Idaho Assignment of Assets

Description

How to fill out Assignment Of Assets?

If you need to finalize, retrieve, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website’s user-friendly and efficient search to find the documents you need.

A variety of templates for both business and personal purposes are categorized by types and jurisdictions or keywords.

Step 5. Complete the transaction. You may use your Visa or Mastercard or a PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Idaho Assignment of Assets.

- Use US Legal Forms to locate the Idaho Assignment of Assets with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to access the Idaho Assignment of Assets.

- You can also find forms you have previously saved in the My documents section of your account.

- If you are a new user of US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

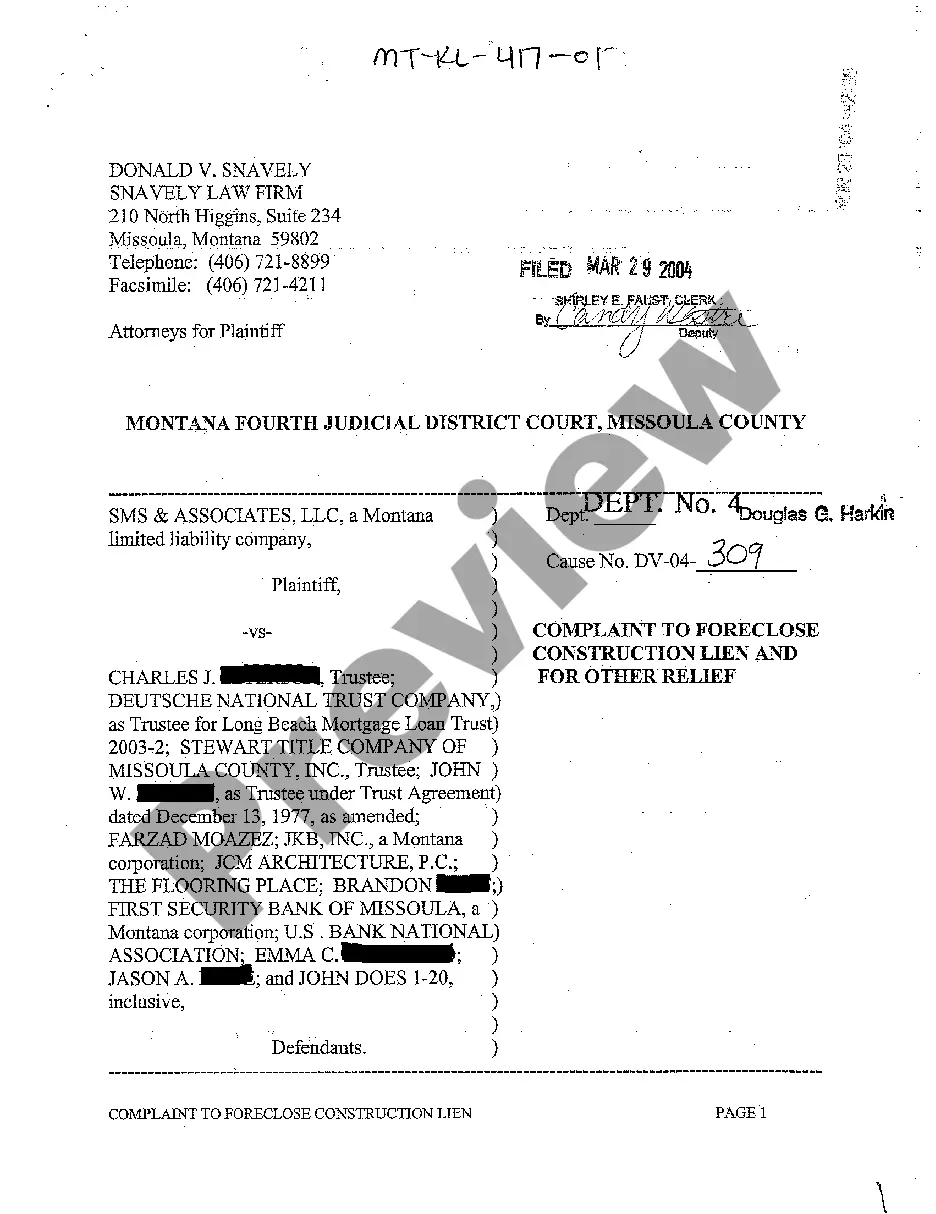

- Step 2. Use the Preview option to review the form’s contents. Make sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Determining whether you can take your husband’s house during a divorce in Idaho depends on several factors, including how the property is titled and its role as marital or separate property. Idaho courts will consider the facts surrounding the case to ensure a fair division of assets. Understanding the Idaho Assignment of Assets can guide you through this process and clarify your rights regarding property division.

Yes, Idaho is classified as a redemption state. In cases of foreclosure, homeowners have the right to redeem their properties even after a sale, usually within a year. This means that if you face foreclosure, knowing about Idaho Assignment of Assets can provide you with options, allowing you to reclaim your home under certain conditions.

Idaho is not strictly a 50/50 state regarding the division of assets. Instead, Idaho follows the principle of equitable distribution during a divorce. This means that the court divides marital property fairly, but not necessarily equally. Understanding the Idaho Assignment of Assets is crucial, as it helps you navigate this equitable division process.

The purpose of the assignment agreement is to document the transfer of rights or interests in assets, ensuring clear understanding and legal protection for all parties involved. This agreement outlines the terms, conditions, and responsibilities associated with the assignment of assets. Utilizing a well-crafted assignment agreement within the framework of Idaho Assignment of Assets can significantly mitigate disputes and misunderstandings.

Asset transfer out refers to the process of moving ownership or rights to assets from one entity to another, often as part of a transaction, liquidation, or financial arrangement. In the context of Idaho Assignment of Assets, this can illustrate various financial strategies employed by individuals or businesses. It provides a clear path for effective asset management and strategic planning.

An assignment of assets involves formally designating ownership rights or responsibilities regarding particular assets to another entity. This legal mechanism is often used to facilitate debt repayment, asset distribution, and estate planning. When considering an Idaho Assignment of Assets, it is vital to understand the implications for both parties involved.

To assign assets means to legally designate or transfer specific rights or interests in property or financial instruments to another party. This process is essential for individuals or businesses looking to organize their financial affairs or manage obligations efficiently. The concept of Idaho Assignment of Assets allows for clearer financial management and planning.

An example of assignment of property in Idaho would be if an individual assigns their rights to receive rental income from a property to a third party. In this scenario, the original owner still retains ownership of the property but allows someone else to collect the income for a specified time. This type of arrangement underscores the flexibility and utility of the Idaho Assignment of Assets framework for property owners.

In the context of Idaho Assignment of Assets, a transfer refers to the act of moving ownership of an asset from one party to another, while an assignment specifically involves the rights and obligations of a contract or interest being handed over. Essentially, an assignment can be seen as a specific type of transfer focused on legal rights. Understanding these distinctions can help in accurately navigating asset management and agreements.

Filling out a certificate of ownership involves providing specific vehicle information and signatures from the respective parties. Clearly write the vehicle's identification number, make, model, and any previous title information. It’s essential to ensure everything is precise to avoid complications. For those needing templates or advice, check out US Legal Forms, which supports your Idaho Assignment of Assets journey.