Idaho Insurance Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Insurance Agent Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most current versions of forms like the Idaho Insurance Agent Agreement - Self-Employed Independent Contractor in moments.

If you already have an account, Log In and download the Idaho Insurance Agent Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Make sure you have selected the correct form for your city/state. Click the Preview button to check the form's details. Read the form description to confirm that you have chosen the right document. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your credentials to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved Idaho Insurance Agent Agreement - Self-Employed Independent Contractor.

- Every template you added to your account has no expiration date and is yours indefinitely.

- If you want to download or print another copy, simply go to the My documents section and click on the form you desire.

- Access the Idaho Insurance Agent Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

To classify yourself as an independent contractor, you need to establish that you work autonomously without direct control from your clients. This includes setting your own rates, choosing your clients, and determining how to complete your work. Utilizing an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor can further define your role and solidify your classification in legal terms.

An agent is someone authorized to act on behalf of another person or entity, often in business transactions. This includes insurance agents, real estate agents, and others who facilitate deals. If you are operating under an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor, you can be recognized as an agent if you fulfill the necessary conditions outlined in the agreement.

An independent contractor typically falls under the category of self-employed individuals. They work independently, offering services to clients without significant oversight. By adhering to an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor, these professionals can clarify their status and obligations, ensuring a better working relationship.

Independent contractors can be considered agents if they operate under a contractual agreement to represent another business. This status often depends on the level of control that the business has over the contractor's work. Understanding the distinction is crucial, especially when using an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor to define roles clearly.

The basic independent contractor agreement outlines the terms of service between a contractor and a client. This document typically includes the scope of work, payment terms, and confidentiality clauses. By utilizing an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor, parties can ensure clear expectations and mutual understanding of responsibilities.

Yes, an independent contractor can act as an agent if they engage in business transactions on behalf of another party. The role of an agent involves representing another individual's or company's interests. When under an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor, the contractor might also fulfill agent responsibilities depending on their contractual obligations.

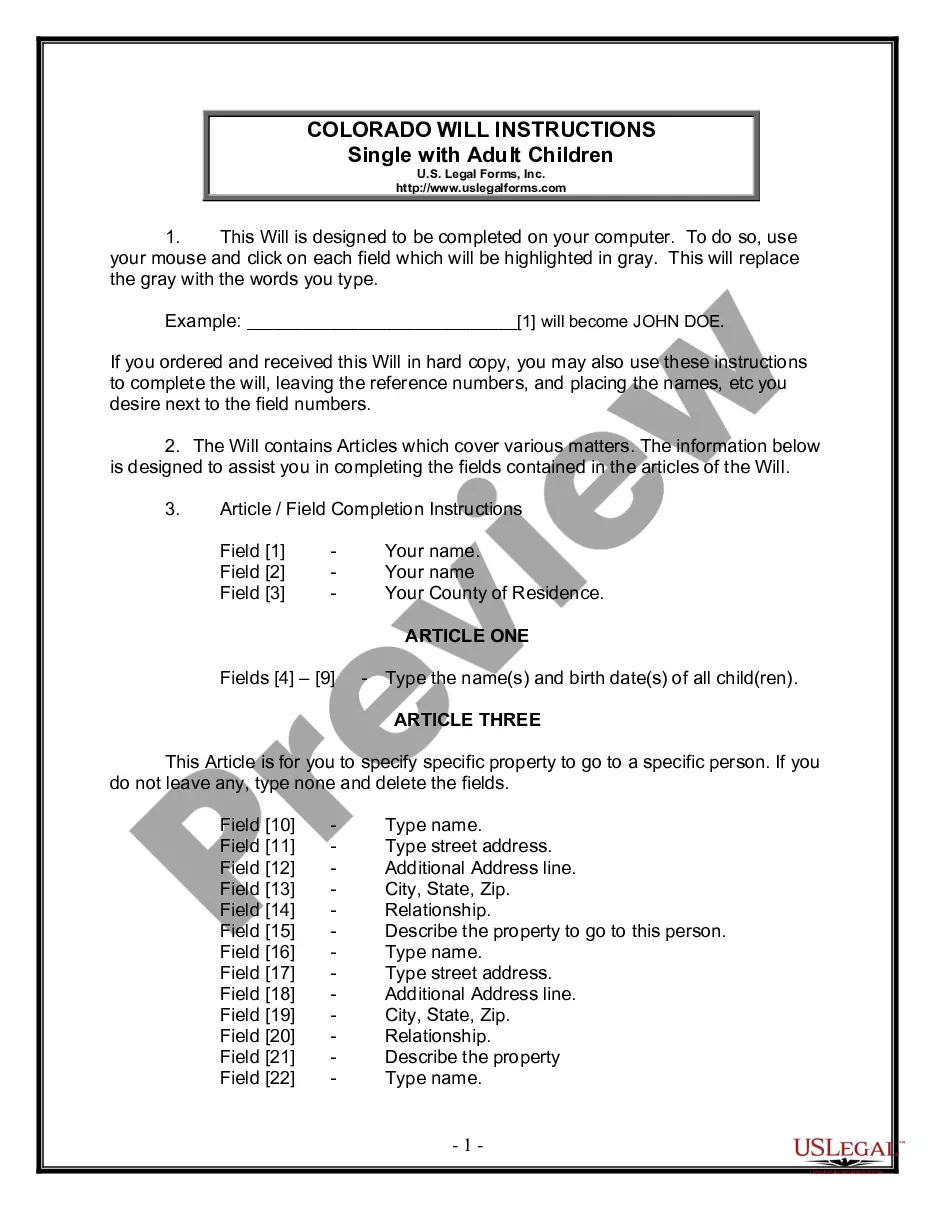

Filling out an independent contractor form, such as the Idaho Insurance Agent Agreement - Self-Employed Independent Contractor, involves providing your personal information, business details, and payment preferences. Be precise when detailing the nature of your services and ensuring all parties understand their obligations. It's crucial to read the entire form carefully before submission to avoid any potential misunderstandings. Platforms like uslegalforms can guide you through each section, making the process easier.

An independent contractor typically completes several essential forms, including a W-9 for tax purposes and an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor to outline terms. Other documents may include invoices for payment and any specialty forms required by the insurance industry. Gathering these forms ensures compliance and clarity in your working relationship. Tools available on uslegalforms can simplify this process by providing comprehensive templates.

Writing an Idaho Insurance Agent Agreement - Self-Employed Independent Contractor starts with clearly defining the roles and responsibilities of both parties. Include important details such as payment terms, duration of the contract, and the scope of work. Make sure to outline the conditions for termination and any confidentiality clauses needed. For a more streamlined approach, consider using platforms like uslegalforms to access templates tailored for your specific needs.

Yes, an independent contractor often needs a certificate of insurance to protect themselves and their clients. This document confirms that the contractor carries adequate insurance coverage, which can include liability and workers' compensation. An Idaho Insurance Agent Agreement - Self-Employed Independent Contractor may require providing this certificate as part of the agreement. It's important to understand the insurance requirements that apply to your specific work situation.