Idaho Approval for Relocation Expenses and Allowances

Description

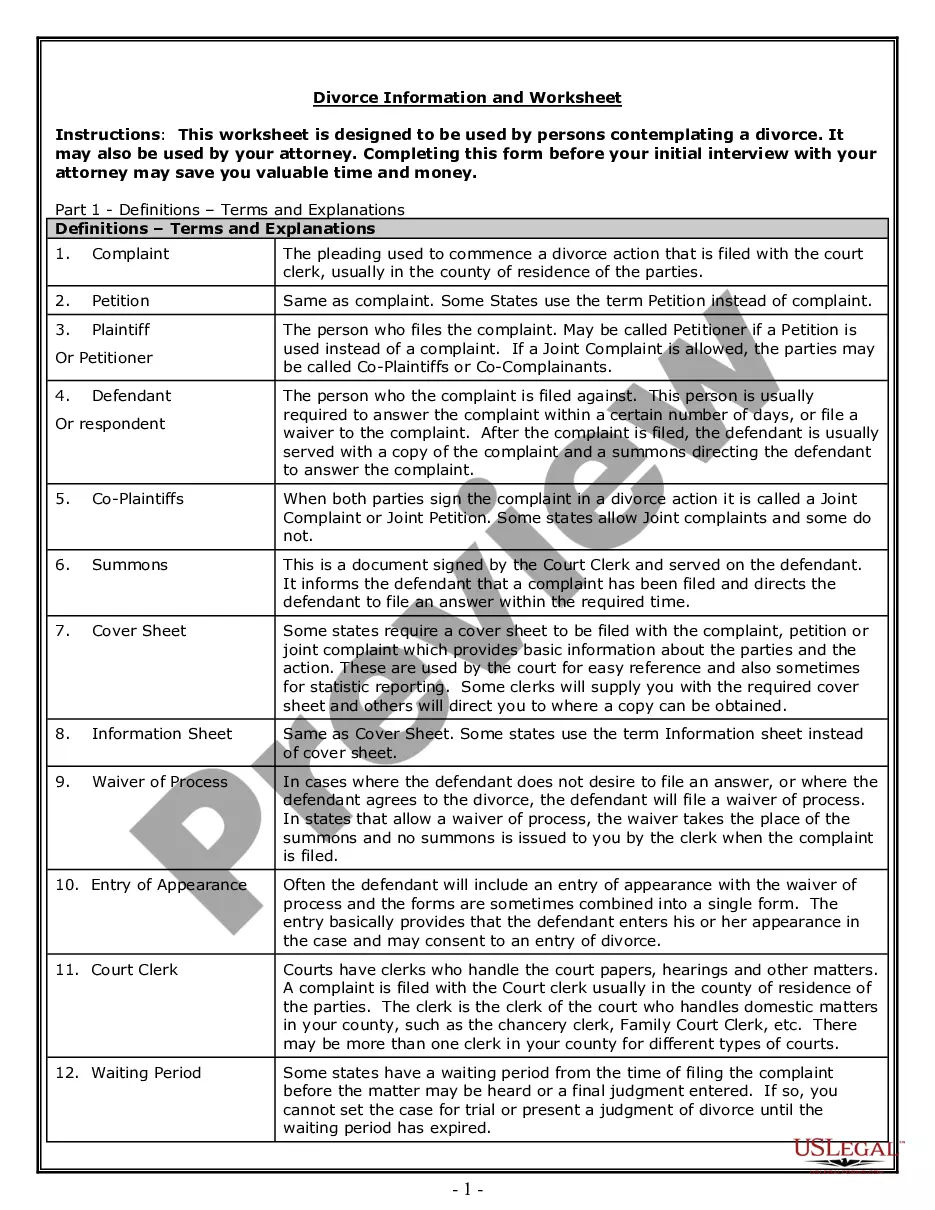

How to fill out Approval For Relocation Expenses And Allowances?

You might invest numerous hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal templates that can be reviewed by experts.

You can effortlessly download or print the Idaho Approval for Relocation Expenses and Allowances from my service.

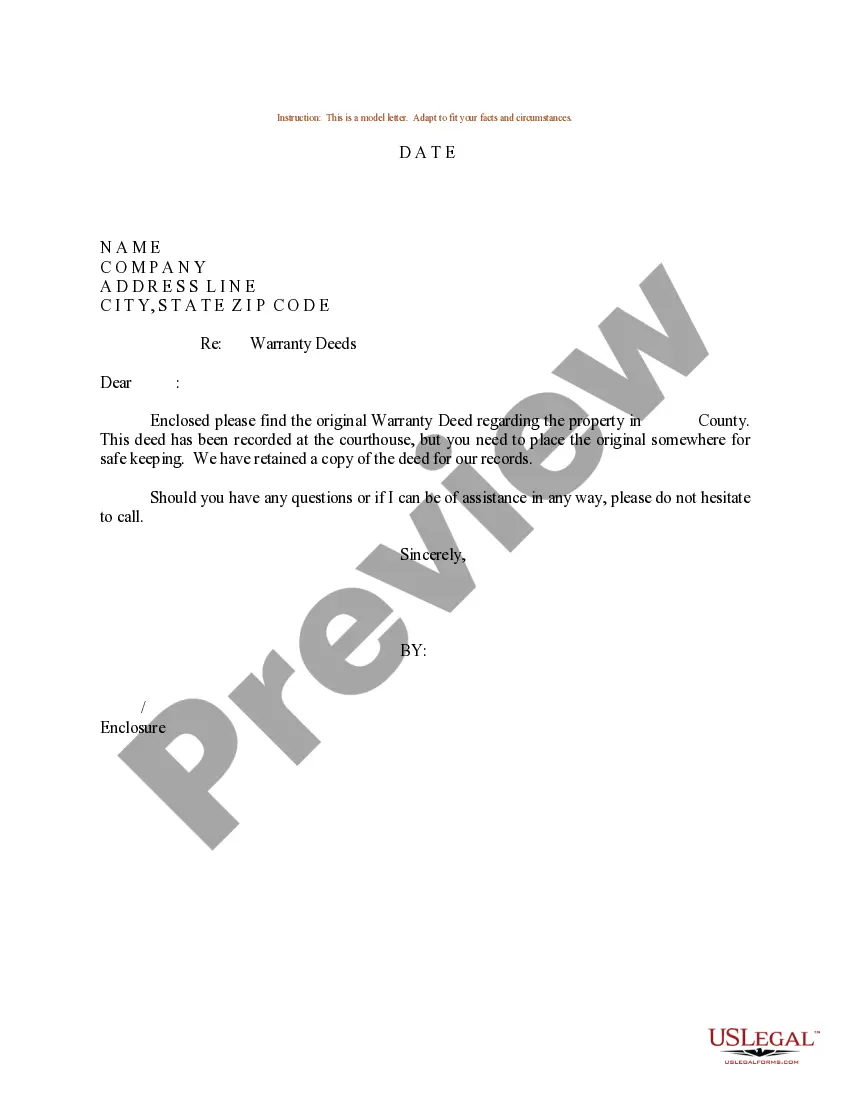

If available, utilize the Review button to review the document template as well.

- If you possess a US Legal Forms account, you may sign in and then select the Download button.

- Then, you can complete, modify, print, or sign the Idaho Approval for Relocation Expenses and Allowances.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/town of your preference.

- Check the form description to verify that you have chosen the right template.

Form popularity

FAQ

When negotiating a relocation package, consider requesting reimbursement for moving costs, temporary accommodation, and travel expenses. Additionally, inquire about coverage for miscellaneous expenses related to your move. Educating yourself about Idaho Approval for Relocation Expenses and Allowances can guide your negotiation. A well-prepared request enhances your chances of receiving a competitive and supportive package.

You can report your relocation expenses on your tax return by utilizing IRS Form 3903. This form allows you to itemize the moving costs that qualify under Idaho Approval for Relocation Expenses and Allowances. Make sure to keep all receipts and documentation related to your move, as this information will support your claims. To assist you further, consider exploring resources available on the USLegalForms platform.

The State Board of Examiners has established State Moving Policy and Procedures. This policy allows reimbursement of moving expenses for a current or newly hired employee.

Put the limit in writing with an offer of relocation reimbursement. The offer details the amount of money you will refund, the types of expenses that qualify, and any other stipulations that you want set on the reimbursement. Make sure you and the job candidate both sign the relocation offer.

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

Accordingly, as of July 2019, only seven states still allowed a moving tax deduction and/or continued to exclude moving reimbursements from income:Arkansas.California.Hawaii.Massachusetts.New Jersey.New York.Pennsylvania.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

The State Board of Examiners has established State Moving Policy and Procedures. This policy allows reimbursement of moving expenses for a current or newly hired employee.

Reimbursement Policies Under the Tax Cuts and Jobs Act of 2017, all expenses paid to or on behalf of an employee for moving expenses are treated as taxable income to the employee.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).