Idaho Accident Report For Workers Comp Compliance

Description

How to fill out Accident Report For Workers Comp Compliance?

Finding the correct legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Idaho Accident Report For Workers Comp Compliance, which you can utilize for professional and personal purposes.

All of the forms are reviewed by professionals and comply with federal and state regulations.

Once you are confident that the form is appropriate, click the Purchase Now button to acquire the form. Choose your preferred pricing plan and enter the necessary information. Create your account and complete your order using a PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, edit, and print the acquired Idaho Accident Report For Workers Comp Compliance. US Legal Forms is the largest repository of legal forms where you can explore various document templates. Use the service to obtain well-crafted documents that adhere to state requirements.

- If you are already a member, Log In to your account and click on the Download option to obtain the Idaho Accident Report For Workers Comp Compliance.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, make sure you have selected the correct form for your city/region. You can review the form using the View option and read the form description to ensure it is suitable for your needs.

- If the form does not fulfill your requirements, utilize the Search field to find the right form.

Form popularity

FAQ

Alabama Workers Comp offers financial support to employees injured on the job. It covers medical expenses and provides compensation for lost wages. While policies may vary across states, understanding Alabama’s framework can help ensure compliance with Idaho Accident Report for Workers Comp Compliance as well. For accurate management, consider using our platform to stay informed about regulations.

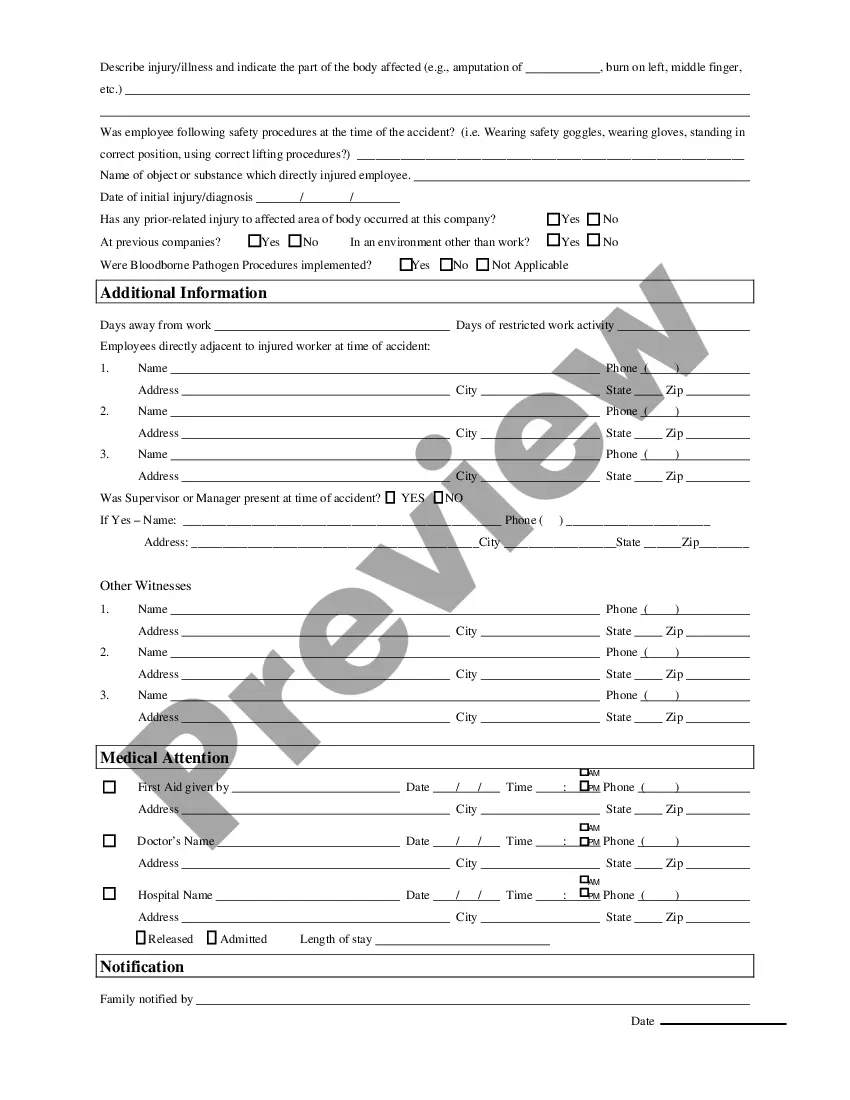

When filling out an injury report, start by identifying the injured party and the incident location. Describe the events leading up to the injury in a clear and concise manner. Be sure to note any immediate actions taken to assist the injured person. This method not only meets the requirements of Idaho Accident Report for Workers Comp Compliance but also establishes a foundation for future claims.

Filling out a work injury report involves gathering essential details such as employee information, injury specifics, and any relevant medical treatment received. You should also include an account of how the injury occurred to provide context. Utilizing a structured form can streamline this process. Using our platform can simplify this effort, ensuring adherence to the Idaho Accident Report for Workers Comp Compliance.

To write an effective injury report example, begin with the date, time, and location of the incident. Clearly describe what happened, including the individuals involved and any witnesses. Additionally, document the nature of the injuries and how they occurred. This approach ensures compliance with Idaho Accident Report for Workers Comp Compliance, and it helps in making informed decisions for future safety practices.

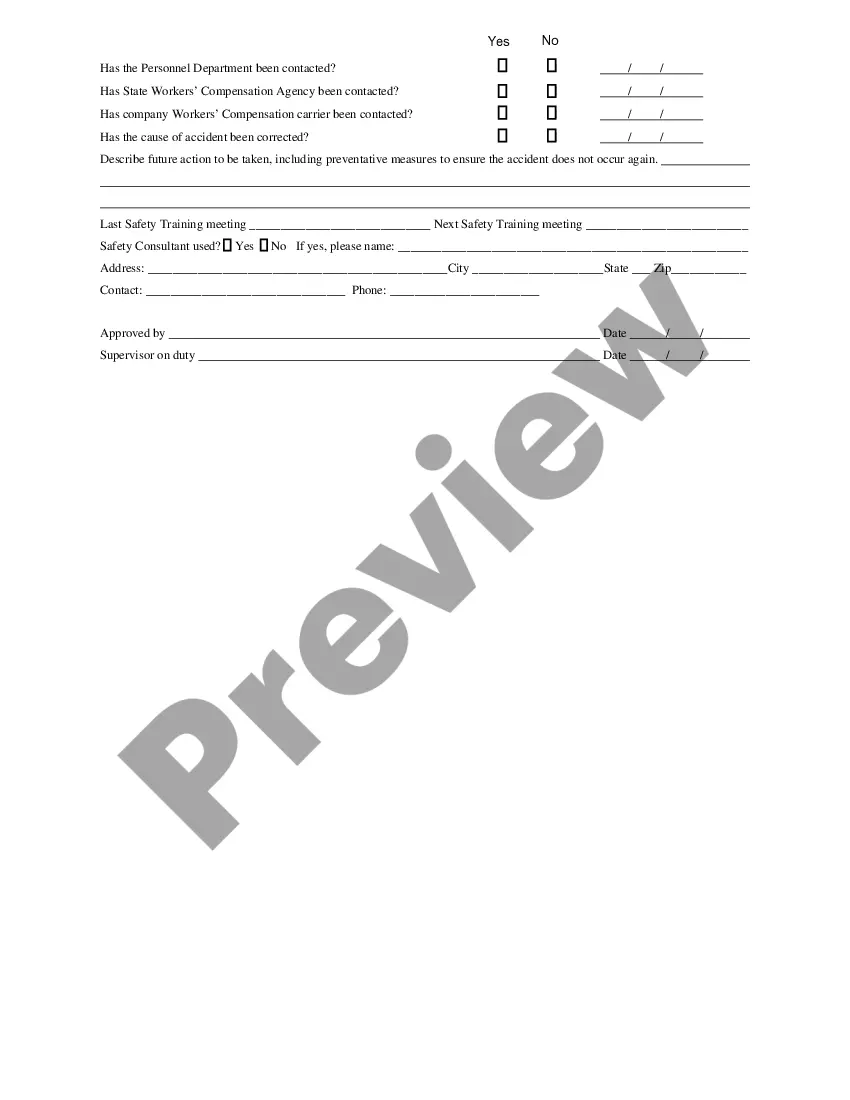

Failing to file a report after an accident can severely diminish your chances of obtaining workers' compensation benefits. It can lead to complications and delays in your claim, causing additional stress during a challenging time. Timely reporting is critical for compliance with Idaho Accident Report For Workers Comp Compliance. To safeguard your rights and interests, always ensure that you complete all necessary reporting.

If an employer fails to report a workplace accident to workers' compensation, they may face penalties, and employees risk losing their benefits. Reporting is crucial for compliance with Idaho Accident Report For Workers Comp Compliance regulations. Employees should advocate for their rights and ensure that accidents are reported properly. If your employer does not report your accident, seeking assistance is advisable.

Determining fault in a sudden stop situation can be complex and depends on the circumstances surrounding the incident. If you hit a car that braked suddenly, it may not automatically mean you are at fault. However, gathering evidence and an accident report is essential for making your case. Consulting with an expert can help clarify the situation, especially concerning Idaho Accident Report For Workers Comp Compliance.

Yes, Idaho law requires that certain accidents involving employees be documented through an accident report. This filing is essential for compliance with Idaho Accident Report For Workers Comp Compliance expectations. By submitting an accident report, you help ensure that your rights to workers' compensation are protected. It also provides vital information for your employer and assists in claim management.

In Idaho, you can typically file a workers' compensation claim for up to one year after the date of your accident. However, the best practice is to file as soon as possible to meet Idaho Accident Report For Workers Comp Compliance requirements. The longer you wait, the more challenging it may become to gather the necessary evidence for your case. Timely action maximizes your chances of success.

To obtain workers' compensation in Idaho, you need to meet three main requirements: you must be an employee, you must have sustained an injury related to your work, and you must report the injury in a timely manner. Following the right procedures ensures adherence to Idaho Accident Report For Workers Comp Compliance standards. Completing these steps can help you navigate the workers' compensation process more effectively. It’s vital to stay informed and thorough.