Idaho Clerical Staff Agreement - Self-Employed Independent Contractor

Description

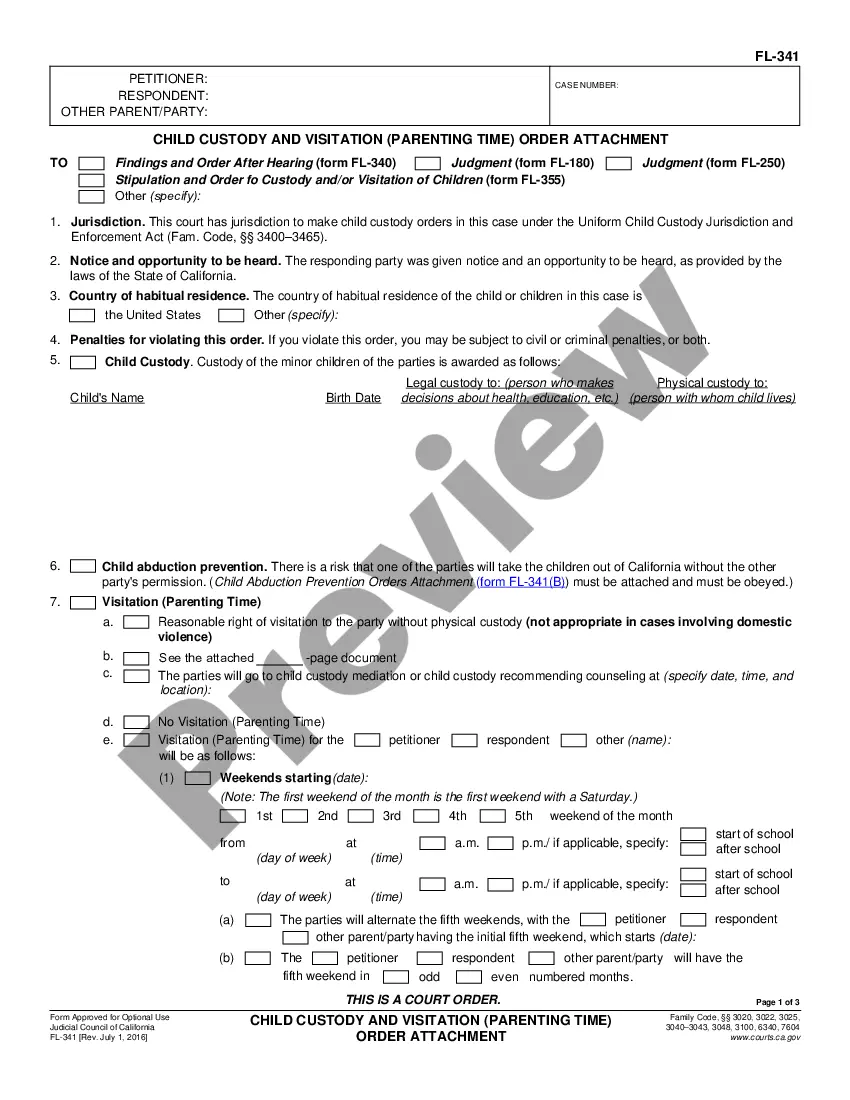

How to fill out Clerical Staff Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords.

You can find the latest versions of forms such as the Idaho Clerical Staff Agreement - Self-Employed Independent Contractor in just a few moments.

Check the form description to ensure you have chosen the correct one.

If the form does not fit your requirements, use the Search area at the top of the screen to find the one that does.

- If you already have a subscription, Log In and download the Idaho Clerical Staff Agreement - Self-Employed Independent Contractor from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to review the form's content.

Form popularity

FAQ

No, an independent contractor does not count as an employee. The relationship defined by an Idaho Clerical Staff Agreement - Self-Employed Independent Contractor clearly distinguishes independent contractors from employees. Independent contractors operate their own businesses, holding different tax and legal obligations. Understanding this distinction is crucial for compliance and proper business functioning.

Yes, a 1099 employee can have a contract. In fact, an Idaho Clerical Staff Agreement - Self-Employed Independent Contractor often outlines the terms of the working relationship. This contract clarifies expectations, responsibilities, and payment terms, protecting both parties. Utilizing a formal agreement helps ensure a smooth working arrangement.

Several factors determine the classification between an employee and an independent contractor. These include the level of control exercised, the permanency of the relationship, and how payment is structured. The Idaho Clerical Staff Agreement - Self-Employed Independent Contractor can clarify roles and responsibilities in a working relationship. It's critical to recognize these distinctions to comply with legal and tax requirements.

The difference between an independent contractor and an employee in Idaho is significant regarding labor rights and tax responsibilities. Employees receive wages and benefits but follow employer guidelines, while independent contractors operate with autonomy under agreements like the Idaho Clerical Staff Agreement - Self-Employed Independent Contractor. This autonomy often allows for greater flexibility and potentially higher compensation. Understanding these differences is vital for all businesses.

In Idaho, the primary difference between an employee and an independent contractor lies in the level of control over work performance. Employees typically follow specific company policies and schedules, while independent contractors use their discretion to fulfill agreements, such as the Idaho Clerical Staff Agreement - Self-Employed Independent Contractor. Furthermore, employees receive benefits like health insurance, whereas contractors do not. This distinction can have significant implications for both parties.

Yes, it is possible for someone to be labeled an independent contractor while functionally acting as an employee. This typically occurs when the hiring party has significant control over the work's details, such as the hours worked and how tasks are performed. Misclassification can lead to tax penalties and disputes, emphasizing the importance of clear terms in the Idaho Clerical Staff Agreement - Self-Employed Independent Contractor. Understanding this distinction helps avoid potential issues.

A person qualifies as an independent contractor if they provide services under a written agreement, like the Idaho Clerical Staff Agreement - Self-Employed Independent Contractor. They generally operate their business, control how work is done, and receive payment for the completed tasks rather than hours worked. Evidence of independence contributes to characterizing them outside of traditional employment. This distinction is crucial for tax obligations and benefits.

To prove employment as an independent contractor, you can use documents like tax forms or payment receipts. The Idaho Clerical Staff Agreement - Self-Employed Independent Contractor serves as an essential document to validate your working relationship. Additionally, maintaining records of invoices and communications can support your status if needed. Providing these documents can help clarify your role in various situations.

Filling out an Idaho Clerical Staff Agreement - Self-Employed Independent Contractor involves gathering key information about both parties. Start by inputting the names, addresses, and contact details of the contractor and the hiring entity. Then, specify the scope of work, payment terms, and deadlines. Finally, ensure both parties sign the document to formalize the agreement.

In Idaho, specific regulations define how much work you can undertake without a contractor license. Generally, engaging in minor tasks or short-term projects might not require a license. However, if your work grows in scale or complexity, securing an Idaho Clerical Staff Agreement - Self-Employed Independent Contractor and obtaining a proper license is beneficial for your business.