Idaho Employment Firm Audit

Description

How to fill out Employment Firm Audit?

Are you currently in a location where you often require documents for either business or personal needs almost every day.

There is a wide array of legal document templates available online, but finding ones that you can trust is challenging.

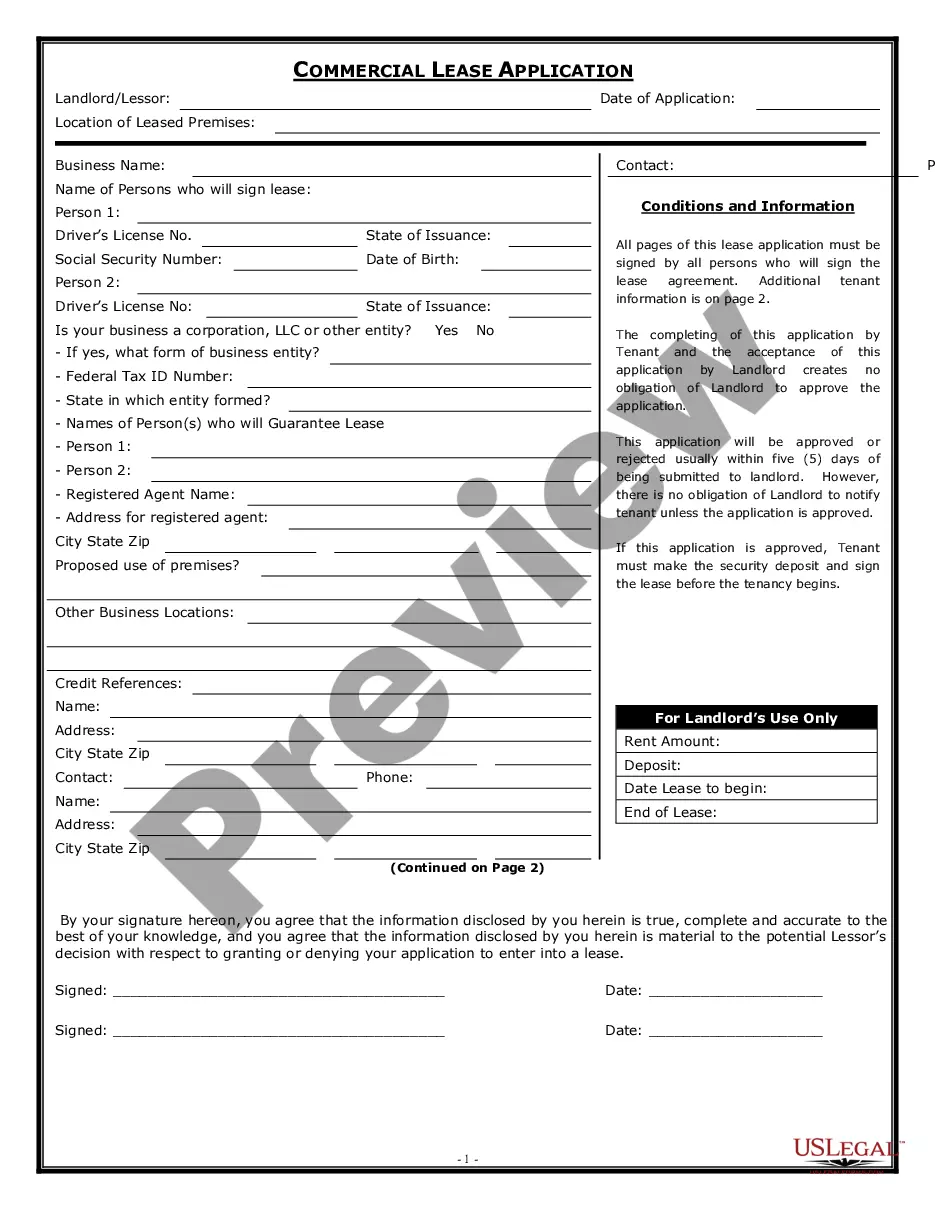

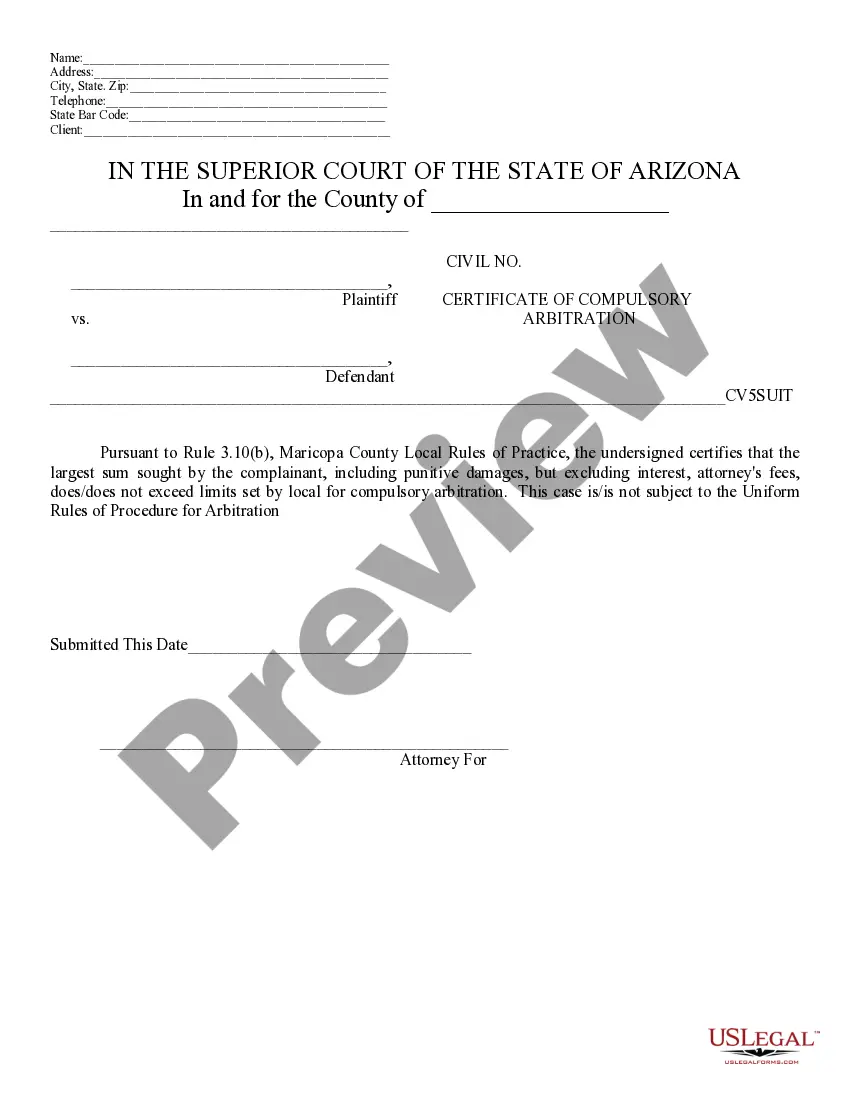

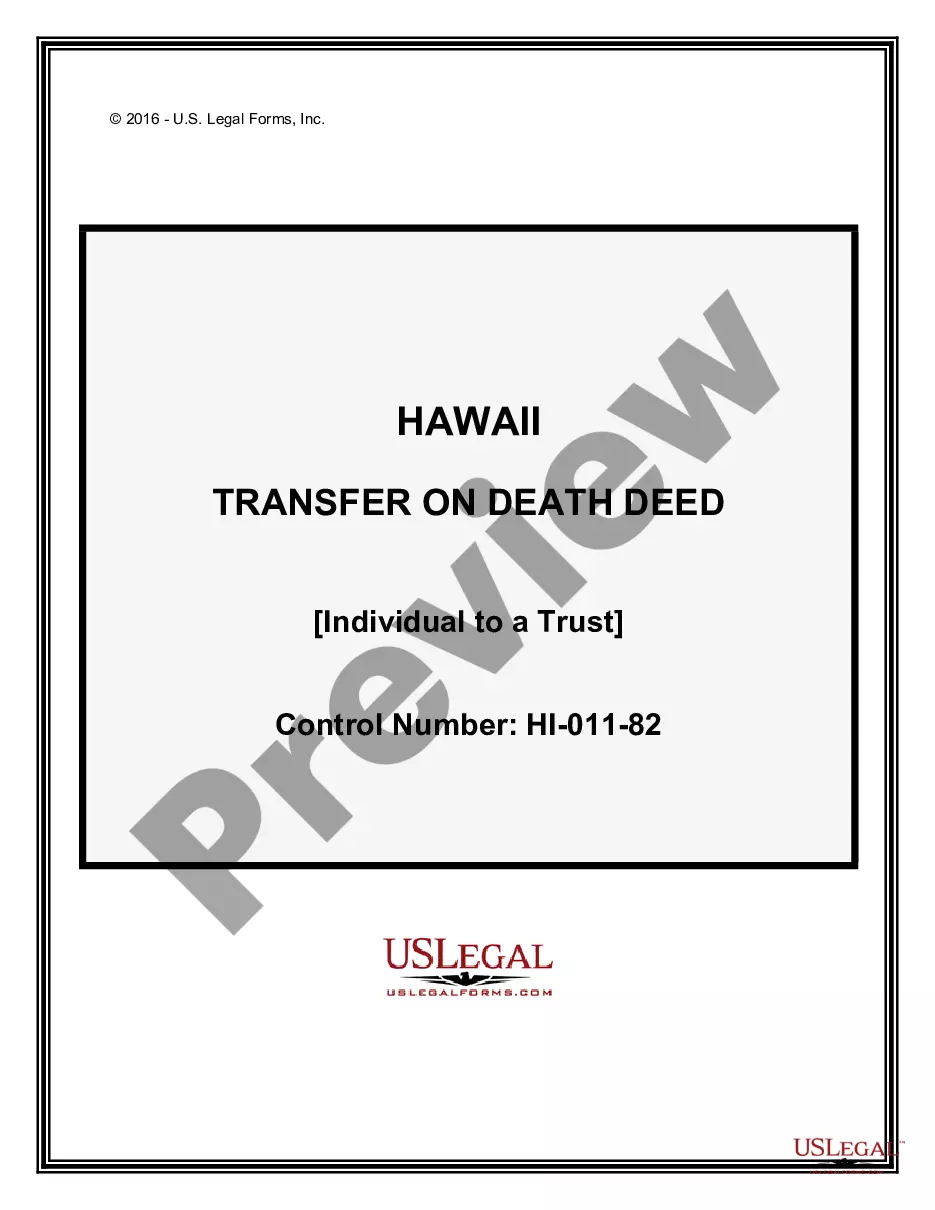

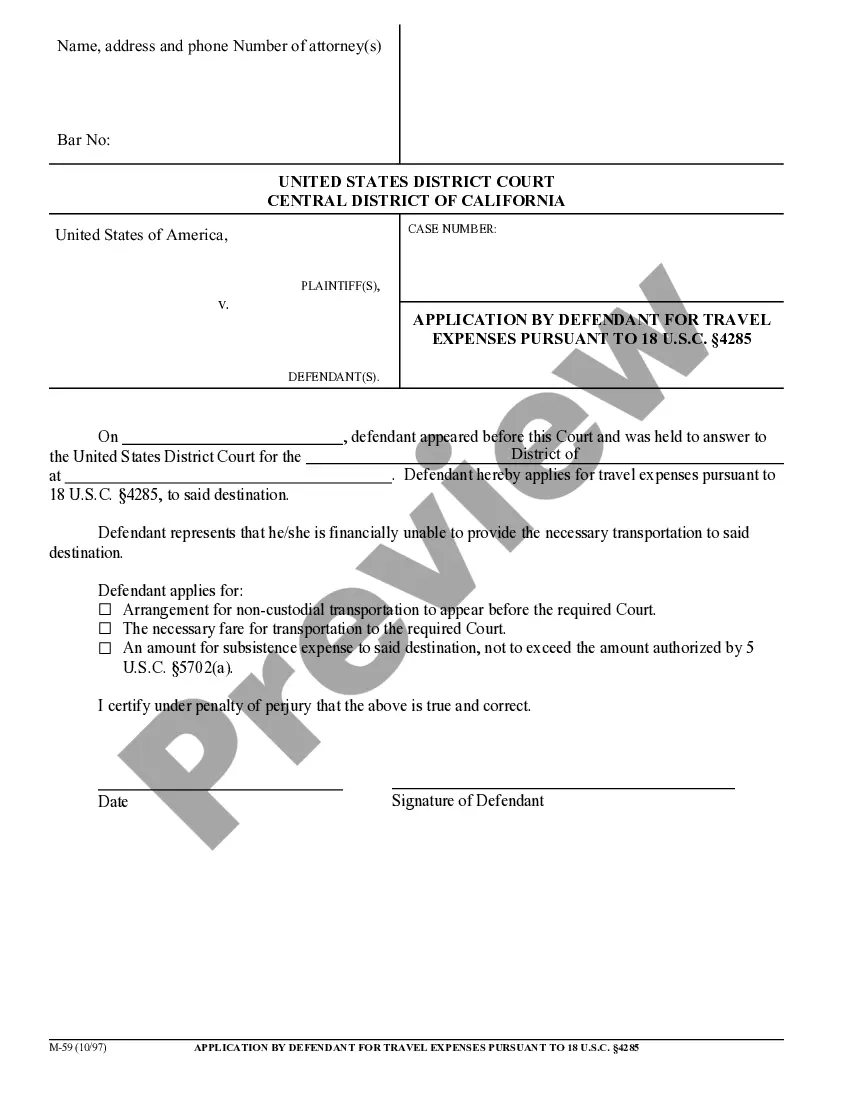

US Legal Forms provides thousands of form templates, such as the Idaho Employment Agency Audit, specifically designed to meet federal and state regulations.

When you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Idaho Employment Agency Audit template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need to ensure it's for the correct state/region.

- Use the Preview button to examine the form.

- Read the description to ensure you have chosen the right form.

- If the form is not what you are looking for, use the Search bar to locate the form that satisfies your needs and requirements.

Form popularity

FAQ

Preparing for a tax audit means organizing your financial records, ensuring all documentation is accurate, and understanding what the auditor may ask. Keeping detailed records will aid in a smooth audit process. Engaging with an Idaho Employment Firm Audit can provide invaluable assistance during your preparation, helping to reduce stress and increase your confidence.

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

Human Resource audits are used to assess the compliance of your HR policies and procedures. They can diagnose issues before they become real problems and help you find the right solutions. But HR compliance audits can be used for more than just defining risk.

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

Labor audits seek to determine employee attitudes toward the employer and to identify possible areas of vulnerability to a union organizing drive.

Washington State Department Labor and Industries (sometimes referred to as L&I) routinely conducts financial audits and records audits of small businesses like general contractors, subcontractors and specialty contractors such as electricians, plumbers, sheet metal fabricators and installers, and roofing companies to

In essence, an HR audit involves identifying issues and finding solutions to problems before they become unmanageable. It is an opportunity to assess what an organization is doing right, as well as how things might be done differently, more efficiently or at a reduced cost.

To be proactive, employers should consider a self-audit, which consists of the following steps:Review job descriptions.Understand both federal and state law and ensure the employer is in compliance.Ensure that FLSA classifications are correct.Keep accurate payroll records.Apply policies consistently.More items...

The EDD can decide to audit if a worker makes the case that he or she is an employee rather than an independent contractor (typically found out when the employee tries to apply for unemployment insurance). Other triggers for an audit include: Filing or paying late. Errors in time records or other statement or documents.

There are three main types of audits: external audits, internal audits, and Internal Revenue Service (IRS) audits.