Idaho Memo - Using Self-Employed Independent Contractors

Description

How to fill out Memo - Using Self-Employed Independent Contractors?

Have you ever found yourself in a situation where you require documents for either business or personal reasons consistently.

There are numerous legal document templates accessible online, but discovering ones that you can trust is not easy.

US Legal Forms provides a vast array of template options, such as the Idaho Memo - Utilizing Self-Employed Independent Contractors, designed to comply with state and federal regulations.

Once you retrieve the correct template, click Buy now.

Choose the payment plan you prefer, complete the required information to create your account, and place an order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and own an account, simply Log In.

- Subsequently, you can obtain the Idaho Memo - Utilizing Self-Employed Independent Contractors template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the template you need and ensure it is for your correct city/region.

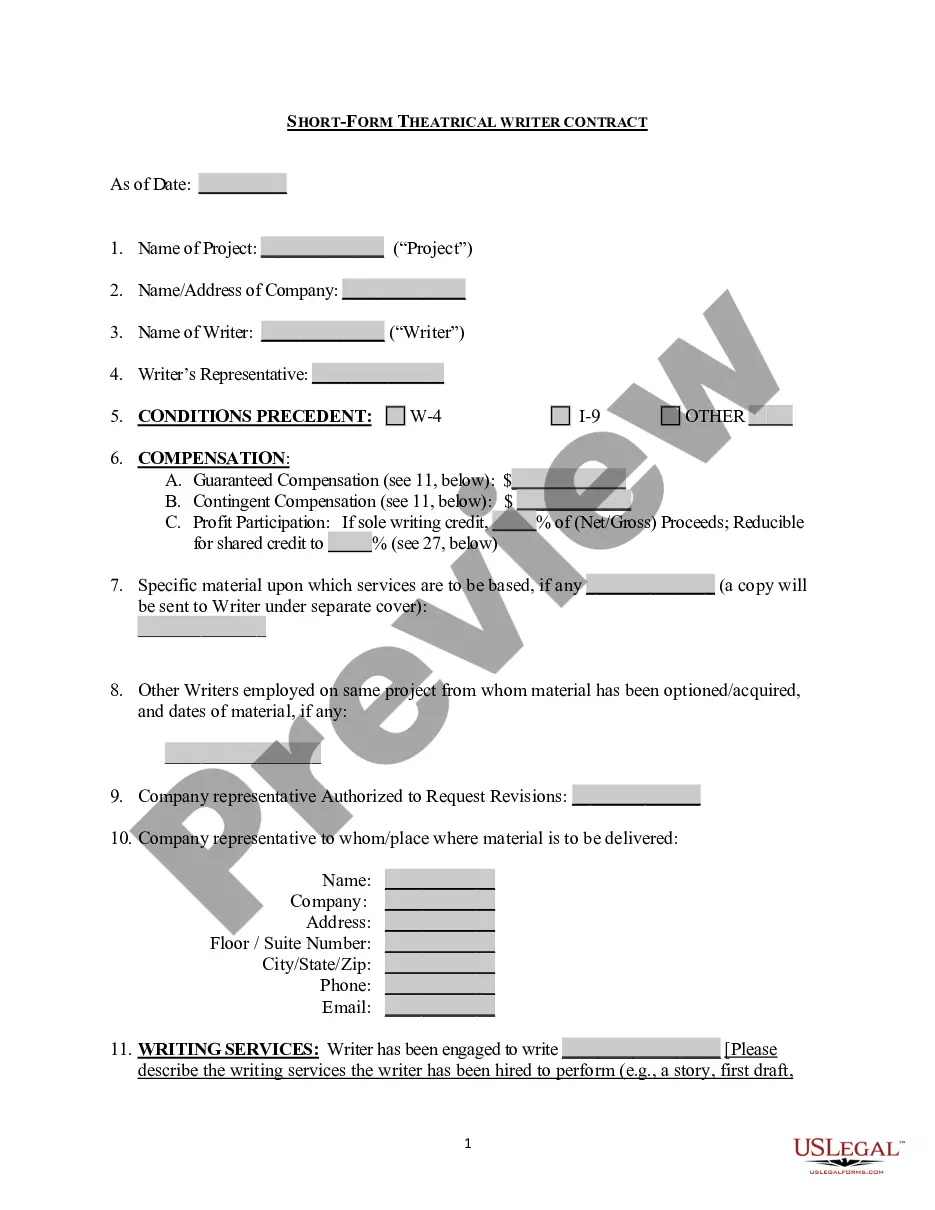

- Utilize the Preview feature to review the form.

- Examine the information to confirm that you have selected the right template.

- If the template isn’t what you’re aiming for, use the Lookup field to find the template that suits your requirements.

Form popularity

FAQ

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

There are several types of business bank accounts to consider for your independent contracting business. You can consider an account with a local bank as well as an online business bank account. You may prefer mobile banking if you don't need to go into a physical branch and don't need to deposit cash.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

' All sole proprietors are, by definition, self-employed. But not all self-employed persons are sole proprietors.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.