Idaho Invoice Template for Cook

Description

How to fill out Invoice Template For Cook?

If you desire to be thorough, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and user-friendly search function to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and claims, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of your legal form and download it onto your device. Step 7. Complete, edit, and print or sign the Idaho Invoice Template for Cook.

- Employ US Legal Forms to find the Idaho Invoice Template for Cook in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to acquire the Idaho Invoice Template for Cook.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you’re using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

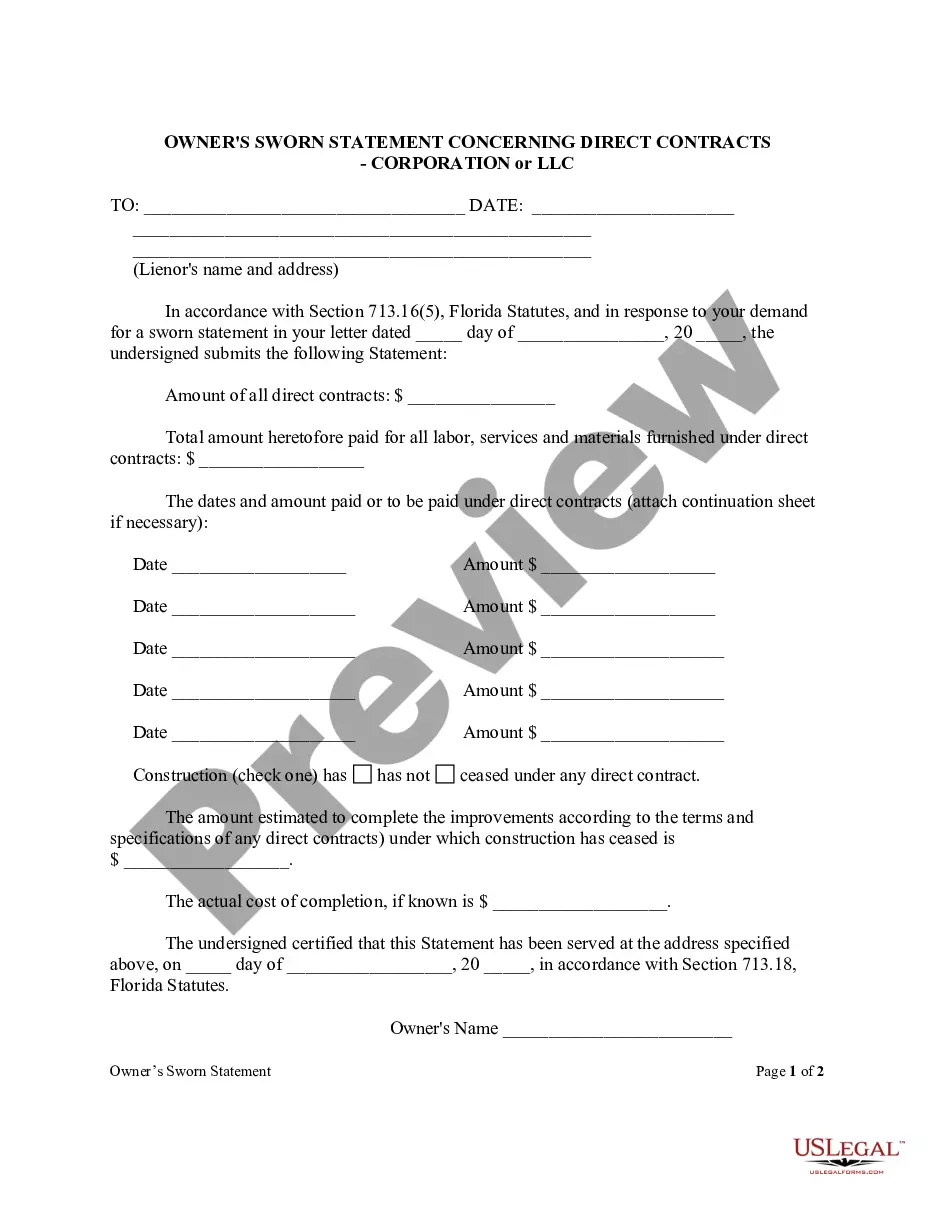

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the outline.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, select the Get now button. Choose the payment plan you prefer and enter your credentials to sign up for an account.

Form popularity

FAQ

Writing a tax invoice statement requires you to include your business details at the top and the client's information below. Itemize each sold service or product, complete with their prices, and calculate any taxes owed. Using an Idaho Invoice Template for Cook can help you structure this more efficiently.

Examples of tax-exempt items in Idaho include certain agricultural products, sales to nonprofits, and machinery used for manufacturing. Keeping track of these exemptions can aid in accurate tax reporting. The Idaho Invoice Template for Cook offers a practical way to record these exempt sales, ensuring compliance with Idaho tax regulations.

An exemption typically applies to purchases that meet specific criteria set by state law, such as items used in manufacturing. Understanding the established guidelines can help you identify when an exemption is relevant. By utilizing the Idaho Invoice Template for Cook, you can clearly document exempt purchases and safeguard against tax liabilities.

In Idaho, most food items for home consumption are exempt from sales tax. This includes groceries purchased at supermarkets and local markets. However, prepared foods sold by restaurants may not be exempt, making the Idaho Invoice Template for Cook a useful tool to correctly categorize your sales.

Yes, Idaho requires a resale certificate for vendors who buy items solely for resale. This certificate helps establish that the buyer will not be responsible for sales tax on those products. Using the Idaho Invoice Template for Cook can facilitate accurate documentation of these transactions.

Exempt items under Idaho sales tax laws include certain agricultural products, manufacturing materials, and some medical equipment. To make your transactions smoother, ensure you understand what qualifies for exemption. The Idaho Invoice Template for Cook helps document these exemptions clearly, making tax filing easier.

In Idaho, certain items are exempt from sales tax, such as groceries and prescription drugs. Additionally, nonprofit organizations may qualify for exemptions when purchasing items for their charitable activities. When using the Idaho Invoice Template for Cook, consider listing exempt items appropriately to ensure compliance.

Making a homemade invoice involves a few easy steps. Start with a blank page or use a template like the Idaho Invoice Template for Cook to guide you. Add your details, the information of the client, and a breakdown of the services and costs. Ensure you keep a copy for your records, as it helps in managing your finances effectively.

Creating your own invoice is simple and can be done quickly. First, decide on the template you want to use, and the Idaho Invoice Template for Cook is an excellent choice. Fill in your name, address, and details regarding the services rendered or goods sold. Don't forget to include a unique invoice number, the date, and payment terms.

Yes, it is perfectly legal to create your own invoice. As long as your invoice contains accurate information about the services or products provided, you are in compliance. The Idaho Invoice Template for Cook gives you a structured format that ensures you include all necessary details. This legal document will help you maintain transparency in your transactions.