Idaho Self-Employed Tour Guide Services Contract

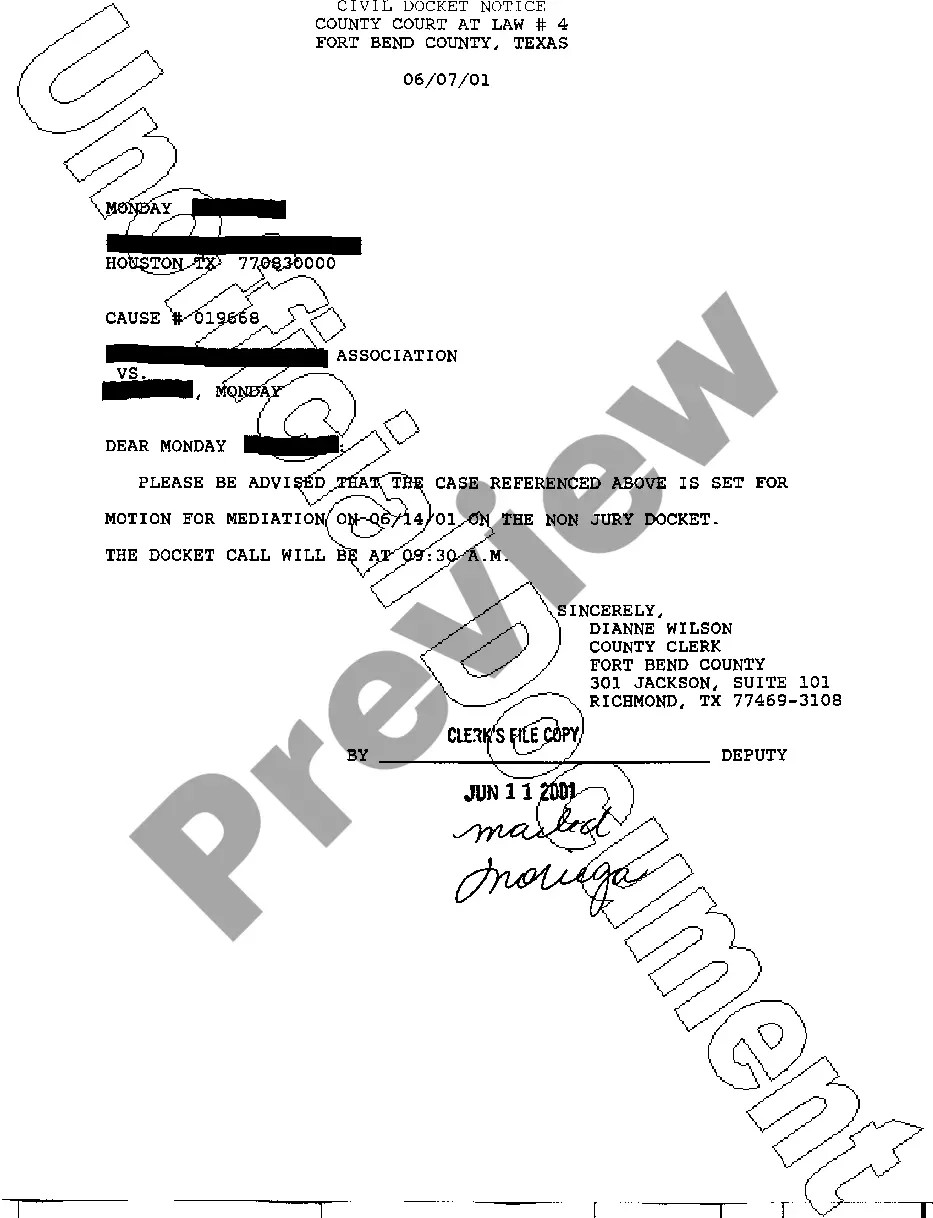

Description

How to fill out Self-Employed Tour Guide Services Contract?

If you desire to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s straightforward and efficient search to locate the documents you require. Numerous templates for commercial and individual purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Idaho Self-Employed Tour Guide Services Contract with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again.

Compete and obtain, and print the Idaho Self-Employed Tour Guide Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Idaho Self-Employed Tour Guide Services Contract.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the overview.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find other types within the legal form category.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Idaho Self-Employed Tour Guide Services Contract.

Form popularity

FAQ

To become a tour guide, you should possess strong communication skills and a passion for sharing knowledge about your area. Knowledge of local history, culture, and attractions is vital, as is the ability to engage and entertain clients. While formal qualifications are not mandatory, an Idaho Self-Employed Tour Guide Services Contract can help you define your role and establish your expertise in the field.

Generally, a tour guide does not require a license in Idaho, but this can depend on the type of tours you provide and the specific area in which you work. Some cities may have their own regulations, so it's important to research local requirements. By using an Idaho Self-Employed Tour Guide Services Contract, you can ensure that you comply with any necessary regulations and protect your interests.

In Idaho, you typically do not need a specific license to operate as a tour guide. However, local regulations may vary, so it's wise to check with your city or county. Licensing can enhance your credibility and reassure clients of your professionalism. An Idaho Self-Employed Tour Guide Services Contract can also help formalize your operations and clarify your responsibilities.

Yes, you can become a tour guide without a formal degree. Many successful tour guides have built their careers based on experience and knowledge rather than academic qualifications. However, a solid understanding of the local area, history, and attractions is essential. Consider using an Idaho Self-Employed Tour Guide Services Contract to establish your business and outline your services.

Yes, Idaho requires certain contractors to be licensed, depending on the type of work they perform. This licensing helps maintain industry standards and protects consumers. If you are providing Idaho Self-Employed Tour Guide Services, be sure to verify whether you need a license and comply with all relevant regulations.

The five essential elements for a legally binding contract are offer, acceptance, consideration, mutual consent, and legality. Each element plays a crucial role in establishing the contract's validity. When drafting your Idaho Self-Employed Tour Guide Services Contract, ensure that these components are clearly outlined to avoid potential issues.

While verbal agreements can be legally binding in Idaho, they often pose challenges in enforcement due to difficulties in proving the terms. For clarity and protection, it is advisable to create a written contract, such as an Idaho Self-Employed Tour Guide Services Contract. A written agreement helps clarify expectations and provides evidence in case of disputes.

Yes, independent contractors, including those providing Idaho Self-Employed Tour Guide Services, typically need a business license. This requirement helps ensure that they comply with local regulations and tax obligations. Before starting your services, check with your local city or county government for specific licensing requirements.

In Idaho, a contract becomes legally binding when it includes an offer, acceptance, consideration, mutual consent, and legal purpose. These key elements ensure that both parties understand their obligations and rights. When creating an Idaho Self-Employed Tour Guide Services Contract, it is vital to include these elements to protect your interests.

Idaho does not legally require an operating agreement for an LLC, but having one is highly recommended. An operating agreement clearly defines the management structure and operating procedures of your business. This document can help prevent disputes and provide clarity for your Idaho Self-Employed Tour Guide Services Contract. By drafting an operating agreement, you can enhance your business's credibility and operational efficiency.