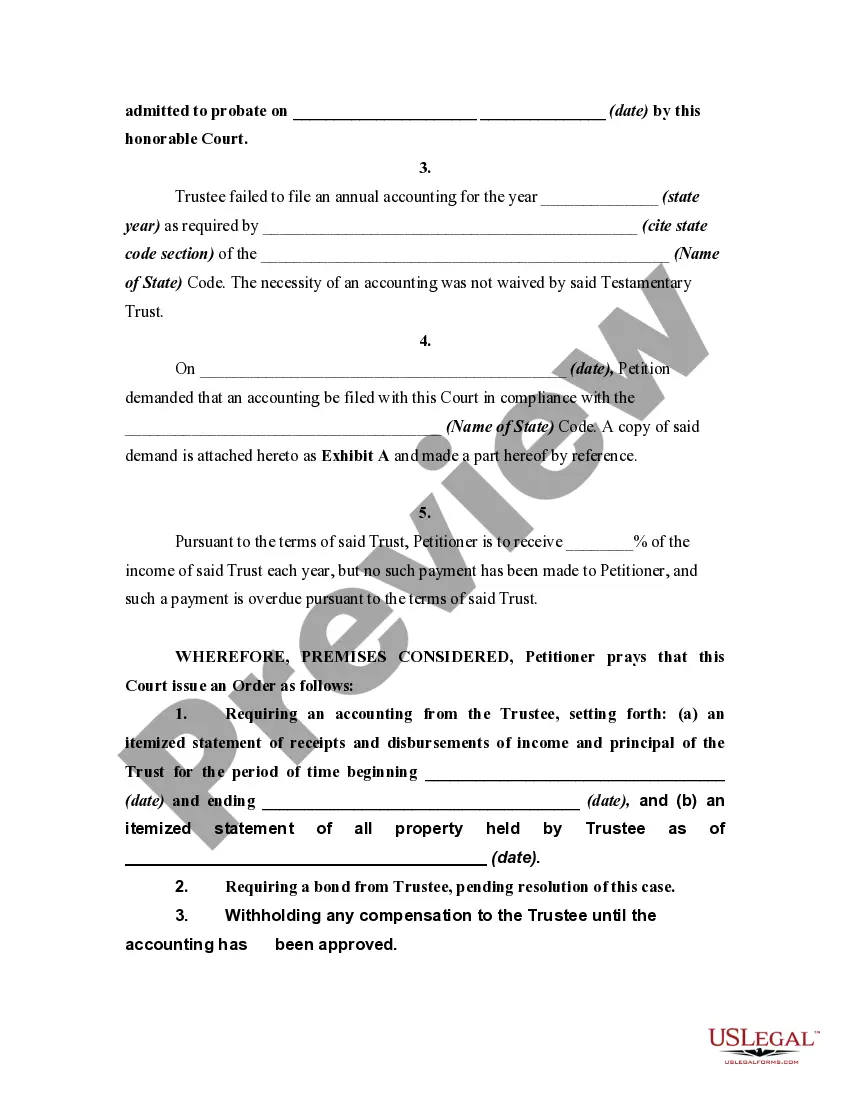

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Idaho Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

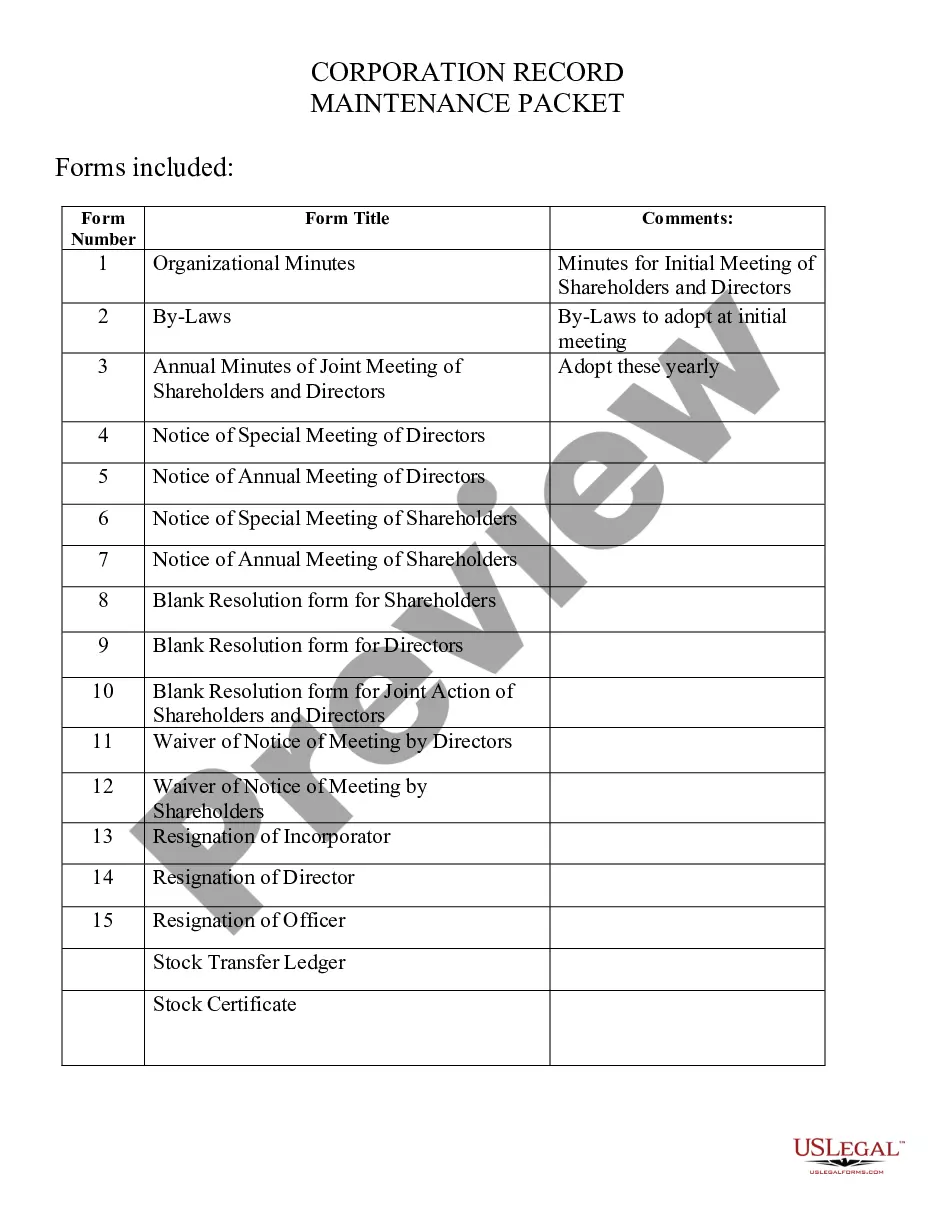

US Legal Forms - one of several greatest libraries of legitimate forms in America - offers a wide range of legitimate document web templates you can acquire or print out. While using web site, you can find a large number of forms for company and specific uses, categorized by categories, claims, or keywords and phrases.You will discover the latest models of forms much like the Idaho Petition to Require Accounting from Testamentary Trustee within minutes.

If you already have a monthly subscription, log in and acquire Idaho Petition to Require Accounting from Testamentary Trustee through the US Legal Forms collection. The Acquire switch will appear on every type you look at. You have accessibility to all previously acquired forms inside the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, allow me to share easy instructions to get you started:

- Be sure to have picked out the right type for your town/state. Click on the Review switch to examine the form`s content material. See the type explanation to actually have selected the proper type.

- In case the type doesn`t satisfy your requirements, utilize the Search field near the top of the monitor to discover the one that does.

- When you are content with the form, affirm your selection by clicking the Purchase now switch. Then, choose the pricing program you prefer and provide your credentials to register on an accounts.

- Approach the purchase. Utilize your bank card or PayPal accounts to perform the purchase.

- Choose the format and acquire the form in your product.

- Make modifications. Load, modify and print out and indication the acquired Idaho Petition to Require Accounting from Testamentary Trustee.

Every single design you included with your money lacks an expiry day which is your own eternally. So, in order to acquire or print out another duplicate, just proceed to the My Forms segment and then click in the type you will need.

Get access to the Idaho Petition to Require Accounting from Testamentary Trustee with US Legal Forms, one of the most substantial collection of legitimate document web templates. Use a large number of skilled and state-certain web templates that meet up with your small business or specific requirements and requirements.

Form popularity

FAQ

15-7-101. Duty to register trusts. The trustee of a trust having its principal place of administration in this state shall register the trust in the court of this state at the principal place of administration.

(a) From time of creation of the trust until final distribution of the assets of the trust, a trustee has the power to perform, without court authorization, every act which a prudent man would perform for the purposes of the trust including but not limited to the powers specified in subsection (c).

The Trust and Estate Dispute Resolution Act, which is more commonly known as "TEDRA", is a set of Idaho statutes that are designed to help families resolve disputes and other problems involving trusts and estates either nonjudicially, or if that can't be done then judicially.

(1) A person may not commence a proceeding against a trustee for breach of trust more than 3 years after the date such person or a representative of such person receives a report from the trustee that adequately disclosed information that could form the basis for a potential claim for breach of trust and informed such ...

Ultimately, the question is not whether it is better to have a will or a trust, but if you should have a trust in addition to a will. If you die without having a valid will or trust in place, the courts will determine how your assets are distributed.

Creating a living trust in Idaho allows the trust-maker to place assets into the trust during life. A trustee is selected and can be anyone you choose. Most people choose to be their own trustee, but a successor must be chosen to manage the trust after your death.

15-7-303. Duty to inform and account to beneficiaries. The trustee shall keep the beneficiaries of the trust reasonably informed of the trust and its administration.

Idaho law provides that a trustee must "observe the standards in dealing with the trust assets that would be observed by a prudent man dealing with the property of another " and "must administer a trust expeditiously".