Idaho Stone Contractor Agreement - Self-Employed

Description

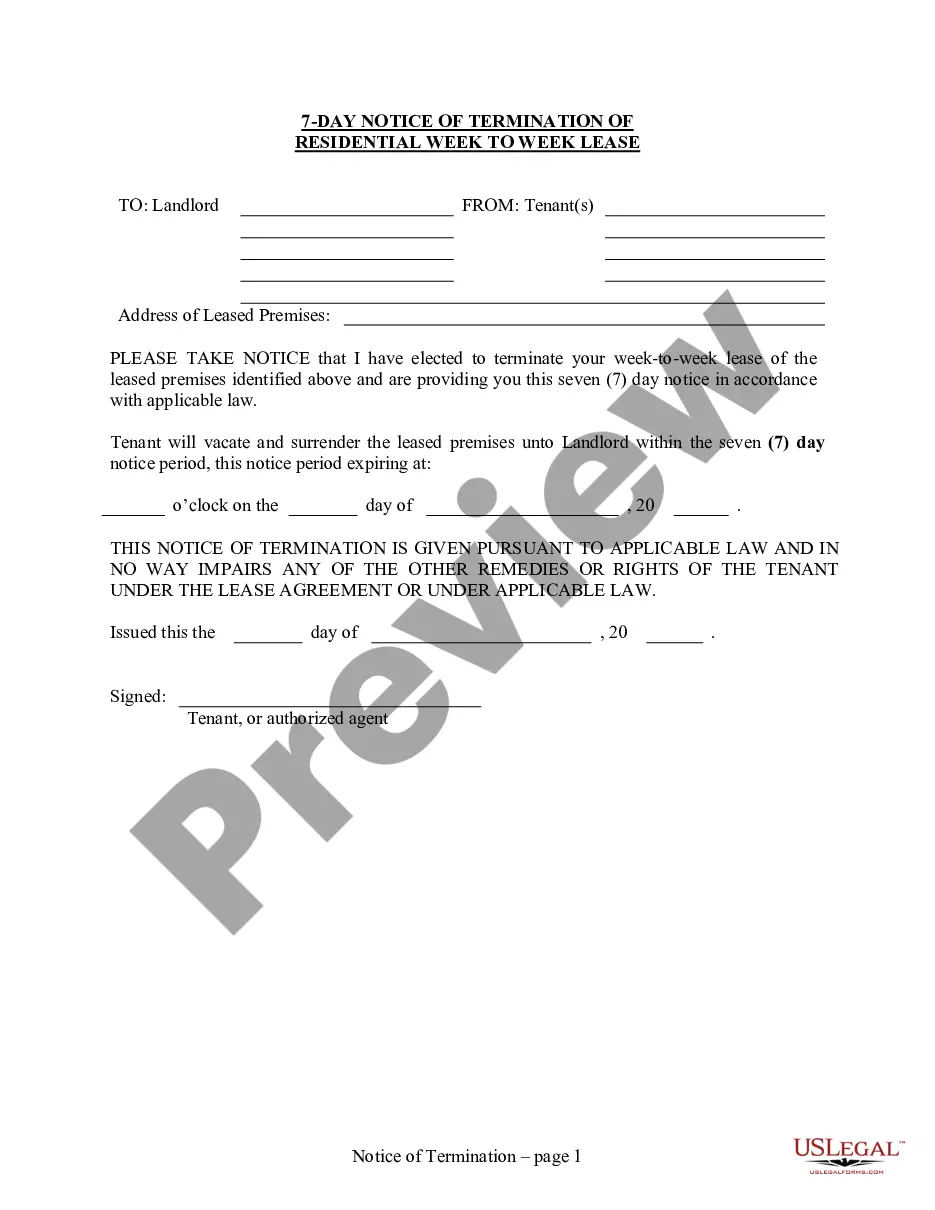

How to fill out Stone Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates that you can download or print. By using the website, you can find thousands of forms for business and personal needs, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Idaho Stone Contractor Agreement - Self-Employed in just seconds.

If you have a monthly subscription, Log In and download the Idaho Stone Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously acquired forms in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have chosen the correct form for your city/county. Click the Preview button to review the form's content. Read the form details to confirm you have selected the right document. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your credentials to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Idaho Stone Contractor Agreement - Self-Employed.

Access the Idaho Stone Contractor Agreement - Self-Employed with US Legal Forms, which is the largest collection of legal document templates.

Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Each template you add to your account has no expiration date and is yours forever.

- So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Gain access to the Idaho Stone Contractor Agreement - Self-Employed with US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements and specifications.

- Find the perfect form tailored to your individual or commercial purposes.

- Download and manage legal documents easily and efficiently.

Form popularity

FAQ

To fill out an independent contractor agreement, start by entering the parties' names and contact details. Next, specify the work details, payment structure, and duration of the contract. Referencing an Idaho Stone Contractor Agreement - Self-Employed template can make this task easier and ensure that you don't overlook important components.

In Idaho, independent contractors may need a business license depending on their location and the type of work they perform. It is essential to check local regulations to ensure compliance. The Idaho Stone Contractor Agreement - Self-Employed can serve as a helpful resource when navigating such legal requirements.

Filling out an independent contractor form involves providing accurate personal information, detailing the tasks you will perform, and specifying your compensation. Be thorough and clear in your descriptions to avoid misunderstandings. Utilizing the Idaho Stone Contractor Agreement - Self-Employed can provide guidance and structure to your form.

To write an independent contractor agreement, start by clearly outlining the scope of work and payment terms. Include details such as deadlines, responsibilities, and confidentiality clauses. Using an Idaho Stone Contractor Agreement - Self-Employed template can simplify this process, ensuring that all necessary elements are covered.

To write a self-employed contract, start by outlining the scope of work, detailing what services you will provide as a contractor. Next, include payment terms, such as the amount, payment schedule, and methods accepted. Additionally, specify the duration of the agreement and any termination clauses. For a thorough and reliable document, consider using the Idaho Stone Contractor Agreement - Self-Employed available on the US Legal Forms platform, which simplifies the process and ensures all essential elements are covered.

Both terms describe similar work arrangements, but they can convey slightly different meanings. 'Self-employed' is a broader term, while 'independent contractor' specifies a professional who offers services through contracts. When utilizing an Idaho Stone Contractor Agreement - Self-Employed, using the latter term may provide more clarity about your specific role.

Contract work often does not qualify as traditional employment. Instead, it involves individuals providing services independently without employer benefits. Hence, when you enter an Idaho Stone Contractor Agreement - Self-Employed, you establish a business relationship rather than an employment one, which affects your benefits and liabilities.

Receiving a 1099 form typically indicates you are self-employed. This form is provided by clients to report payments made to you throughout the year. Thus, if you receive a 1099 while working under an Idaho Stone Contractor Agreement - Self-Employed, it confirms your status as an independent contractor.

Writing an independent contractor agreement involves several key components. Start by clearly defining the scope of work, payment terms, and deadlines. The Idaho Stone Contractor Agreement - Self-Employed template offered on the uslegalforms platform can simplify this process, ensuring you include all necessary terms for clarity and compliance.

Indeed, a contractor is generally viewed as self-employed. This status applies to those who work independently, managing their projects without employer oversight. If you're entering into an Idaho Stone Contractor Agreement - Self-Employed, this understanding of your status is critical for legal and tax purposes.