Idaho Employee Retirement Agreement

Description

How to fill out Employee Retirement Agreement?

Choosing the right legal record format could be a have a problem. Obviously, there are a variety of themes available on the net, but how do you discover the legal develop you want? Make use of the US Legal Forms website. The assistance delivers a large number of themes, like the Idaho Employee Retirement Agreement, that you can use for enterprise and private needs. All of the kinds are checked out by experts and satisfy federal and state demands.

If you are previously signed up, log in to your account and then click the Obtain option to have the Idaho Employee Retirement Agreement. Utilize your account to appear through the legal kinds you might have bought earlier. Go to the My Forms tab of the account and have an additional version from the record you want.

If you are a new user of US Legal Forms, here are straightforward directions for you to stick to:

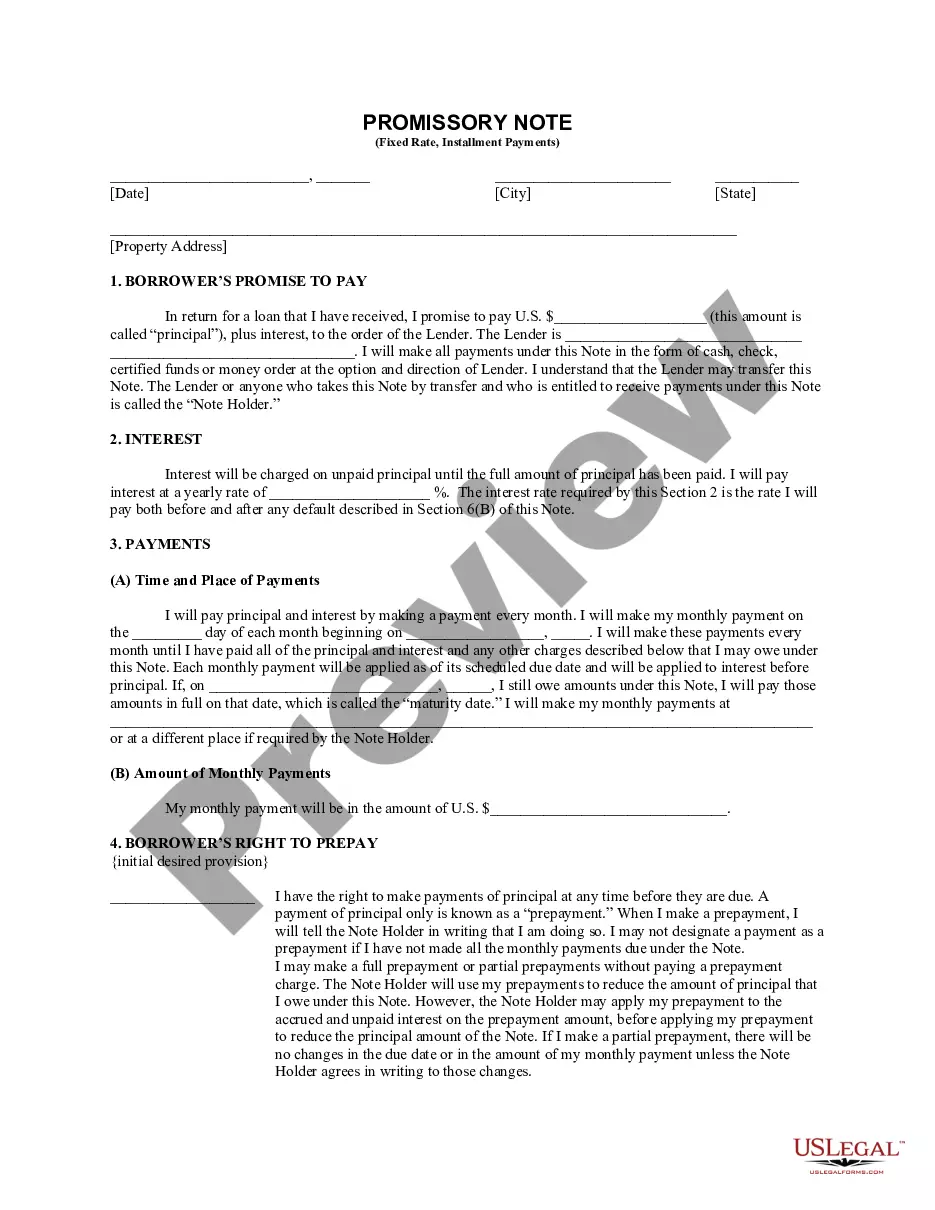

- Initial, be sure you have selected the proper develop for your personal metropolis/region. You can look through the form making use of the Review option and look at the form explanation to ensure it will be the best for you.

- In case the develop is not going to satisfy your preferences, use the Seach area to find the proper develop.

- Once you are positive that the form would work, go through the Acquire now option to have the develop.

- Select the rates prepare you desire and enter in the required information. Design your account and pay money for the order utilizing your PayPal account or charge card.

- Opt for the document structure and download the legal record format to your device.

- Complete, edit and produce and sign the obtained Idaho Employee Retirement Agreement.

US Legal Forms is definitely the biggest collection of legal kinds where you can see a variety of record themes. Make use of the service to download appropriately-created paperwork that stick to condition demands.

Form popularity

FAQ

When you reach SSFRA and begin receiving your Social Security benefit, the PERSI amount is reduced although your income remains somewhat constant. The accelerated amount is based on the number of years and months you are away from SSFRA when you retire under PERSI's plan.

Your benefit is calculated based on your highest average monthly salary (gross salary) over a base period and your total months of service.

The PERSI Base Plan is designed to provide pension benefits to career public employees.

Both you and your employer make contri- butions to PERSI. Your contributions are credited to a personal account that earns interest. The money in your account belongs to you?it is always yours no matter what! Employer contributions are pooled into a trust to cover future benefits for all members.

Unless you request more withheld, PERSI will withhold 20 percent for federal taxes if the payment is made to you. You may withdraw your funds from the Choice 401(k) Plan, or you may defer distribution to a future date if you have at least $1,000 in your account when your employment with a PERSI employer ends.

During that period, the Public Employee Retirement System of Idaho (PERSI) was among the nation's most stable systems, the study found. In 2020, the state's pension fund was 89% funded, ranking in the top 10 among all 50 states.