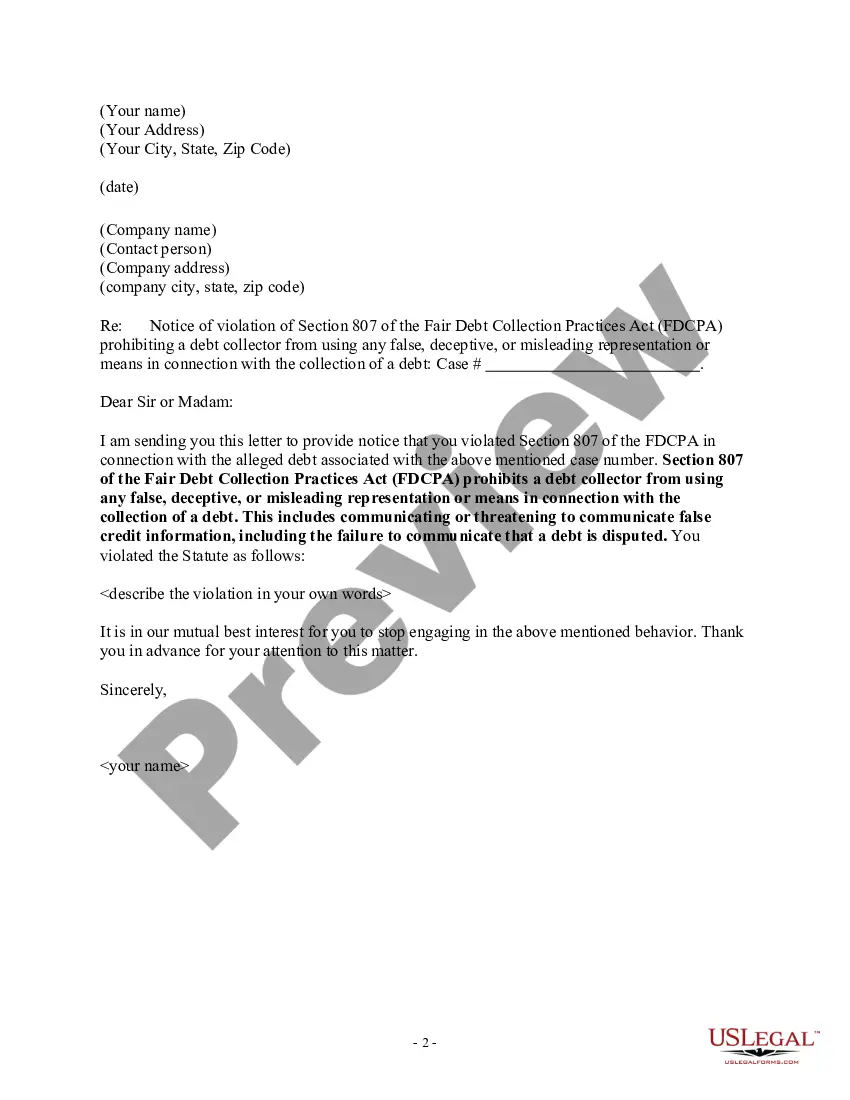

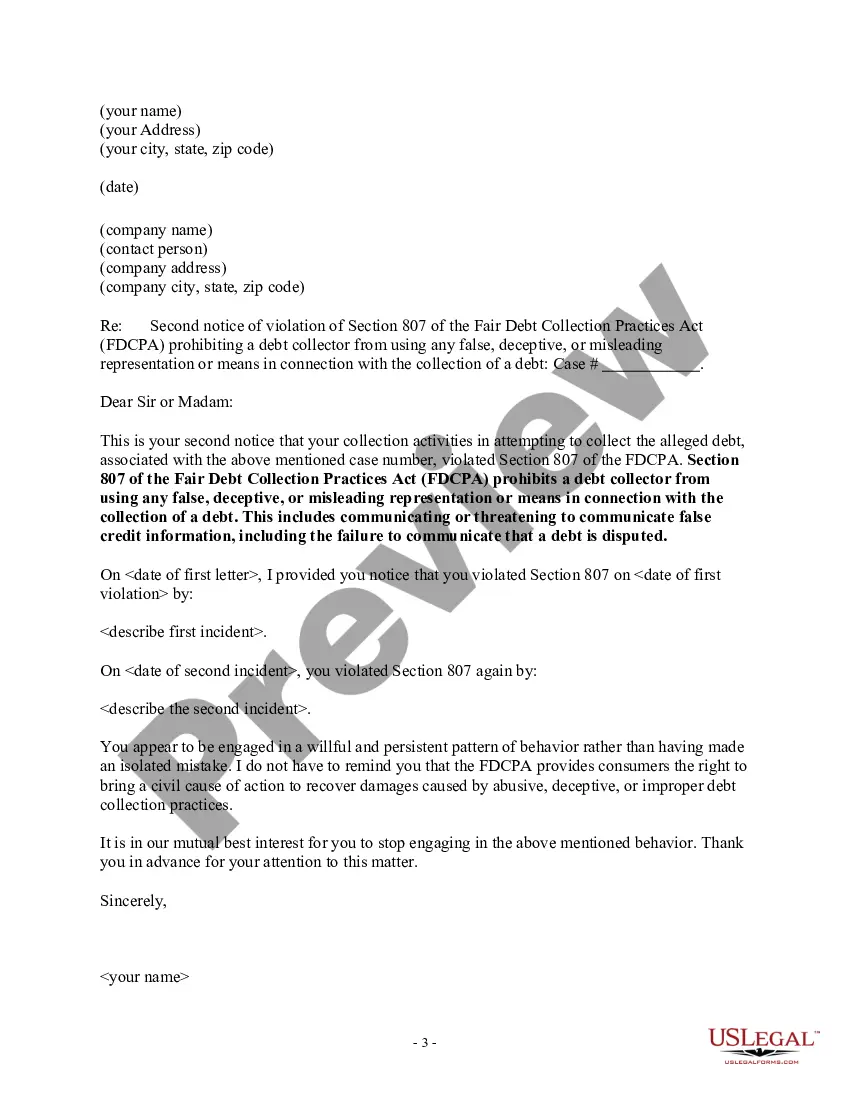

Idaho Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

Are you currently in a circumstance where you need to obtain documents for perhaps business or personal activities almost every day? There are numerous legal document templates accessible on the web, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of document templates, including the Idaho Notice of Violation of Fair Debt Act - False Information Disclosed, which are crafted to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply sign in. Then, you can download the Idaho Notice of Violation of Fair Debt Act - False Information Disclosed template.

Access all of the document templates you have purchased in the My documents section. You can obtain another copy of the Idaho Notice of Violation of Fair Debt Act - False Information Disclosed at any time, if needed. Click the required document to download or print the template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. This service offers professionally designed legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- Obtain the document you need and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Check the description to confirm you have selected the right document.

- If the document is not what you’re looking for, use the Search field to find the document that fits your needs and criteria.

- When you find the correct document, click Get now.

- Select the pricing plan you want, enter the required information to create your account, and place an order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

That is why Congress enacted the federal Fair Debt Collection Practices Act, a 1977 law that prohibits third-party collection agencies from harassing, threatening and inappropriately contacting someone who owes money. U.S. debt collection agencies employ just under 130,000 people through about 4,900 agencies.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

You have the right to be treated fairly by debt collectors. The Fair Debt Collection Practices Act (FDCPA) applies to personal, family, and household debts. This includes money you owe for the purchase of a car, for medical care, or for charge accounts.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.