Idaho Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Are you presently in a situation where you require documents for either business or personal purposes almost every time.

There are numerous official document templates accessible online, but finding ones you can trust is challenging.

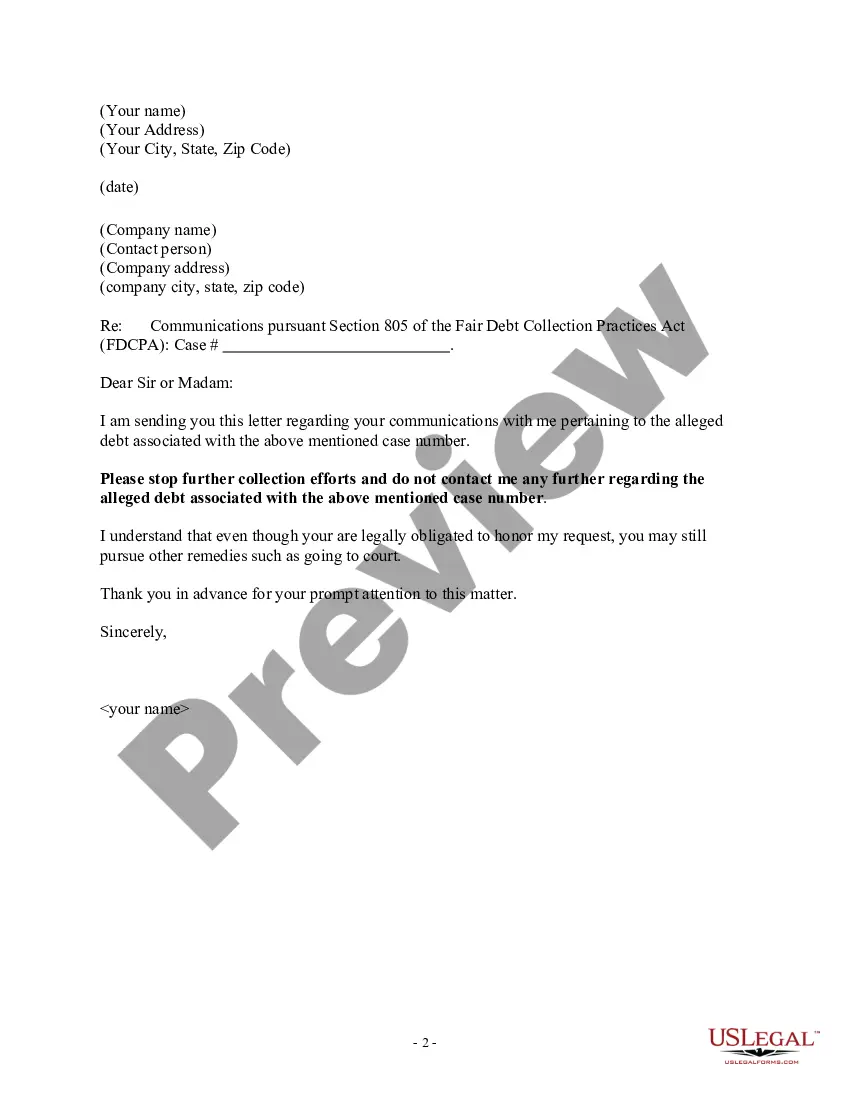

US Legal Forms provides a vast array of form templates, such as the Idaho Notice of Violation of Fair Debt Act - Notice to Stop Contact, which are designed to comply with state and federal regulations.

Once you find the right form, click on Download now.

Select the pricing plan you desire, complete the required information to set up your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Idaho Notice of Violation of Fair Debt Act - Notice to Stop Contact template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the appropriate city/region.

- Utilize the Review button to evaluate the form.

- Check the details to confirm you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

When you don't pay, the creditor can then go to the state and say, 'They're not listening to what you said to them, and you need to do something,' Satz said. And the court then has the power to hold the debtor in contempt, and the debtor can be hauled in and brought to jail.

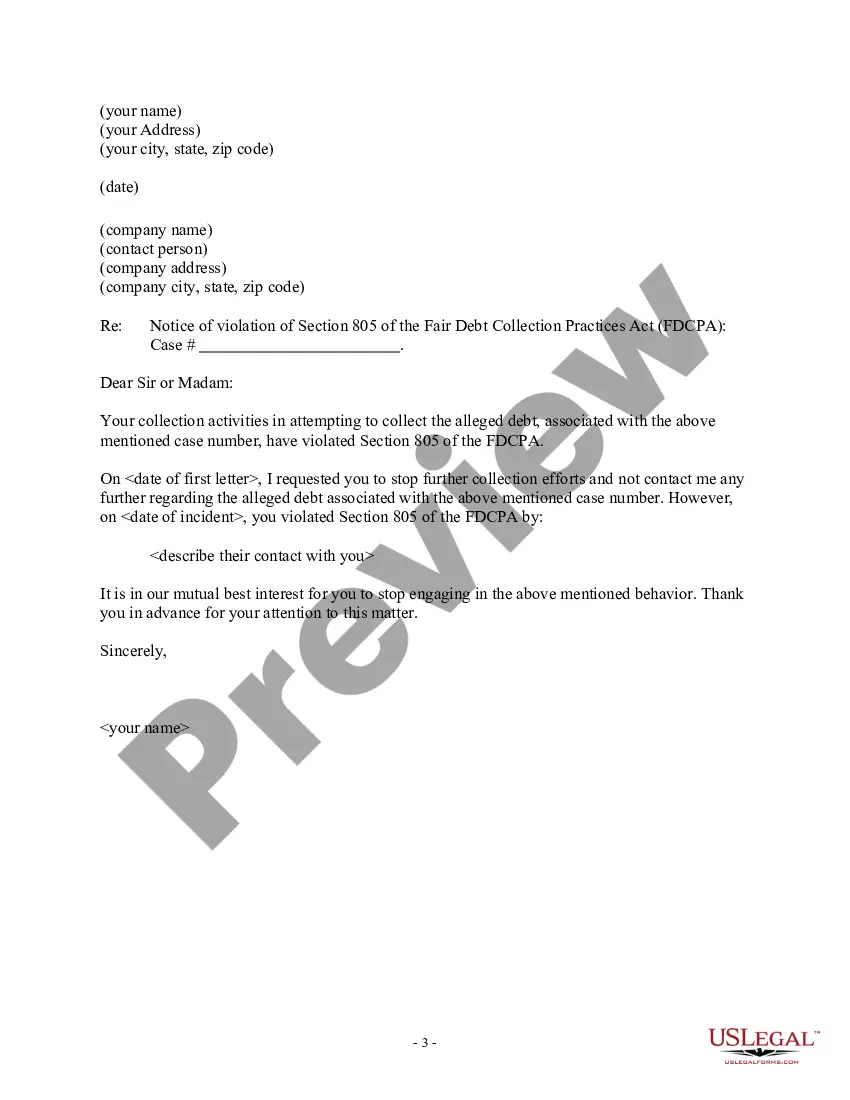

Once you dispute the debt, the debt collector can't call or contact you to collect the debt or the disputed part until the debt collector has provided verification of the debt in writing to you. Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt.

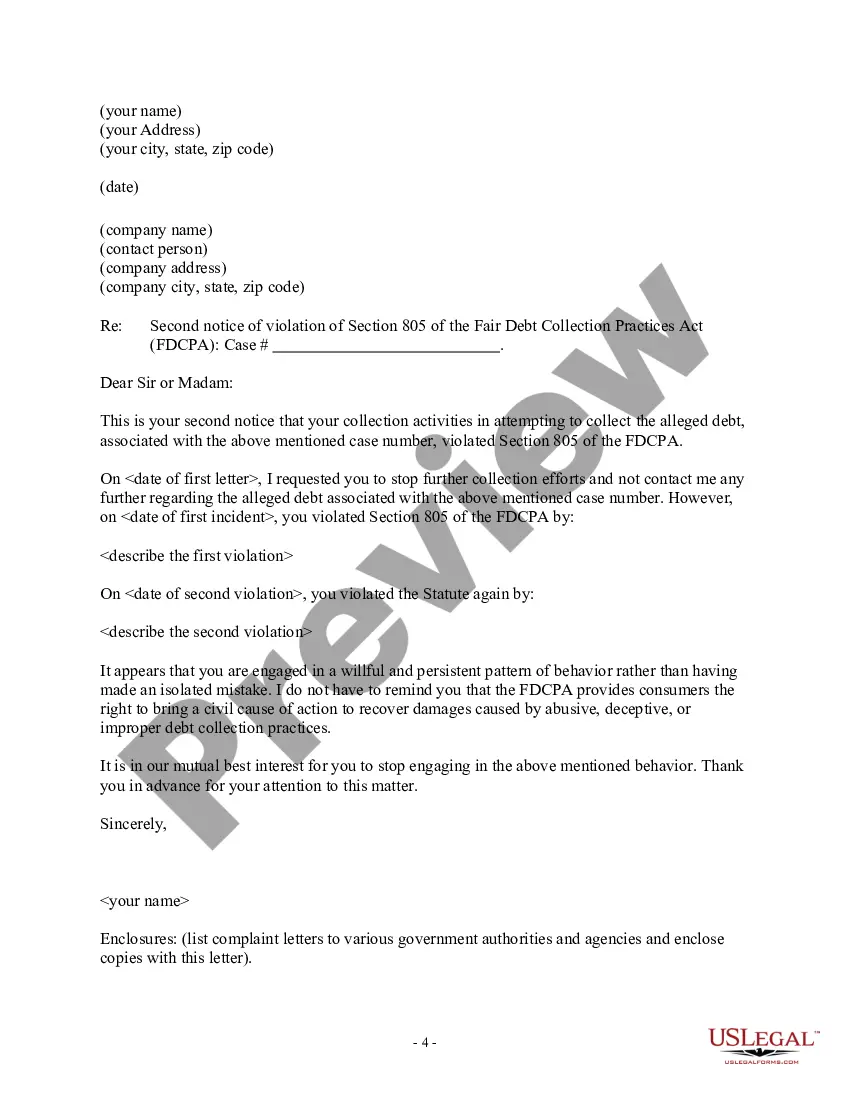

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

In almost all cases, the answer to this is no. More than a century ago, prison was a real risk for many types of ordinary household debt. In modern times, there's no possible way you could go to prison for non-payment of most types of debt.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Debt collection agencies are not bailiffs; They have no extra-legal authority. Debt collectors are either acting on behalf of your creditor or working for a company that has taken on the debt. They don't have any special legal powers and can't do anything different than the original creditor.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

Can a debt collector come to your house without notice? Yes, there's no formal process that debt collectors have to follow, unlike court appointed representatives, such as bailiffs.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.