Idaho Agreement and Assignment of Judgment for Collection to Collection Agency

Description

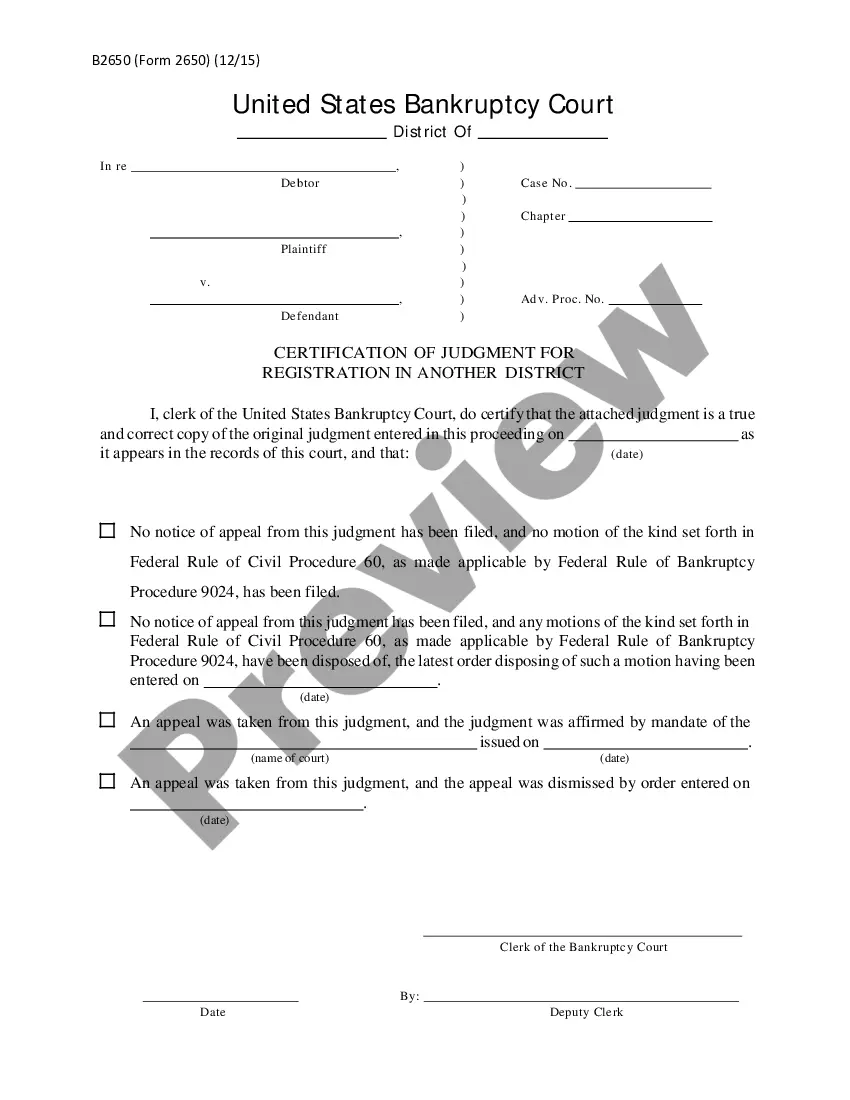

How to fill out Agreement And Assignment Of Judgment For Collection To Collection Agency?

If you have to complete, download, or print out authorized file layouts, use US Legal Forms, the greatest selection of authorized kinds, which can be found on the web. Take advantage of the site`s basic and practical research to discover the files you will need. Numerous layouts for business and individual reasons are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Idaho Agreement and Assignment of Judgment for Collection to Collection Agency within a couple of clicks.

In case you are previously a US Legal Forms client, log in to the accounts and click the Down load option to get the Idaho Agreement and Assignment of Judgment for Collection to Collection Agency. You can even accessibility kinds you previously delivered electronically in the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your appropriate metropolis/nation.

- Step 2. Take advantage of the Review choice to check out the form`s content material. Do not forget to see the explanation.

- Step 3. In case you are unsatisfied using the type, take advantage of the Search field near the top of the monitor to get other types of the authorized type format.

- Step 4. Once you have found the shape you will need, go through the Purchase now option. Choose the pricing program you like and add your accreditations to register to have an accounts.

- Step 5. Method the financial transaction. You should use your bank card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the format of the authorized type and download it in your device.

- Step 7. Comprehensive, revise and print out or indicator the Idaho Agreement and Assignment of Judgment for Collection to Collection Agency.

Each and every authorized file format you purchase is the one you have for a long time. You might have acces to each type you delivered electronically in your acccount. Select the My Forms portion and select a type to print out or download once more.

Remain competitive and download, and print out the Idaho Agreement and Assignment of Judgment for Collection to Collection Agency with US Legal Forms. There are millions of professional and express-specific kinds you can use to your business or individual demands.

Form popularity

FAQ

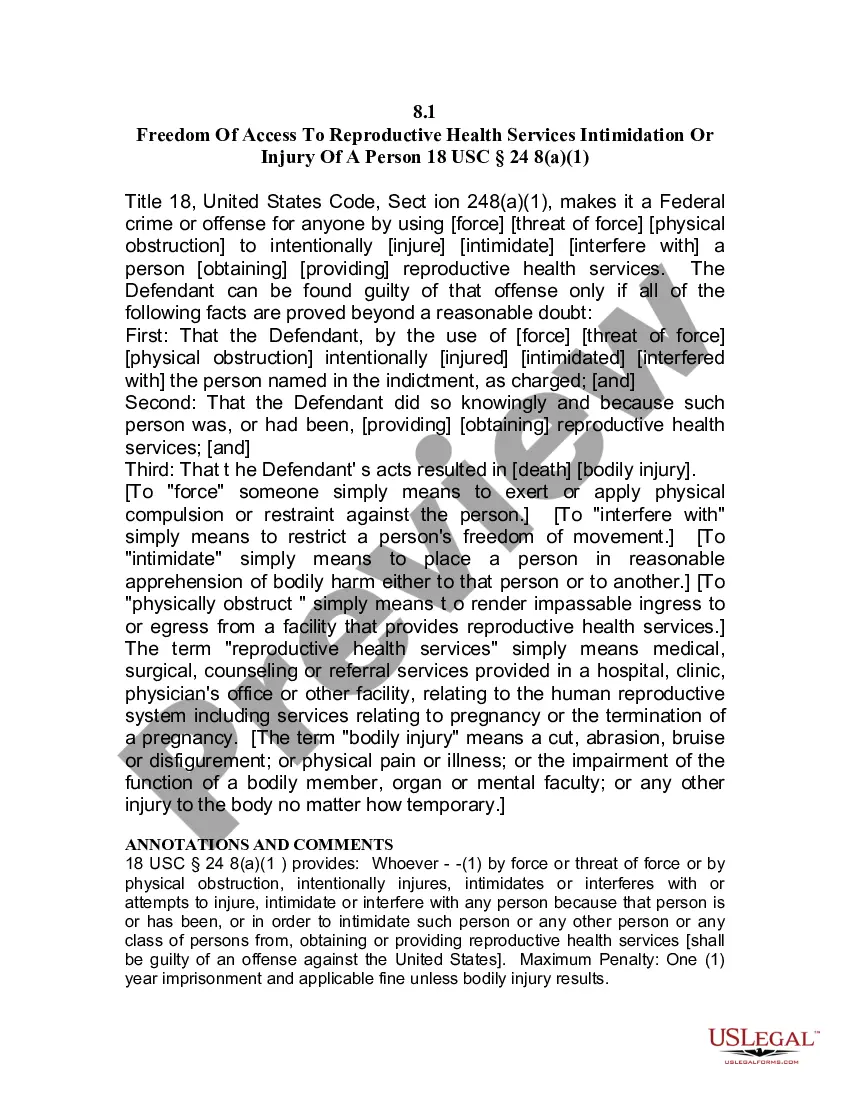

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

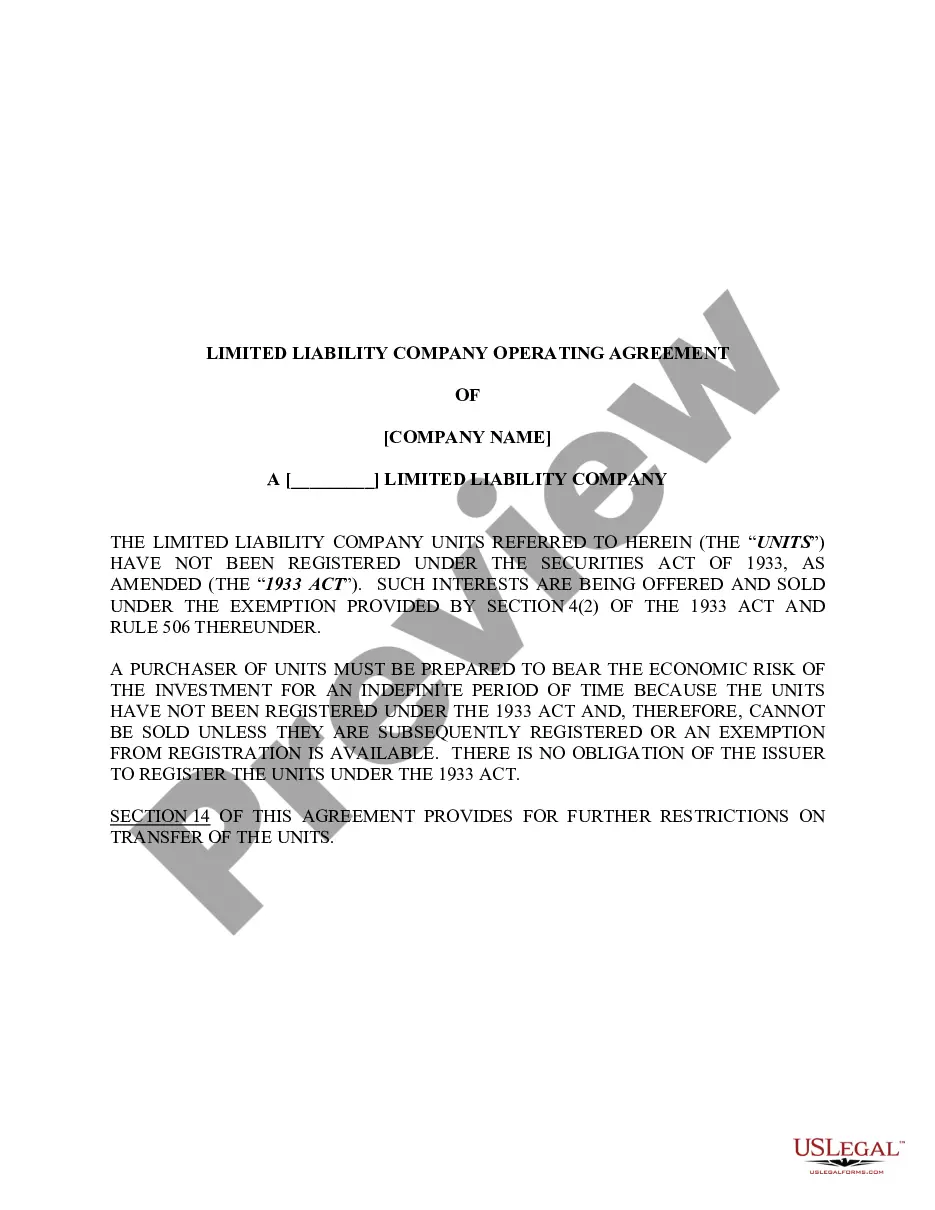

Once your debt has been sold you owe the buyer money, not the original creditor. The debt purchaser must follow the same rules as your original creditor. You keep all the same legal rights. They cannot add interest or charges unless they are in the terms of your original credit agreement.

Where delinquent debt goes: third-party collection agencies. When you can't pay your debt, most creditors follow a similar process to increase their chances of persuading you to pay. One of the tools at their disposal is selling your debt to a third-party collection agency.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

When you can't pay your debt, most creditors follow a similar process to increase their chances of persuading you to pay. One of the tools at their disposal is selling your debt to a third-party collection agency.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect from you. Under the FDCPA, a debt collector is someone who regularly collects debts owed to others.

Debts never disappear unless you repay them, settle them, or declare bankruptcy. However, Idaho prevents creditors from taking legal action against debtors after a specific period. Oral debts have a statute of limitations of four years, while the statute of limitations on written debts is five years.