Idaho Heating Contractor Agreement - Self-Employed

Description

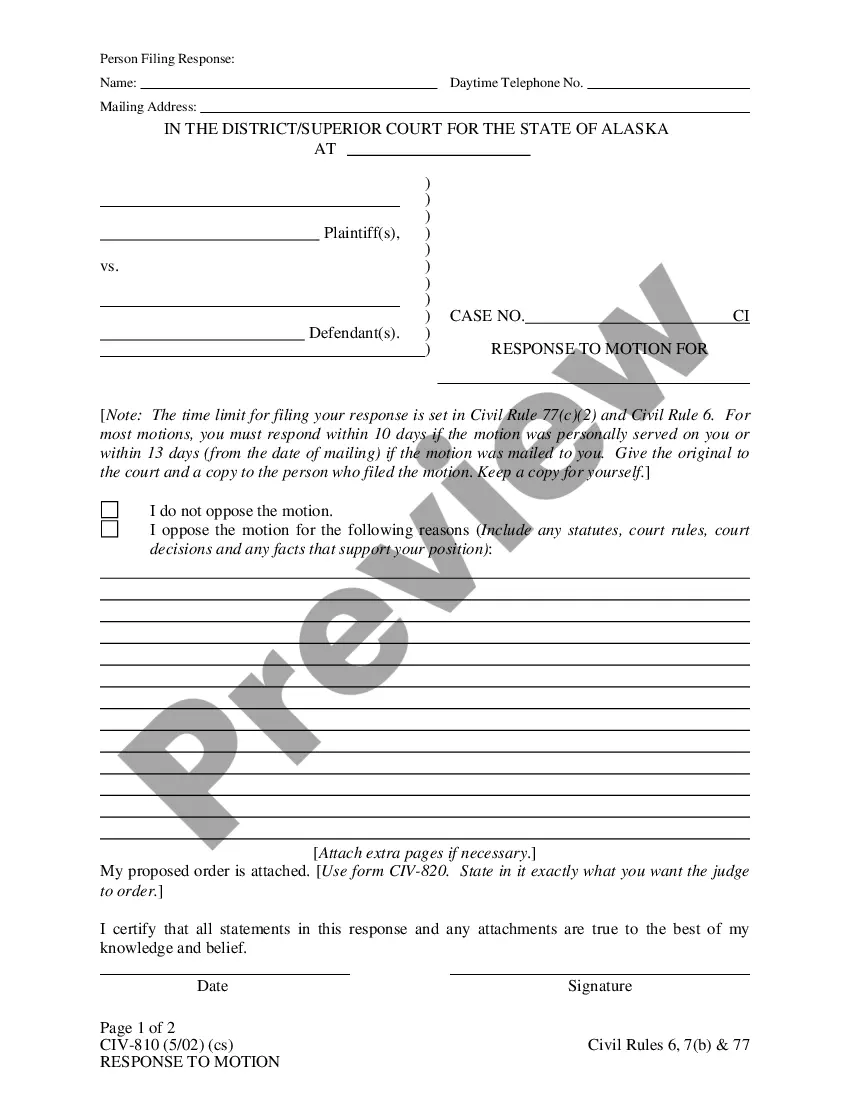

How to fill out Heating Contractor Agreement - Self-Employed?

Locating the appropriate legal document template can be a challenge.

Certainly, numerous designs are accessible online, but how can you obtain the legal template you desire.

Utilize the US Legal Forms website. The service offers an extensive array of templates, including the Idaho Heating Contractor Agreement - Self-Employed, which can be utilized for both business and personal needs.

You can view the document using the Preview button and read its description to verify it is the correct one for your needs.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and then click the Download button to obtain the Idaho Heating Contractor Agreement - Self-Employed.

- Use your account to browse through the legal documents you have previously acquired.

- Visit the My documents section of your account to retrieve another copy of the document you require.

- If you are a first-time user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have chosen the correct document for your city/region.

Form popularity

FAQ

Both terms are generally acceptable, but they may imply different aspects of your work arrangement. Self-employed highlights your independence in managing a business, while independent contractor emphasizes your specific agreement with a client. In the context of an Idaho Heating Contractor Agreement - Self-Employed, either term can appropriately describe your role, so choose based on the context of your discussions.

To be classified as self-employed, you must operate your business independently and manage risks associated with it. Individuals generate income without an employer-employee relationship. It’s crucial to understand your classification as self-employed, especially when entering into agreements like the Idaho Heating Contractor Agreement - Self-Employed, to ensure all legalities are covered.

A basic independent contractor agreement outlines the terms of work between a contractor and a client. This document typically includes the scope of work, payment terms, and project deadlines. By using an Idaho Heating Contractor Agreement - Self-Employed, you can clearly define your responsibilities and expectations with clients, making the work process smoother.

Absolutely, an independent contractor counts as self-employed. This status allows you autonomy over your work and income. When operating under an Idaho Heating Contractor Agreement - Self-Employed, be sure to understand the nuances of your relationship with your clients to maintain clarity and protect your interests.

Yes, independent contractors are indeed considered self-employed. They operate their businesses, provide services to clients, and are responsible for their taxes. If you are working as an independent contractor under an Idaho Heating Contractor Agreement - Self-Employed, you should be aware of your rights and obligations in this arrangement.

Yes, receiving a 1099 form usually indicates that you are self-employed. This form reports your earnings to the IRS as a non-employee. As a self-employed individual, you may need to keep track of your business expenses to ensure you maximize your tax benefits, such as those related to an Idaho Heating Contractor Agreement - Self-Employed.

employed contract should clearly define the services to be provided, payment terms, and timelines. In the context of the Idaho Heating Contractor Agreement SelfEmployed, it’s essential to include any specific requirements or expectations. Additionally, consider adding clauses about confidentiality, liability, and dispute resolution. This creates a stronger framework for your working relationship.

Writing an independent contractor agreement begins with identifying the parties involved and outlining the scope of work. Include payment terms, project timelines, and any pertinent details in the Idaho Heating Contractor Agreement - Self-Employed. It's important to remain clear and concise, so both parties understand their responsibilities. After drafting the agreement, have both you and your client review and sign it.

Filling out an independent contractor agreement involves providing essential details about both parties. Include the scope of work, payment terms, and deadlines in the Idaho Heating Contractor Agreement - Self-Employed. Make sure to clarify any specific responsibilities and deliverables. Finally, both you and your client should sign and date the agreement to indicate mutual consent.

As an independent contractor, you will need to fill out several key documents. Typically, this includes a W-9 form for tax purposes and the Idaho Heating Contractor Agreement - Self-Employed to outline your responsibilities. Additionally, you may need to provide invoices for your services, depending on the arrangement with your clients. Having the proper paperwork ensures clarity and professionalism in your work.