Idaho Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal uses, organized by categories, states, or keywords. You can find the latest versions of forms like the Idaho Agreement to Sell Partnership Interest to Third Party in just seconds.

If you already have a subscription, Log In to download the Idaho Agreement to Sell Partnership Interest to Third Party from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Select the format and download the form to your system.

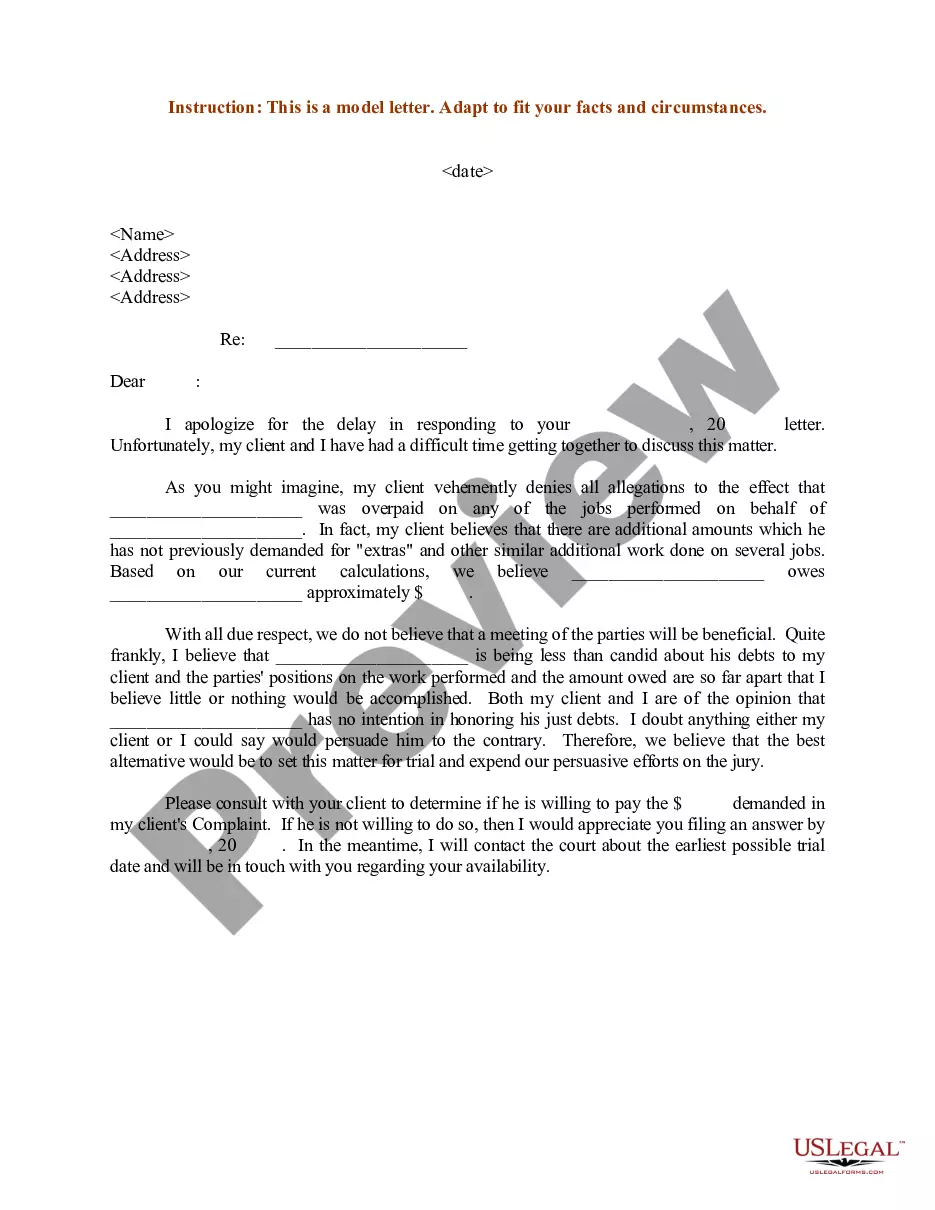

Make modifications. Fill out, edit, print, and sign the downloaded Idaho Agreement to Sell Partnership Interest to Third Party. Each template you save in your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, just go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content.

- Check the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to sign up for the account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

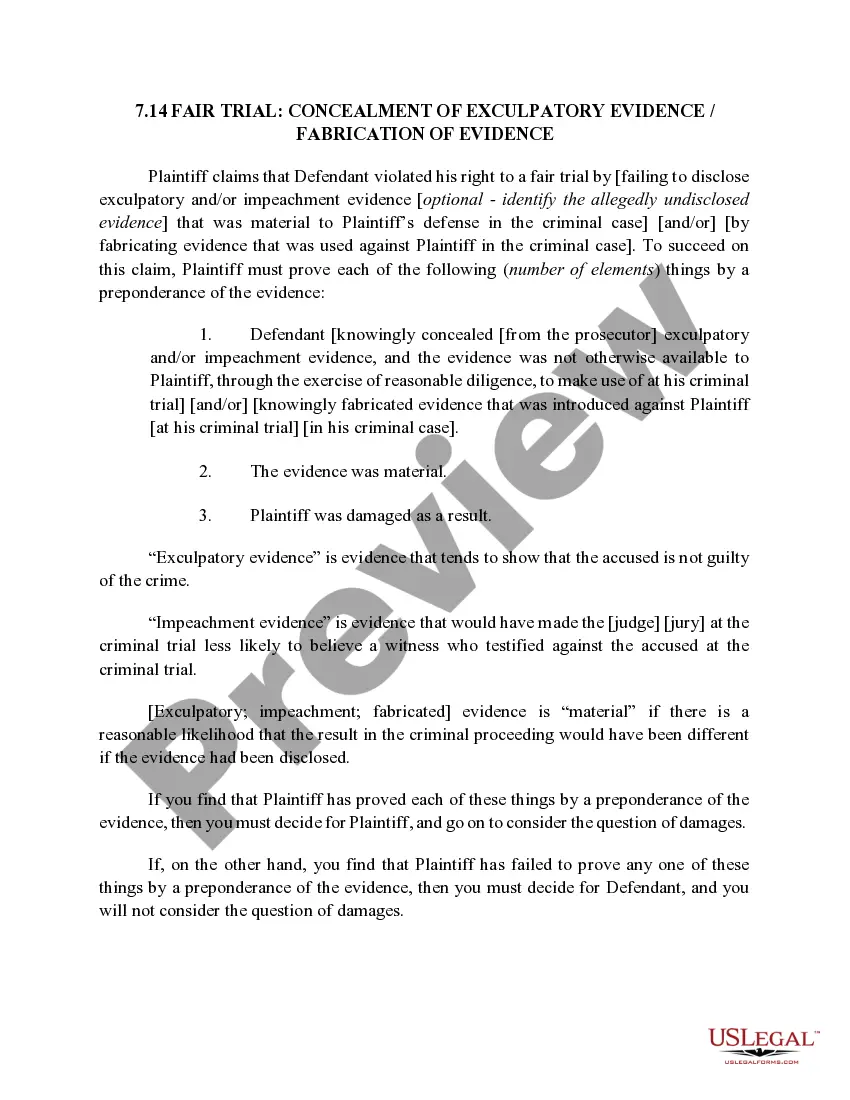

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

A legally binding partnership, however, requires that each partner is assigned specific roles and responsibilities, financial expectations, and future planning expectations for the business. The partnership should also have an agreement as to handling the exit of one of the business partners.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

A partnership agreement is a legally binding document between the partners of a business to establish roles and responsibilities. All partners within a business are expected to sign this legally binding contract.

If your business is a limited liability company or general partnership, your partner can't sell the company without your consent. He may, however, sell his interest in the company if you don't have a buy-sell agreement.

Partners in a firm are jointly and severally liable for any breach of trust committed by one partner, in which they were implicated. Persons other than partners may have authority to deal with third parties on behalf of the firm; however, such persons have no implied mandate.

Your legal partnership is essentially a single legal entity, and the situation can become complicated when one partner wants to sell his or her shares and the other partner refuses. Whether or not you can force your business partner to buy you out largely depends on your written agreement.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

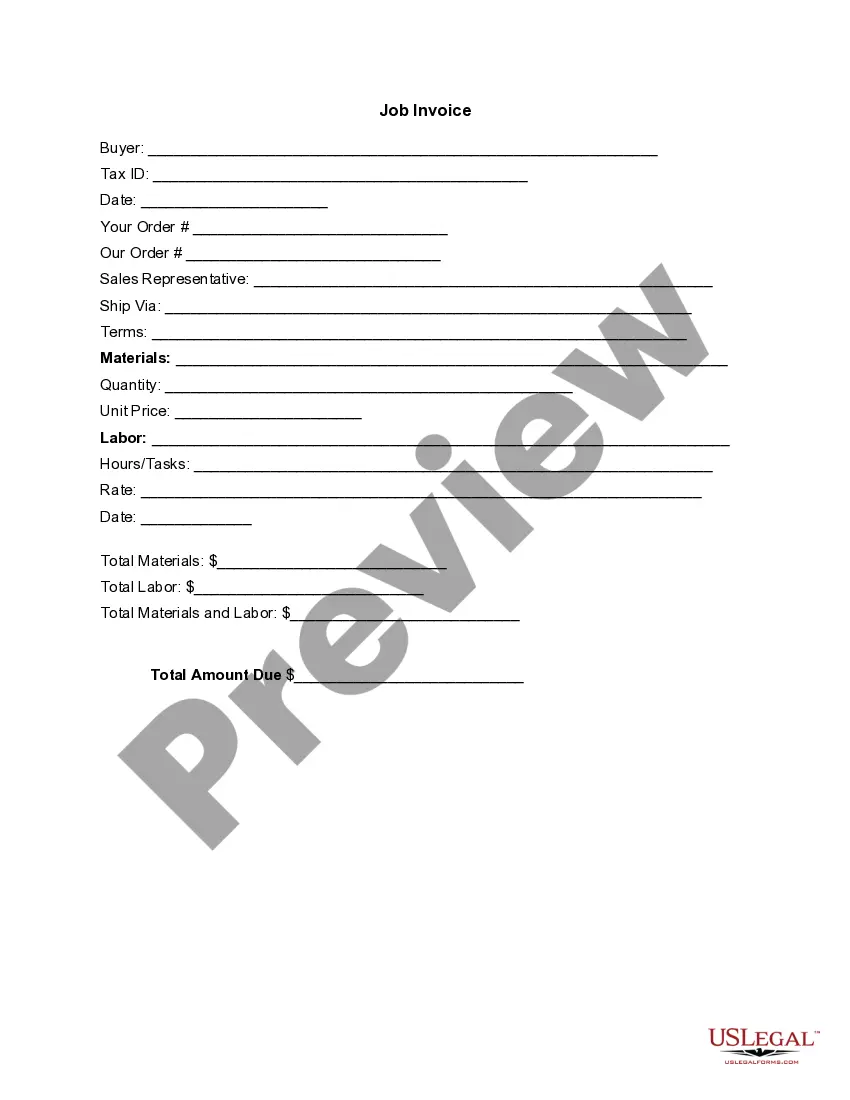

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.