Idaho Severance Agreement between Employee and College

Description

How to fill out Severance Agreement Between Employee And College?

Selecting the appropriate official document template can be a challenge.

Clearly, there are numerous templates available online, but how can you locate the exact document you need.

Utilize the US Legal Forms website. The service provides a vast array of templates, including the Idaho Severance Agreement between Employee and College, which can be utilized for both business and personal purposes.

You can view the form using the Preview button and review the form details to ensure it fits your requirements. If the form does not meet your criteria, use the Search area to find the right document. When you are confident that the form is appropriate, click the Buy now button to purchase the document. Choose the pricing plan you prefer and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the official document template to your device. Complete, modify, print, and sign the obtained Idaho Severance Agreement between Employee and College. US Legal Forms is the largest collection of legal templates where you can find various document formats. Utilize the service to download professionally crafted documents that adhere to state requirements.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Obtain button to access the Idaho Severance Agreement between Employee and College.

- Use your account to view the legal templates you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your region/locality.

Form popularity

FAQ

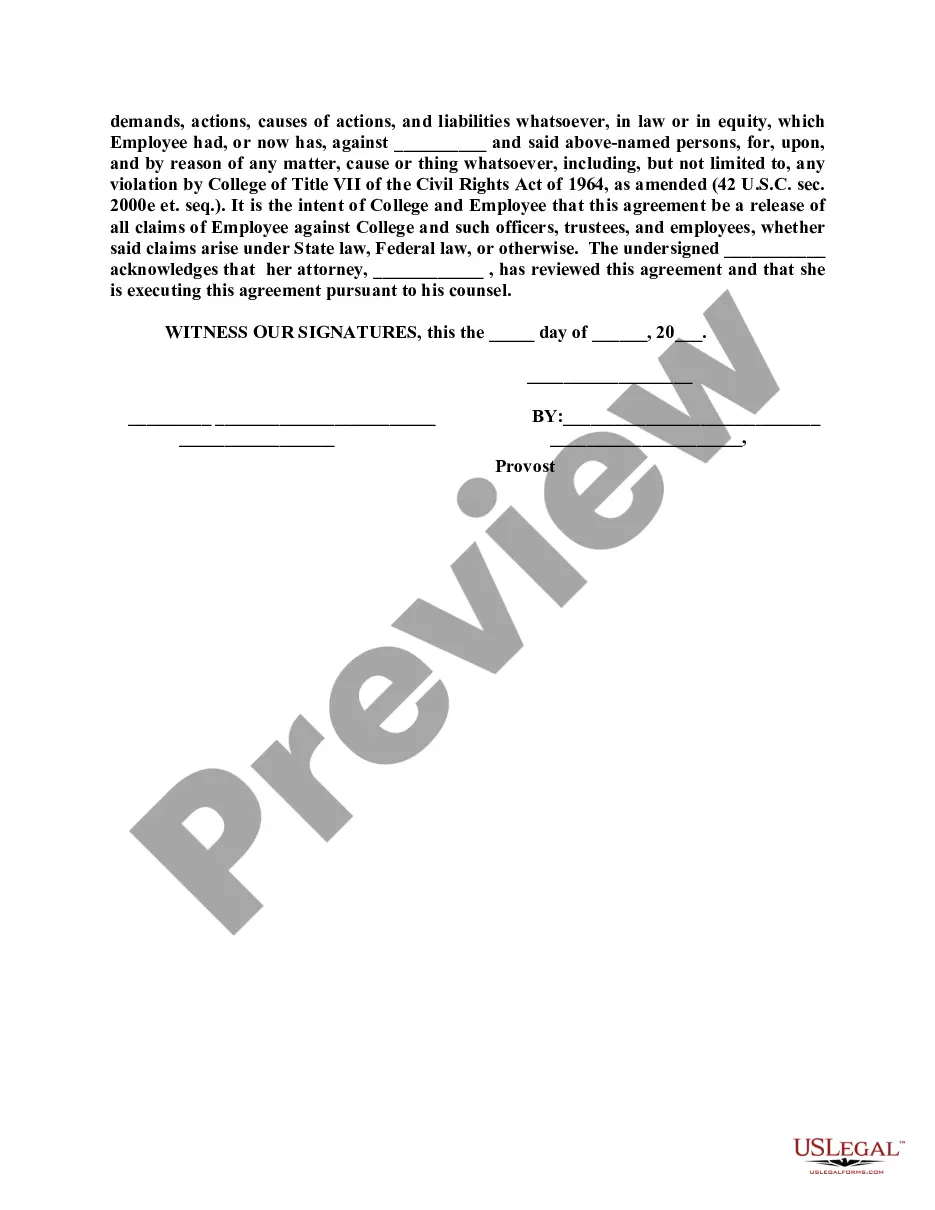

A separation agreement (also commonly referred to as a severance agreement) between an employer and a departing employee specifying terms of the employee's separation from employment, including a release of legal claims against the employer in exchange for a benefit.

Severance pay a retrenched employee must at least be paid 1 week's pay for each completed year of ongoing service. However, the employer must pay the retrenched employee the amount specified in any policy or his/her employment contract, if that amount is larger.

An employer who wants to avoid paying severance must provide advanced written notice the longer you have worked at the company, the more notice must be provided. According to the employment standards in Alberta: After serving three months, an employer must give you one week's notice.

Idaho law requires that if an employee quits, is terminated or is laid off, all wages then due must be paid the soonest of: the next regularly scheduled payday or within 10 days of the separation - weekends and holidays excluded.

Neither Idaho law nor the federal Fair Labor Standards Act requires an employer to provide vacation, holiday, severance or sick pay. These items are matters for agreement between the employer and the employee or their authorized representative.

No federal or state law in Idaho requires employers to pay out an employee's accrued vacation, sick leave, or other paid time off (PTO) at the termination of employment.

Idaho is an employment-at-will state, which means that without a written employee contract, employees can be terminated for any reason at any time, provided that the reason is not discriminatory and that the employer is not retaliating against the employee for a rightful action.

When is the last paycheck due after an employee separates? Idaho law requires that if an employee quits, is terminated or laid off, all wages then due must be paid the sooner of the next regularly scheduled payday or within 10 days of the separation (weekends and holidays excluded).

Though sometimes used interchangeably, termination pay and severance pay are not the same thing. While all employees of three months or longer with a company are entitled to termination pay (in place of notice) upon dismissal, not everyone is entitled to severance pay.