Idaho Self-Employed Steel Services Contract

Description

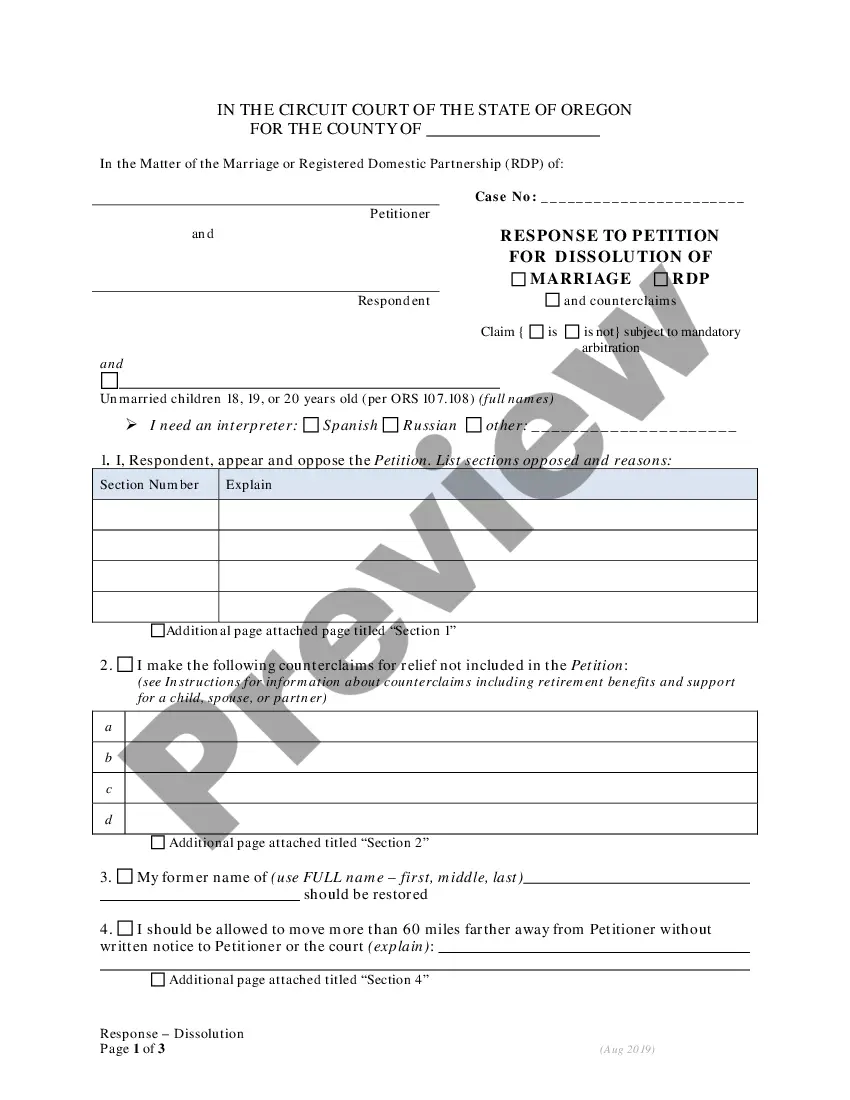

How to fill out Self-Employed Steel Services Contract?

Finding the appropriate legal document template can be a challenge. Of course, there are numerous formats available online, but how will you locate the legal form you need? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Idaho Self-Employed Steel Services Contract, which can be utilized for both business and personal purposes. All the documents are reviewed by experts and meet federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Idaho Self-Employed Steel Services Contract. Use your account to review the legal forms you have acquired previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can browse the form using the Preview button and read the form details to verify it is the right one for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Buy now button to acquire the form. Choose the payment plan you prefer and input the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the document format and download the legal document template for your use. Complete, modify, print, and sign the acquired Idaho Self-Employed Steel Services Contract.

Take advantage of US Legal Forms to streamline your document preparation process.

- US Legal Forms is the largest collection of legal documents where you can find numerous record formats.

- Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- The platform provides a user-friendly interface for easy navigation.

- All templates are vetted to ensure compliance with legal standards.

- It supports both personal and business documentation needs.

- Access a wide variety of templates tailored for different legal requirements.

Form popularity

FAQ

Yes, Idaho requires contractors to be licensed for most construction work. This requirement helps protect consumers and ensures that contractors meet the necessary standards. If you are involved in an Idaho Self-Employed Steel Services Contract, obtaining a license not only keeps you compliant but also enhances your credibility in the industry.

Yes, it is illegal to perform contractor work in Idaho without a valid license if your project exceeds the established threshold. Engaging in unlicensed work can lead to fines and other penalties. To avoid these risks, ensure you are licensed when undertaking an Idaho Self-Employed Steel Services Contract.

Yes, subcontractors in Idaho must also obtain a contractor license if they engage in work that exceeds the $2,000 limit. This requirement ensures that all parties involved in a project maintain a standard of quality and legality. Therefore, if you are a subcontractor working on an Idaho Self-Employed Steel Services Contract, make sure you are properly licensed.

Yes, construction services are generally taxable in Idaho. This tax applies to the sale of construction services and materials. If you are entering into an Idaho Self-Employed Steel Services Contract, it is essential to factor in these taxes to ensure accurate budgeting and compliance with state laws.

Section 45 525 in Idaho outlines the regulations for contractor licensing and the penalties for non-compliance. This section emphasizes the importance of obtaining a license before engaging in significant construction activities. Understanding this law is crucial for anyone involved in an Idaho Self-Employed Steel Services Contract, as it helps avoid legal issues.

You need a contractor's license in Idaho when your project value exceeds $2,000, including materials and labor. Moreover, if you are performing work that requires specialized skills, a license becomes necessary. Ensuring you have the proper licensing protects you and your clients, especially in the context of an Idaho Self-Employed Steel Services Contract.

Yes, independent contractors in Idaho typically need a business license to operate legally. This requirement helps ensure that all businesses meet state regulations and standards. If you're considering a venture, such as those outlined in the Idaho Self-Employed Steel Services Contract, obtaining a business license is an essential step to protect your interests.

An independent contractor in Idaho is a person or business that provides services to clients while maintaining their own business operations. They are not employees; instead, they work under a contract that defines the terms of service. This structure allows for greater flexibility and can be particularly beneficial when using the Idaho Self-Employed Steel Services Contract.

Yes, in Idaho, you typically need a license to subcontract work, especially in the construction and steel services industry. Subcontractors must comply with state regulations, which often require proper licensing to ensure quality and safety standards. To navigate these requirements effectively, consider using the Idaho Self-Employed Steel Services Contract.

To qualify as an independent contractor in Idaho, you must demonstrate your ability to operate a business and provide services to clients. You should have a clear contract outlining the scope of work, payment terms, and responsibilities. Additionally, you must not be an employee of another company; instead, you should manage your own business under the Idaho Self-Employed Steel Services Contract.