Idaho Self-Employed Mechanic Services Contract

Description

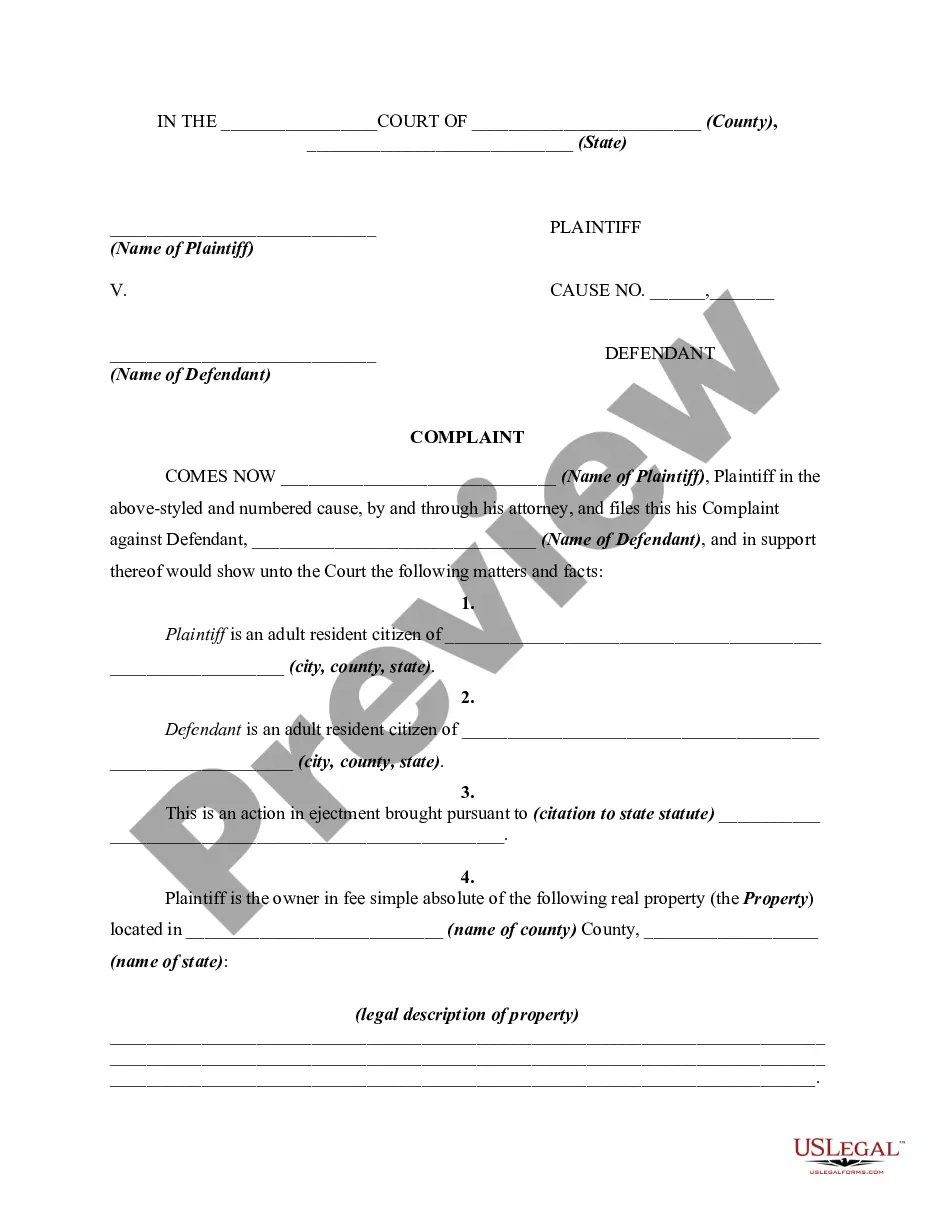

How to fill out Self-Employed Mechanic Services Contract?

US Legal Forms - one of the largest collections of legal documents in the U.S. - offers a wide range of legal document templates you can purchase or print.

By utilizing the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You will find the latest versions of forms similar to the Idaho Self-Employed Mechanic Services Contract in just minutes.

If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

Once you are happy with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your details to sign up for an account.

- If you already have a subscription, Log In to download the Idaho Self-Employed Mechanic Services Contract from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you start.

- Ensure you have selected the correct form for your jurisdiction/area. Click the View button to check the form's contents.

- Review the form summary to confirm that you have chosen the right form.

Form popularity

FAQ

Self-employment tax in Idaho consists primarily of Social Security and Medicare taxes applicable to your net earnings. This tax is set at 15.3% on your income derived from self-employment, including income earned from an Idaho Self-Employed Mechanic Services Contract. Understanding how this tax impacts your total liability can help you plan your finances efficiently.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time.

Idaho sales tax law says contractors are the consumers (end users) of all the goods they use. As a result, they must pay sales tax on all purchases, including all the equipment, tools, and supplies they use to build, improve, repair, or alter real property.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

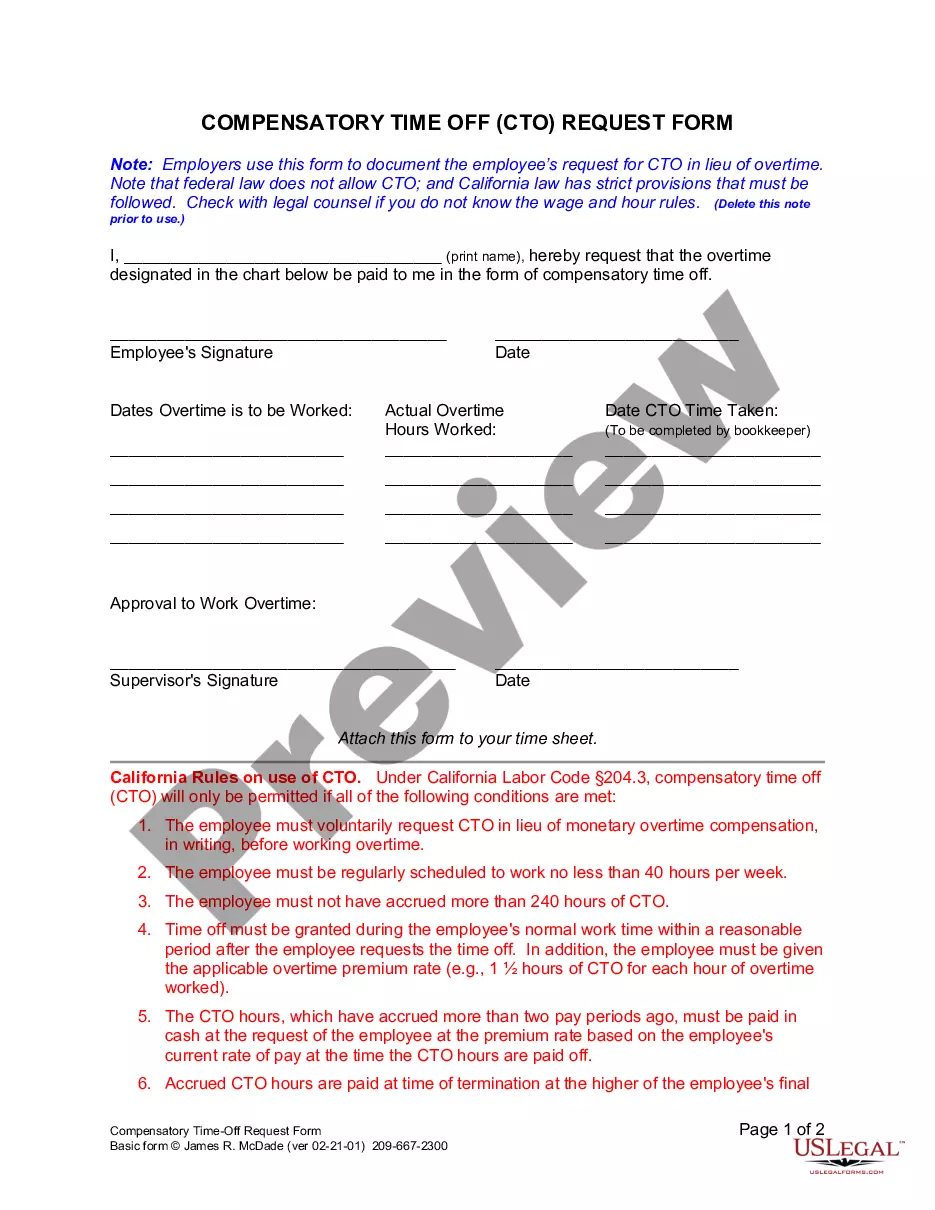

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.