Idaho Checklist for Proving Entertainment Expenses

Description

How to fill out Checklist For Proving Entertainment Expenses?

Have you ever found yourself in a situation where you need documents for either business or personal uses almost every day.

There are numerous legal document templates available online, but locating forms you can trust is not simple.

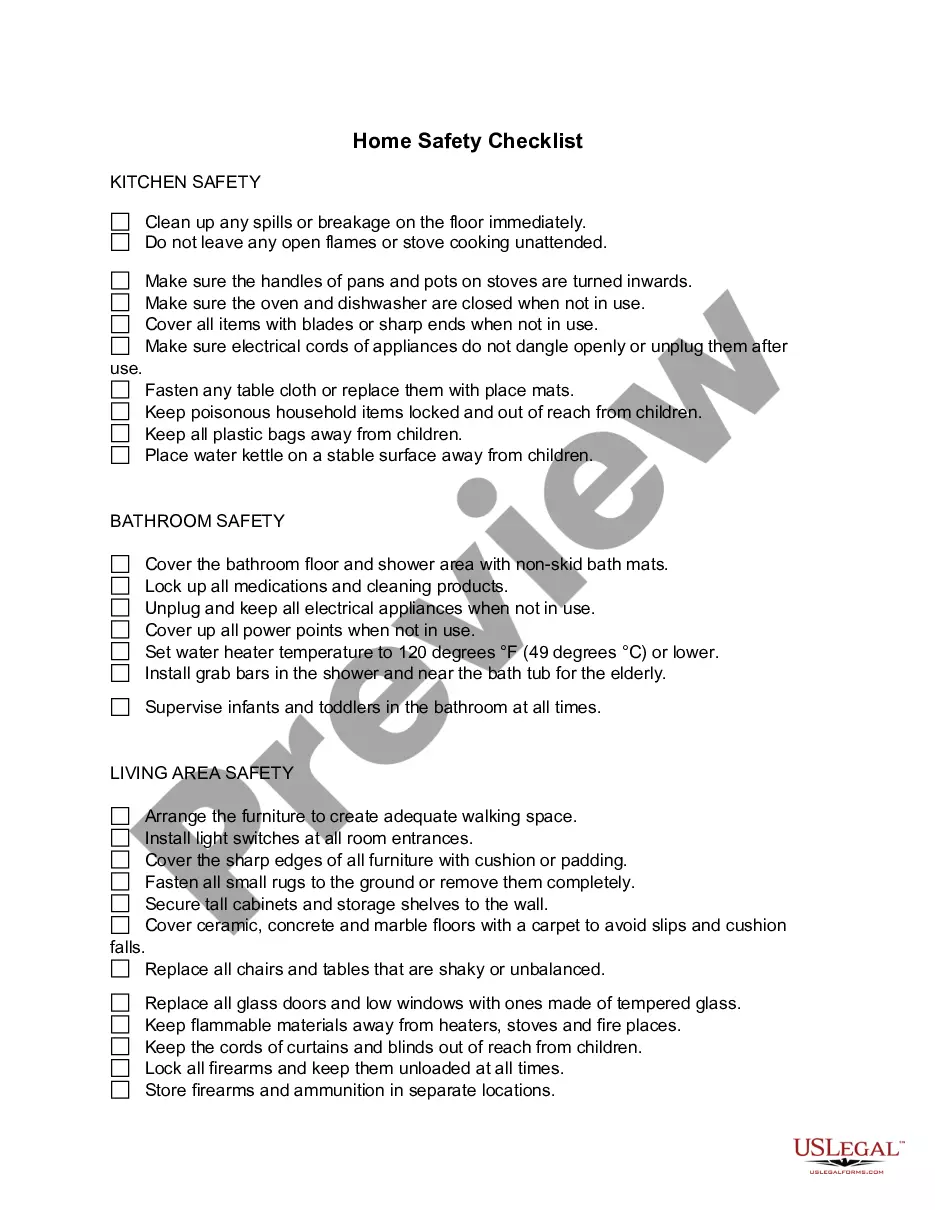

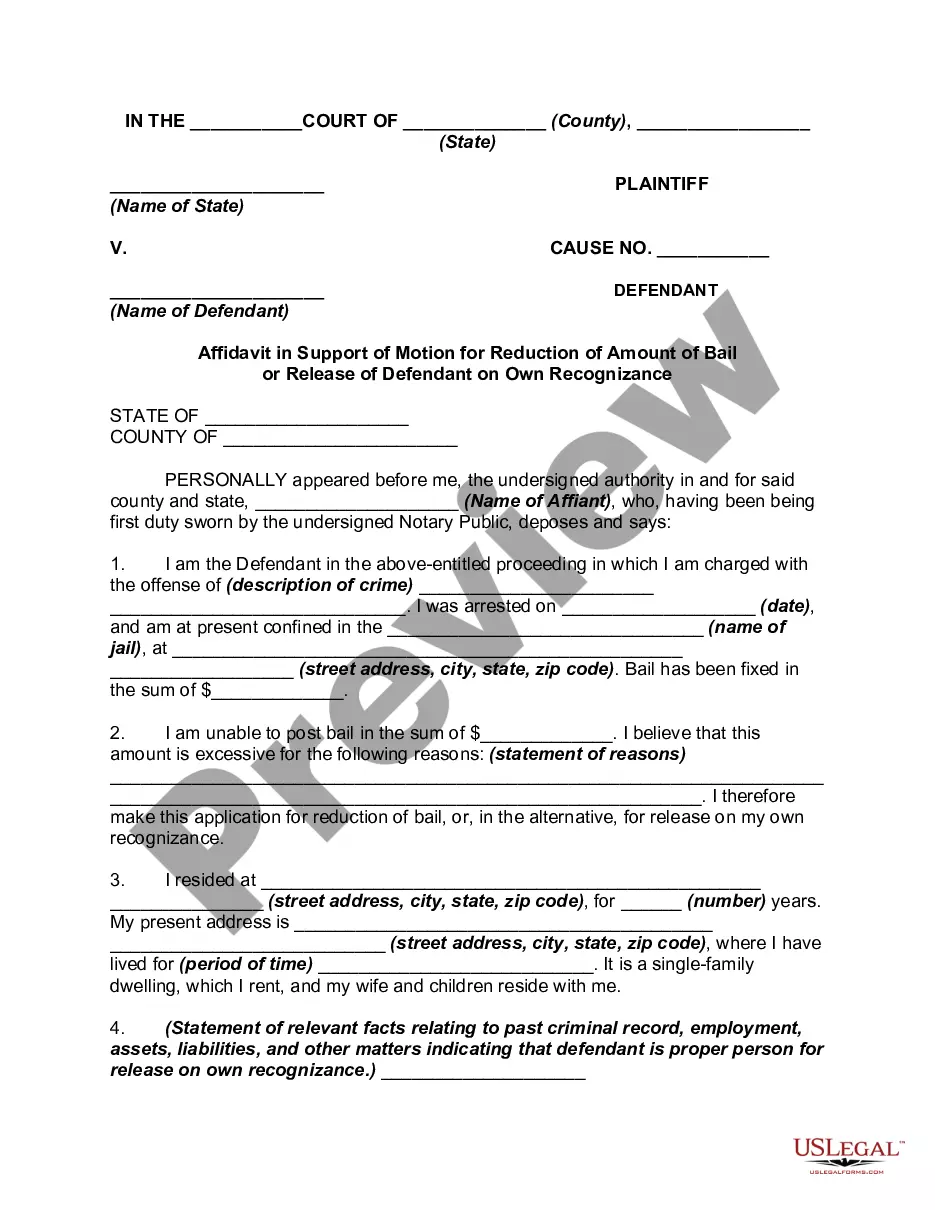

US Legal Forms offers thousands of form templates, including the Idaho Checklist for Proving Entertainment Expenses, designed to comply with federal and state regulations.

Once you find the right form, click on Acquire now.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterwards, you can download the Idaho Checklist for Proving Entertainment Expenses template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the appropriate area/county.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you seek, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Entertainment expenses include the cost of entertaining customers or employees at social and sports events, restaurant meals and theater tickets, among other things. You may deduct business entertainment expenses subject to certain conditions.

The 2018 Tax Cuts and Jobs Act brought a few big changes to meals and entertainment deductions. The biggest one: entertainment expenses are no longer deudctible.

Your business can deduct 100% of food, beverage, and entertainment expenses incurred for recreational, social, or similar activities that are incurred primarily for the benefit of employees other than certain highly compensated employees (for example, food and beverages and entertainment at company picnics or company

Entertainment can involve eating, drinking and other hospitality. Types of entertainment include: 'business entertainment' of clients - eg discussing a particular business project or forming or maintaining a business connection.

S32-10 (1): Entertainment means (a) entertainment by way of food, drink or recreation and any transport or (b) accommodation or travel to do with providing entertainment by way of food, drink or recreation.

2022 Meals And Entertainment Deductions ListBusiness meals with clients (50%)Office snacks and other food items (50%)The cost of meals while traveling for work (50%)Meals at a conference that go above the ticket price (50%)Lunch out with less than half of company employees (50%)More items...?

Businesses will be permitted to fully deduct business meals that would normally be 50% deductible. Although this change will not affect your 2020 tax return, the savings will offer a 100% deduction in 2021 and 2022 for food and beverages provided by a restaurant.

Entertainment expenses include the cost of entertaining customers or employees at social and sports events, restaurant meals and theater tickets, among other things. You may deduct business entertainment expenses subject to certain conditions.

Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.