Idaho Self-Employed Independent Welder Services Contract

Description

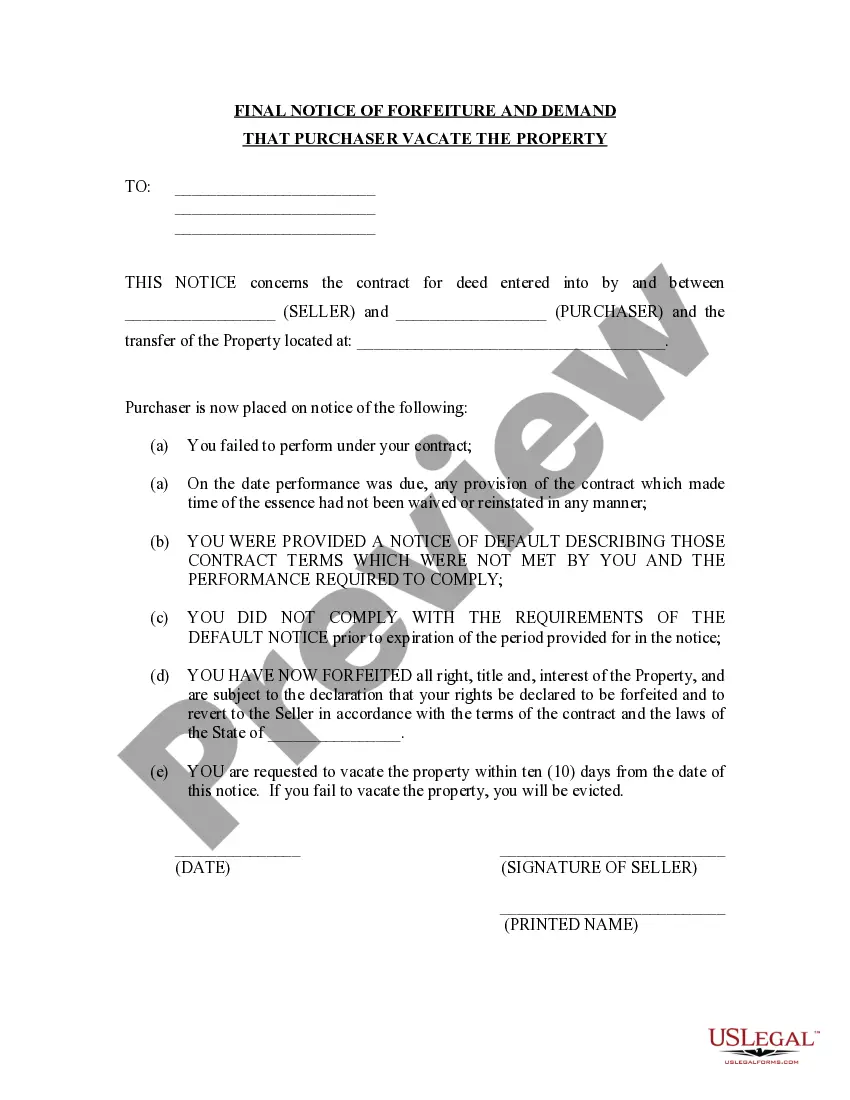

How to fill out Self-Employed Independent Welder Services Contract?

Selecting the appropriate authentic document template can be challenging.

Clearly, there are numerous designs accessible online, but how do you locate the authentic version you need.

Utilize the US Legal Forms site. The platform offers a wide selection of templates, such as the Idaho Self-Employed Independent Welder Services Agreement, that you can use for both business and personal purposes.

You can preview the document using the Review button and read the form description to confirm this is the right one for you.

- All of the forms are verified by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and then click on the Get button to obtain the Idaho Self-Employed Independent Welder Services Agreement.

- Use your account to browse the official forms you have previously purchased.

- Visit the My documents section in your account and retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your location/state.

Form popularity

FAQ

There are several types of business bank accounts to consider for your independent contracting business. You can consider an account with a local bank as well as an online business bank account. You may prefer mobile banking if you don't need to go into a physical branch and don't need to deposit cash.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

All contractors are required by Idaho law to be registered with the Idaho Contractors Board, which is a division of the State of Idaho, Bureau of Occupational Licenses.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.