The articles of amendment shall be executed by the corporation by an officer of the corporation.

Idaho Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation

Description

How to fill out Articles Of Amendment To The Articles Of Incorporation Of Church Non-Profit Corporation?

Are you in a situation where you require documents for occasional business or specific objectives almost every workday.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Idaho Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation, which are designed to comply with state and federal regulations.

Once you have obtained the correct form, click Buy now.

Choose the pricing plan you prefer, enter the requested information to create your account, and purchase your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Idaho Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

- Use the Preview option to review the form.

- Check the description to verify that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The article for a non-profit organization refers to the formal documents that establish the nonprofit's existence. These articles outline the organization’s purpose, structure, and governance. Filing 'Idaho Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation' allows you to make necessary changes to these foundational documents as your organization grows.

A corporation can amend or add as many articles as necessary in one amendment. The original incorporators cannot be amended. If amending/adding officers/directors, list titles and addresses for each officer/director.

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

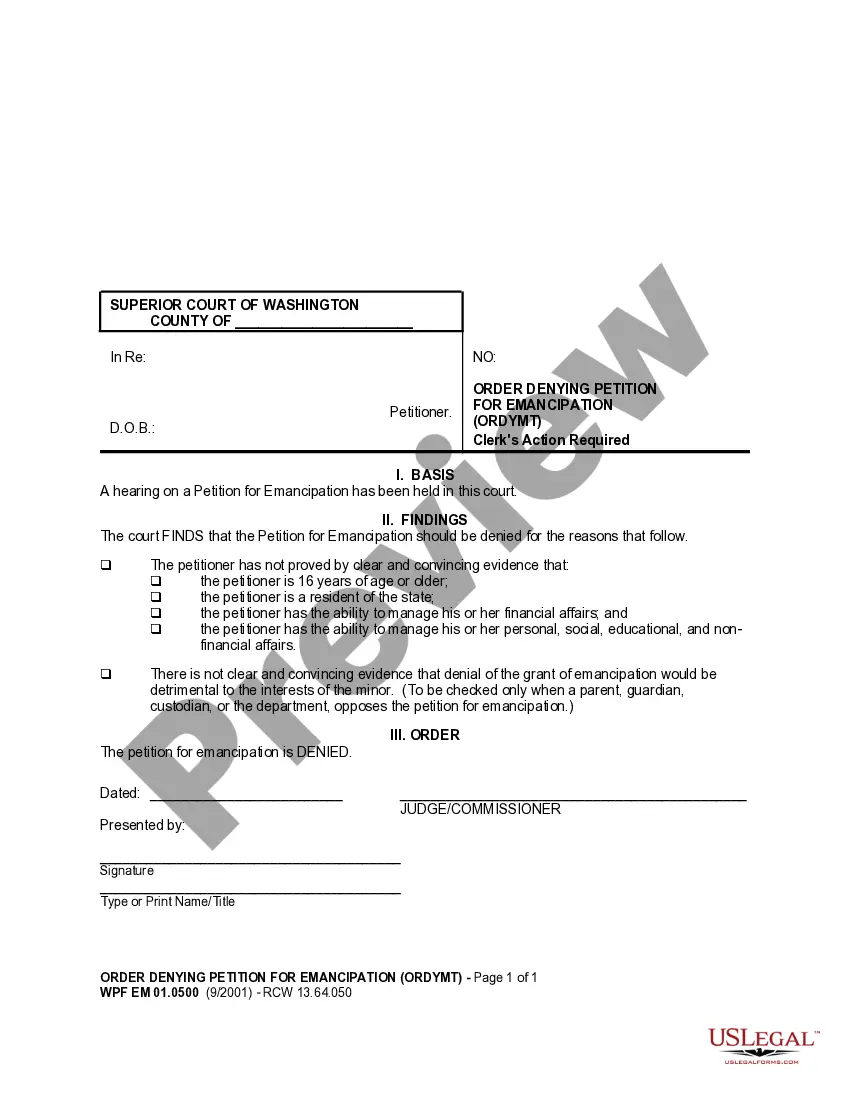

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

Any corporation may for legitimate corporate purpose or purposes amend its articles of incorporation by a majority vote of its board of directors or trustees and the vote or written assent of two-thirds of its members if it be a non-stock corporation, or if it be a stock corporation, by the vote or written assent of

Unless otherwise prescribed by this Code or by special law, and for legitimate purposes, any provision or matter stated in the articles of incorporation may be amended by a majority vote of the board of directors or trustees and the vote or written assent of the stockholders representing at least two-thirds (2/3) of

How to Start a Nonprofit in IdahoName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

Under Idaho Code 63-602B, property is exempt from taxation if it is owned by a religious corporation or society and is used "exclusively" for religious worship, educational purposes, or recreational activities.

To make amendments to your Idaho Corporation, you submit the completed Articles of Amendment form, or you may draft your own Articles of Amendment and provide them to the Secretary of State by mail or in person. Submit them in duplicate with the filing fee.

To form a 501(c)(3) nonprofit organization, follow these steps:Step 1: Name Your Idaho Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.Step 7: Apply for 501(c)(3)