District of Columbia Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

Choosing the best lawful papers template might be a battle. Naturally, there are a variety of themes available on the Internet, but how can you find the lawful form you will need? Take advantage of the US Legal Forms site. The assistance offers a huge number of themes, for example the District of Columbia Term Sheet - Royalty Payment Convertible Note, which you can use for organization and personal requirements. Every one of the varieties are checked by specialists and fulfill state and federal specifications.

If you are presently registered, log in to the accounts and then click the Down load button to have the District of Columbia Term Sheet - Royalty Payment Convertible Note. Use your accounts to look with the lawful varieties you may have purchased earlier. Check out the My Forms tab of your own accounts and have another copy of your papers you will need.

If you are a new end user of US Legal Forms, listed below are basic guidelines that you should adhere to:

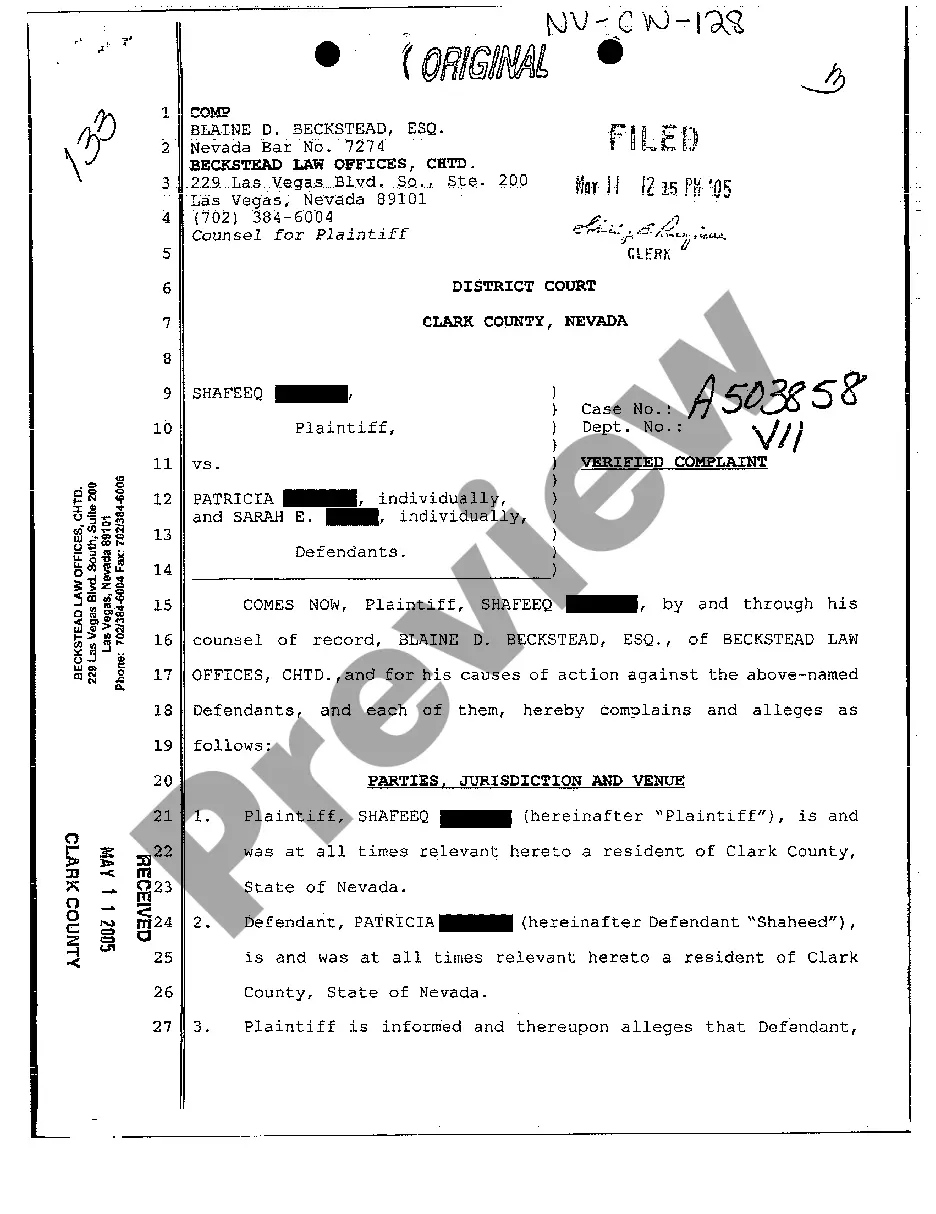

- Very first, be sure you have selected the appropriate form for the area/state. You may check out the shape using the Review button and read the shape description to make sure it will be the best for you.

- When the form fails to fulfill your preferences, use the Seach area to get the proper form.

- Once you are sure that the shape is proper, click on the Acquire now button to have the form.

- Choose the costs strategy you want and enter in the required information. Build your accounts and pay for your order with your PayPal accounts or Visa or Mastercard.

- Opt for the submit structure and obtain the lawful papers template to the gadget.

- Total, modify and print and indication the acquired District of Columbia Term Sheet - Royalty Payment Convertible Note.

US Legal Forms may be the most significant collection of lawful varieties where you can discover various papers themes. Take advantage of the service to obtain expertly-created papers that adhere to state specifications.

Form popularity

FAQ

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

Calculating post-money valuation Post-money valuation = Pre-money valuation + Size of investment. ... Share price = New investment amount / # of new shares received. ... Post-money valuation / total # of shares post-investment = New investment amount / # of new shares received.

Most convertible notes, like other forms of debt, provide that they are due at the maturity date, usually 18 to 24 months. Occasionally, convertible notes will provide that at maturity they automatically convert to equity, or convert to equity at the option of the lender.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

A venture capital term sheet is the blueprint for an investment. Although term sheets have a set of formalized components, terms are generally undefined. The parties involved may have different understandings of what the terms mean.