Idaho Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

How to fill out Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

Are you inside a placement where you will need files for either enterprise or individual purposes virtually every day? There are a variety of legitimate file web templates available online, but getting kinds you can rely isn`t easy. US Legal Forms delivers a large number of kind web templates, just like the Idaho Agreement of Shareholders of a Close Corporation with Management by Shareholders, which are written to fulfill federal and state specifications.

In case you are currently familiar with US Legal Forms web site and get a merchant account, merely log in. After that, you may down load the Idaho Agreement of Shareholders of a Close Corporation with Management by Shareholders design.

Unless you offer an bank account and want to begin to use US Legal Forms, abide by these steps:

- Discover the kind you need and ensure it is for that proper metropolis/region.

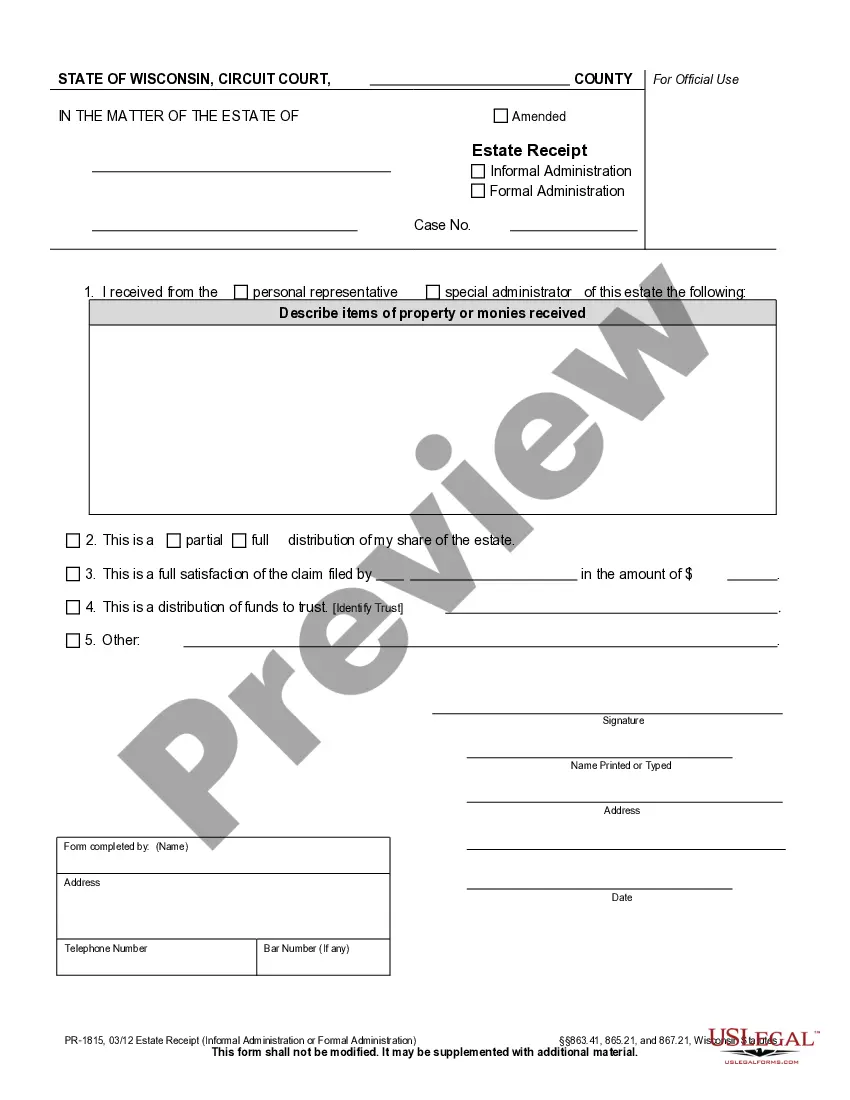

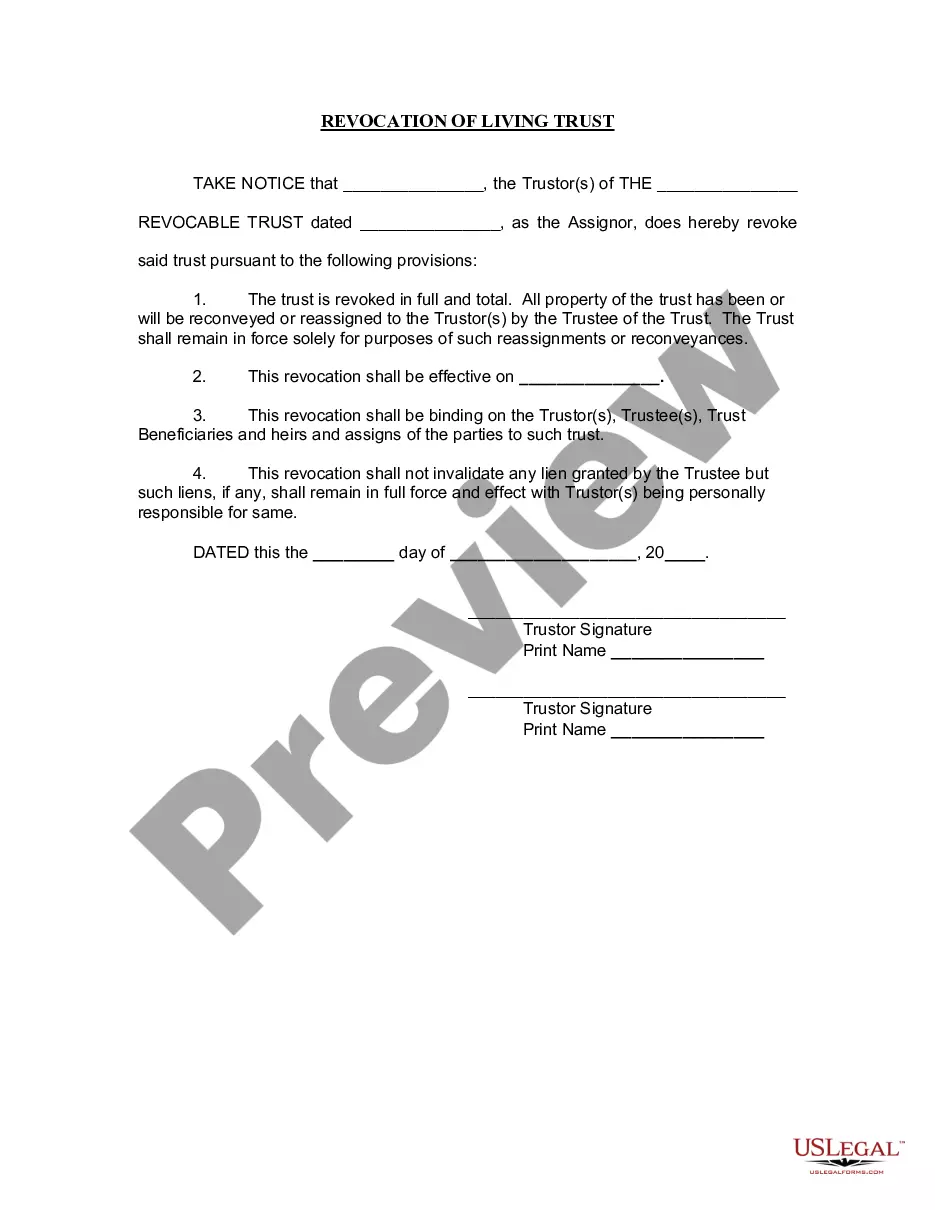

- Make use of the Review button to check the shape.

- Browse the explanation to ensure that you have chosen the appropriate kind.

- If the kind isn`t what you are seeking, take advantage of the Research industry to discover the kind that suits you and specifications.

- When you get the proper kind, click on Purchase now.

- Choose the rates program you need, fill out the necessary info to produce your bank account, and pay money for your order utilizing your PayPal or charge card.

- Pick a convenient paper file format and down load your duplicate.

Get each of the file web templates you might have bought in the My Forms menu. You may get a extra duplicate of Idaho Agreement of Shareholders of a Close Corporation with Management by Shareholders any time, if possible. Just select the required kind to down load or print out the file design.

Use US Legal Forms, one of the most extensive variety of legitimate kinds, to save some time and avoid mistakes. The assistance delivers expertly manufactured legitimate file web templates which can be used for an array of purposes. Generate a merchant account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

There are basic components that every shareholder's agreement contains. Examples include the number of shares issued, the issuance date, and the percentage of ownership of shareholders. Shareholders' agreements often determine the selling and transferring of shares to third parties.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

Idaho Statutes (d) A limited liability company's indebtedness to a member or transferee incurred by reason of a distribution made in ance with this section is at parity with the company's indebtedness to its general, unsecured creditors, except to the extent subordinated by agreement.

Set out below are the most common types of clauses we see in shareholders agreements. Director and Management Structure. ... Buy-Sell Provisions. ... Financing. ... Share Transfer Restrictions. ... Dispute Resolution. ... Confidentiality. ... Company Contracts. ... Meetings of Directors and/or Shareholders.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.

Operation and management of the company. ... The Board of Directors and rights to appoint another Director. ... Share transfers (Pre-emptive rights and drag along / tag along) ... Protection of the business' interests (restraint provisions) ... Deadlocks and disputes. ... Meetings of the Board and Shareholders. ... Decision making.

30-25-304. LIABILITY OF MEMBERS AND MANAGERS. (a) A debt, obligation, or other liability of a limited liability company is solely the debt, obligation, or other liability of the company.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.