Idaho UCC-1 for Personal Credit

Description

How to fill out UCC-1 For Personal Credit?

Have you ever been in a situation where you need documentation for either business or personal purposes almost every day.

There are numerous legal document templates available on the internet, but finding ones you can trust isn't easy.

US Legal Forms provides thousands of form templates, including the Idaho UCC-1 for Personal Credit, designed to comply with state and federal regulations.

Once you've acquired the appropriate form, click Purchase now.

Choose the pricing plan you wish, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Idaho UCC-1 for Personal Credit template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

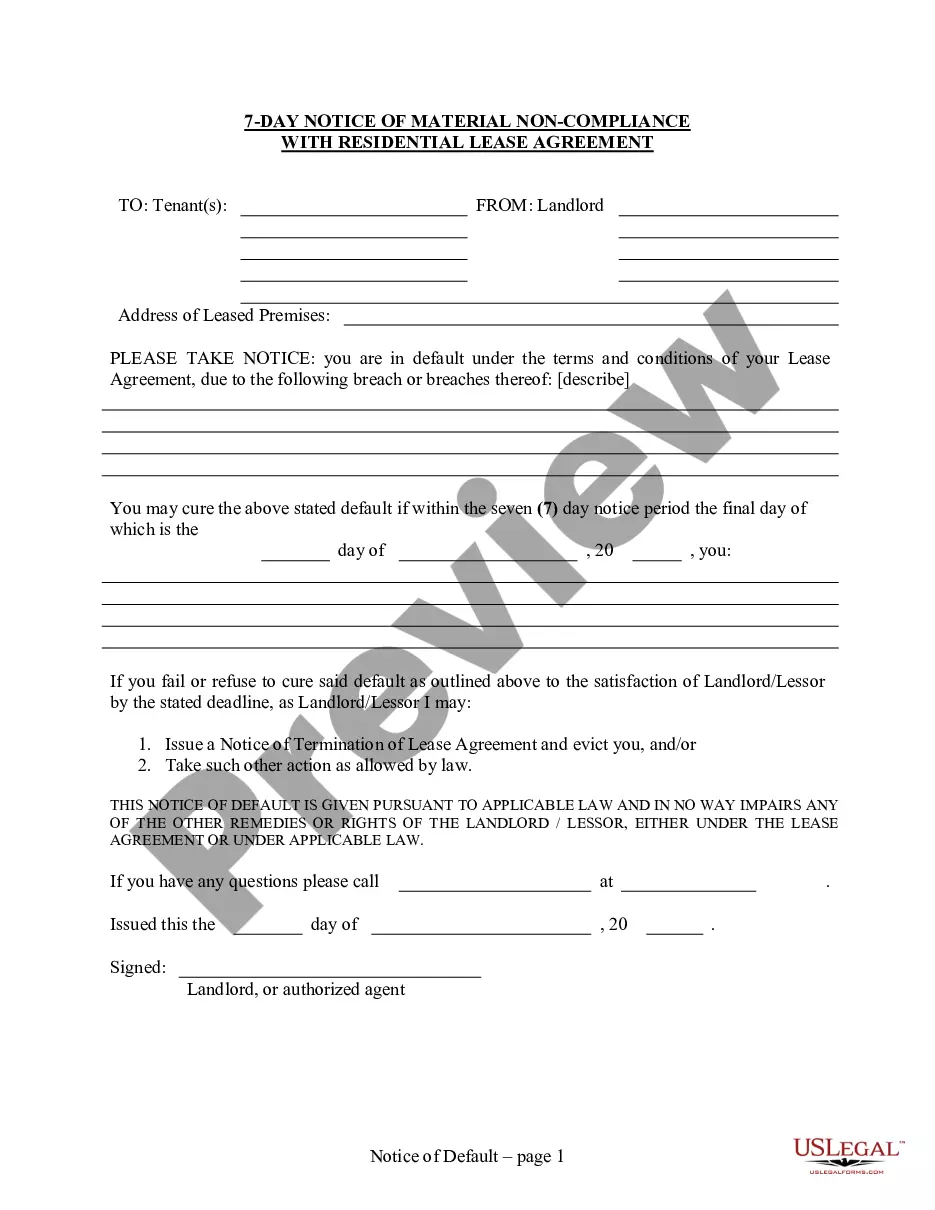

- Utilize the Preview button to review the document.

- Read the description to confirm you have selected the correct form.

- If the document is not what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

1 filing is a legal form that a creditor files to secure its interest in a borrower's property or assets used as collateral for a loan. The filing serves as a public notice that the creditor has the right to take possession of the assets as repayment on the underlying debt.

Additionally, a UCC filing does not natively impact your credit score. But a UCC filing does appear on your credit report, and it could affect whether you will qualify for other financing forms later down the road. For example, say that you receive funding from one lender who filed a UCC lien on some of your assets.

Uniform Commercial Code1 statement is a legal notice filed by creditors as a way to publicly declare their rights to potentially obtain the personal properties of debtors who default on business loans they extend.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

If you need to remove a UCC filing form your credit report, ask the lender to file for its removal. In order to do this, they need to file a UCC-3 Financing Statement Amendment. You can also just wait it out. Depending on how long you have been with the lender, the filing may be removed within a few months.

Article 9 of the Uniform Commercial Code governs secured transactions. It provides a mechanism whereby a secured creditor can perfect its security interest in the debtor's assets by filing a UCC-1 financing statement. In theory, anyone can file a UCC-1 against anyone else.

UCC-1 Financing Statements, commonly referred to as simply UCC-1 filings, are used by lenders to announce their rights to collateral or liens on secured loans. They're usually filed by lenders with the debtor's state's secretary of state office when a loan is first originated.

A UCC3 is a change statement to a UCC1. It's an amendment filing to an original UCC1 financing statement that changes or adds information to the originally filed UCC1. It's a filing tool secured parties use to manage their UCC portfolio to maintain their perfected security interests.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).