Idaho Compensable Work Chart with Explanation

Description

How to fill out Compensable Work Chart With Explanation?

Are you currently in a situation where you need documents for either business or personal purposes almost all the time.

There are numerous legitimate document templates accessible online, but finding trustworthy ones is challenging.

US Legal Forms offers a vast selection of form templates, such as the Idaho Compensable Work Chart with Explanation, designed to meet federal and state requirements.

Once you acquire the appropriate form, click Get now.

Choose the pricing plan you prefer, provide the necessary details to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Idaho Compensable Work Chart with Explanation template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct state/region.

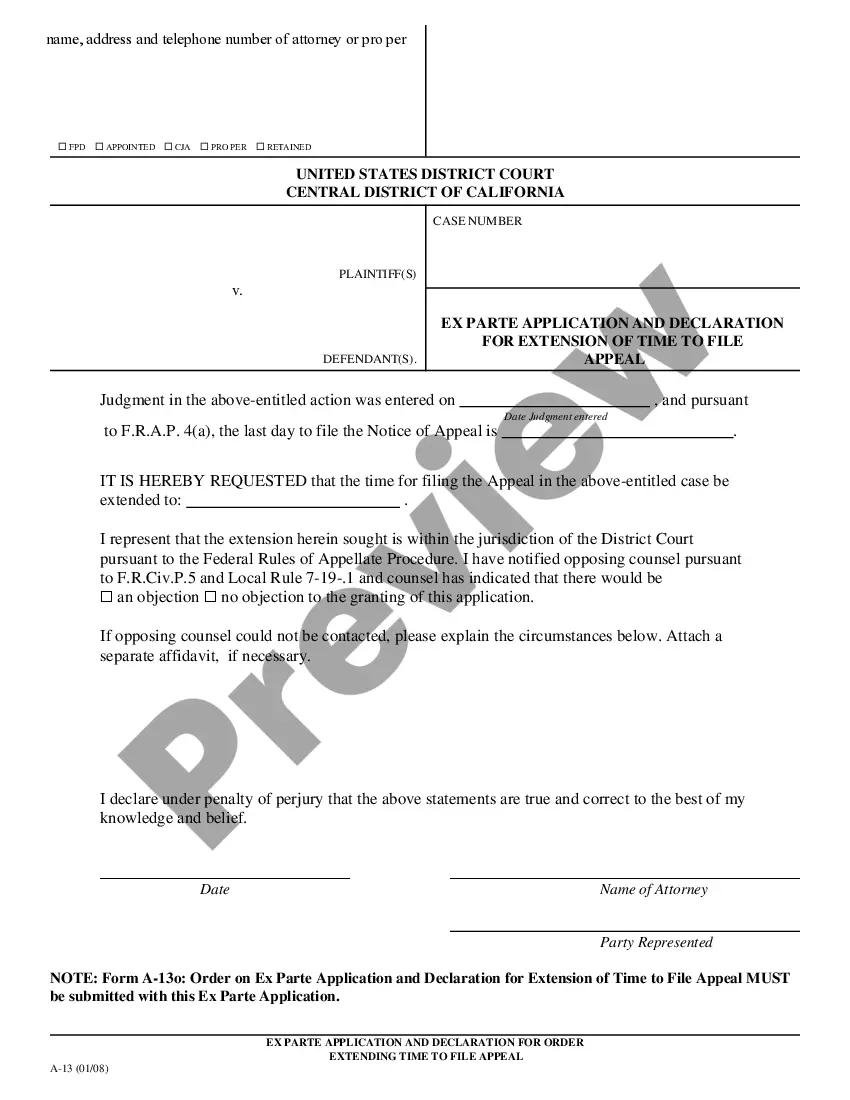

- Utilize the Review button to check the form.

- Read the description to verify you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Indeed, Idaho has a workers' compensation program designed to provide benefits to employees who are injured on the job. This program offers important protections for both workers and employers. To navigate the regulations effectively, the Idaho Compensable Work Chart with Explanation serves as a valuable resource.

In Idaho, a workweek that consists of 32 hours may not typically be classified as full-time. Generally, employers adhere to a 40-hour workweek standard for full-time status. This can influence employee benefits and workers' compensation responsibilities, as outlined in the Idaho Compensable Work Chart with Explanation.

Yes, Idaho requires most businesses with employees to carry workers' compensation insurance. This requirement protects workers and employers from financial loss due to workplace injuries. To understand what this means for your business, consult the Idaho Compensable Work Chart with Explanation for detailed insights.

Certain individuals, such as independent contractors and some agricultural workers, may be exempt from workers' compensation in Idaho. However, it's crucial to verify your specific situation against the Idaho Compensable Work Chart with Explanation. This tool helps clarify eligibility and responsibilities under Idaho law.

In Idaho, sole proprietors are generally not required to carry workers' compensation insurance, but they have the option to do so. This decision can provide financial protection in case of workplace injuries. Understanding how this fits into the Idaho Compensable Work Chart with Explanation can help you make an informed choice.

Several states, including Texas and New Jersey, do not mandate workers' compensation insurance for all businesses. This can affect how you manage employee safety and financial risk. For those in Idaho, it's essential to refer to the Idaho Compensable Work Chart with Explanation to understand your obligations better.

In Idaho, certain groups may be exempt from workers' compensation coverage. This includes domestic workers, agricultural workers with fewer than three employees, and certain independent contractors. Understanding these exemptions is crucial, as they can affect your rights and benefits if an injury occurs. For more detailed information, refer to the Idaho Compensable Work Chart with Explanation to clarify your specific situation.

To file a workers' compensation claim in Idaho, you first need to report your injury to your employer as soon as possible. They will provide you with a claim form that you must complete and submit to the insurance provider. It is important to include details about your injury and how it occurred, as this information will be vital for assessing your case. Additionally, consulting the Idaho Compensable Work Chart with Explanation can help you understand which injuries qualify for compensation.

There is no strict limit on the maximum hours salaried employees can work in Idaho. However, employees must be compensated for overtime if they meet the criteria as non-exempt under federal and state laws. Understanding these differences is crucial, and the Idaho Compensable Work Chart with Explanation can help illuminate the specifics. UsLegalForms offers resources to clarify any uncertainties regarding working hours and employee compensation.

Labor laws for salaried employees in Idaho define how wages, hours, and overtime are managed. Salaried employees may be exempt or non-exempt based on their job responsibilities and salary levels. To ensure you are up to date with these regulations, refer to the Idaho Compensable Work Chart with Explanation for clarity on what labor laws apply. UsLegalForms provides useful documents for navigating these laws effectively.