilize the software, including rights and limitations. The Idaho Purchase and License Agreement of Custom Software Program helps protect both parties by clearly defining how the software can be used, ensuring compliance with legal standards.

Licenses that grant ownership of the software copy to the end user are often referred to as 'ownership licenses' or 'full licenses.' In the case of an Idaho Purchase and License Agreement of Custom Software Program, this type of license allows the user to hold rights similar to ownership, such as the ability to transfer the license under certain conditions. This arrangement provides users with greater flexibility and control over their software.

A standard license agreement typically does not grant the right to distribute the software without explicit permission. Most agreements, including an Idaho Purchase and License Agreement of Custom Software Program, specify that distribution rights remain with the software creator. Therefore, users should carefully review the terms to understand their limitations regarding distribution.

A software license grants the purchaser the right to use the software according to the terms outlined in the agreement. This includes permissions such as installation, access, and sometimes modifications. In an Idaho Purchase and License Agreement of Custom Software Program, these terms ensure that users can leverage the software effectively while adhering to legal guidelines.

Granting a license means that the software creator allows a user to access and use the software under specific conditions. This permission is formalized through a legal document, such as an Idaho Purchase and License Agreement of Custom Software Program. By obtaining a license, users gain clarity on how they can benefit from the software while respecting the creator's rights.