Idaho Agreement Between Board Member and Close Corporation

Description

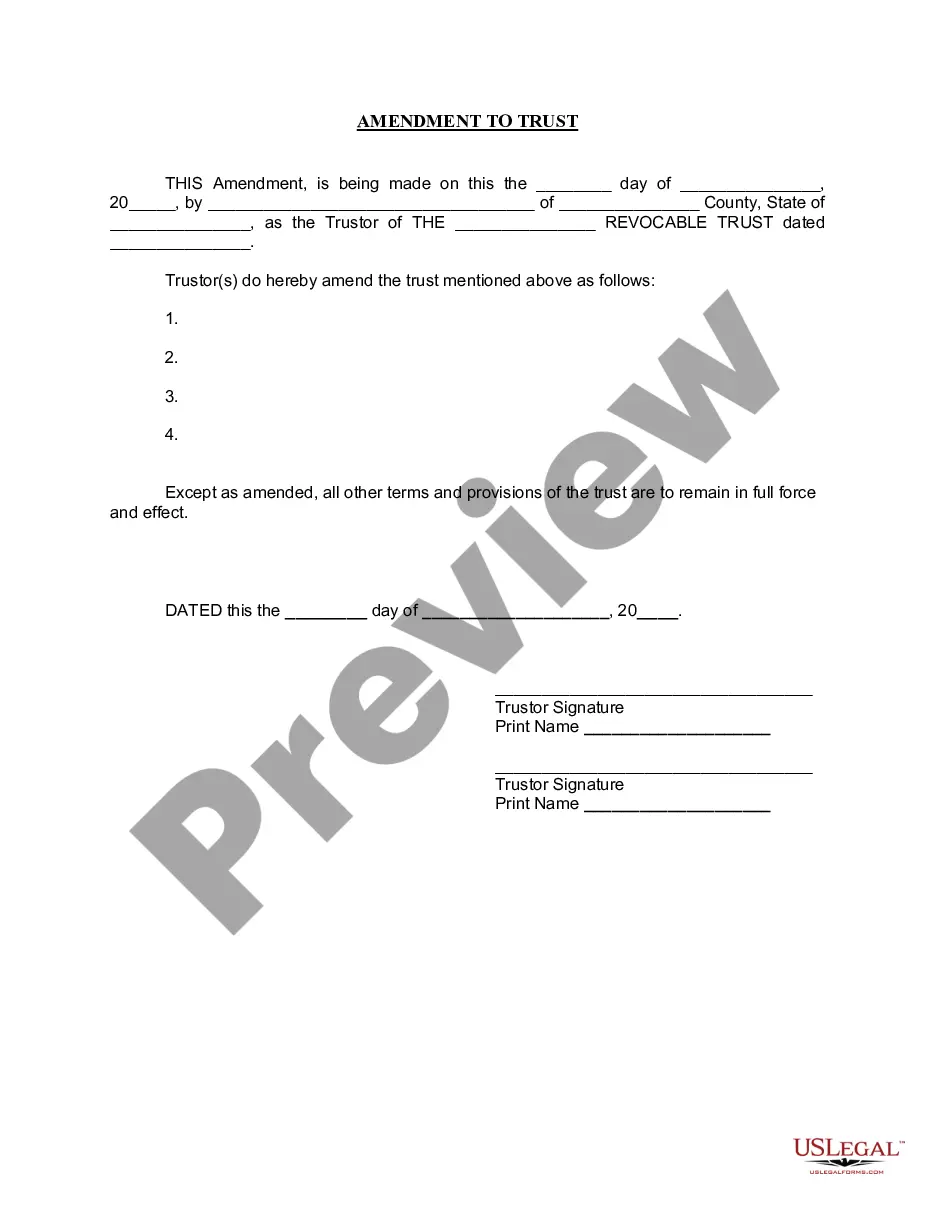

How to fill out Agreement Between Board Member And Close Corporation?

You might spend numerous hours online trying to locate the approved document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the Idaho Agreement Between Board Member and Close Corporation from the platform.

To find another version of your form, use the Search field to locate the template that suits your needs.

- If you already have a US Legal Forms account, you can sign in and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Idaho Agreement Between Board Member and Close Corporation.

- Every legal document template you obtain is yours permanently.

- To get another copy of any acquired form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city you choose.

- Read the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

In Idaho, a first-time misdemeanor can lead to various penalties, including fines and possibly jail time, depending on the crime. However, many first-time offenders receive alternative sentencing or probation. If legal issues arise concerning your corporation or personal matters, consider the benefits of consulting professionals to navigate the law effectively, especially when considering an Idaho Agreement Between Board Member and Close Corporation.

Idaho Secretary of State Secretary of State: File the appropriate form to terminate the business registration or transfer it to a new owner. You may need to call the Secretary of State's office at 208-334-2301 to obtain the appropriate form.

When the business dissolves, officers are responsible for the liquidation of company assets. Proceeds from the sale are then payable for outstanding debts that remain. Once all the debts are satisfied, the owners or shareholders of the business may claim and divide the balance of the assets.

Forming a PLLC in Idaho (in 6 Steps)Step One) Choose a PLLC Name.Step Two) Designate a Registered Agent.Step Three) File Formation Documents with the State.Step Four) Create an Operating Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.10-Jan-2022

An Idaho PLLC is a limited liability company (LLC) formed specifically by people who will provide Idaho licensed professional services. LLCs in general are businesses registered with the state that consist of one or more peoplecalled LLC memberswho own the business.

Typically, your shareholders will have to vote to dissolve the S-Corp. The decision to dissolve the business has to be a majority vote. Some states only require a simple majority, while others call for a supermajority or something else, like a two-thirds majority.

NOTE: You can, as an individual, act as your own registered agent if you have an Idaho physical address. Or, you may use another legal business entity who is filed with our office with an Idaho physical address, but not your own entity.

To dissolve your corporation in Idaho, you can sign in to your SOSBiz account and choose terminate business. Or, you can provide the completed Articles of Dissolution form in duplicate to the Secretary of State by mail or in person, along with the filing fee.

Create an Idaho operating agreement for the PLLC An operating agreement is a key business document that outlines the operations and management of a company and the obligations and responsibilities of the members. Idaho doesn't require PLLCs to file an operating agreement, but it's a good idea to create one.

Limited Liability Company (LLC) Operates under a legal contract between the owners called an Operating Agreement. All LLCs, including single member ones, need a legal Operating Agreement created by an attorney that conforms with Idaho law.