Idaho Assignment of Interest in Joint Venture with Consent

Description

How to fill out Assignment Of Interest In Joint Venture With Consent?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Idaho Assignment of Interest in Joint Venture with Consent, suitable for business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Idaho Assignment of Interest in Joint Venture with Consent. Access your account to view the legal forms you have previously purchased. Navigate to the My documents tab in your account to obtain an extra copy of the document you need.

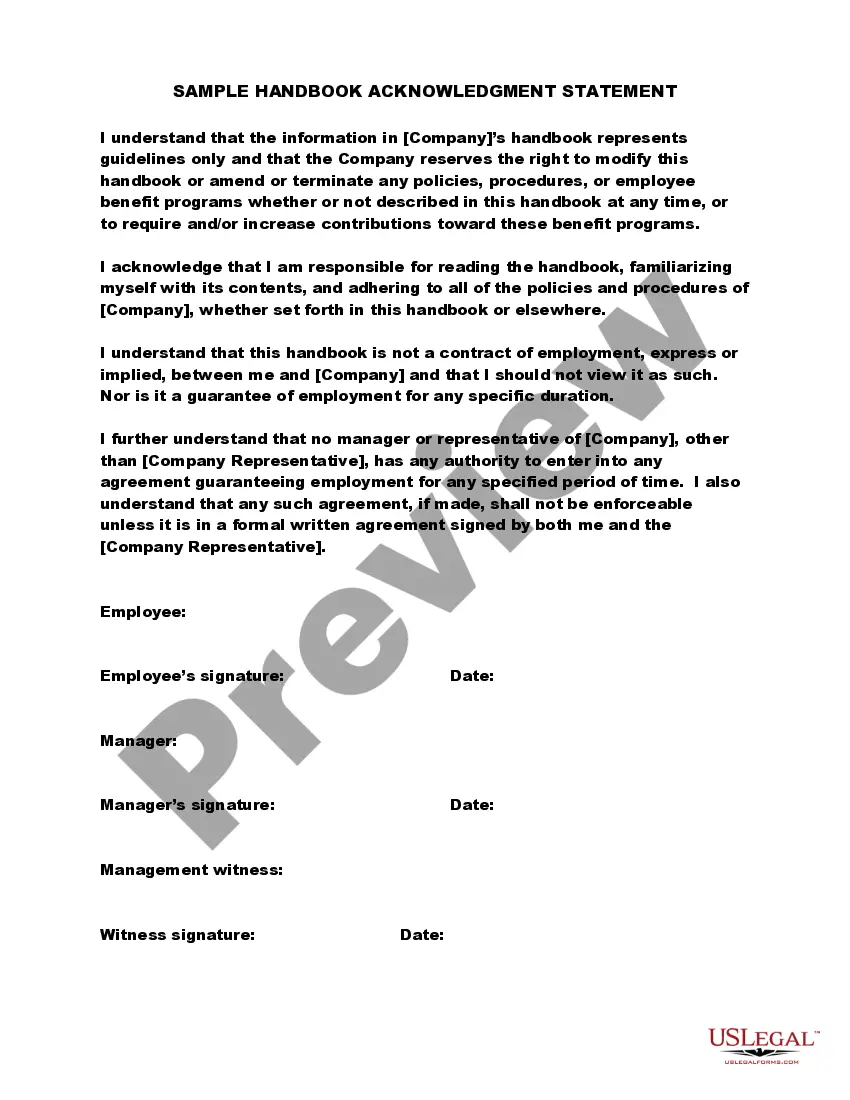

If you are a new user of US Legal Forms, here are some simple instructions for you to follow: First, ensure you have selected the correct form for your locality/region. You can review the document using the Preview button and examine the document outline to confirm that it is the appropriate one for you.

US Legal Forms represents the largest repository of legal templates available for which you can find a wide array of document templates. Utilize the service to obtain professionally crafted paperwork that adheres to state regulations.

- If the template does not fulfill your requirements, use the Search field to find the correct form.

- Once you are confident that the document is suitable, click the Get Now button to obtain the form.

- Select the pricing plan you desire and input the necessary information. Create your account and process the payment using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Idaho Assignment of Interest in Joint Venture with Consent.

Form popularity

FAQ

Schedule K-1 serves to report each partner's income, losses, and other tax-related information from a partnership. This form is crucial for accurate personal tax returns, reflecting one's share in the partnership's financial activities. By understanding Schedule K-1, individuals engaged in an Idaho Assignment of Interest in Joint Venture with Consent can ensure proper tax treatment of their earnings.

Idaho Form 65, the partnership income tax return, should be filed with the Idaho State Tax Commission. You can submit it electronically or send a paper copy via mail. When participating in an Idaho Assignment of Interest in Joint Venture with Consent, timely filing is essential to maintain compliance with state tax regulations.

1 form in Idaho refers to the Schedule K1, which details income, deductions, and credits received by partners or shareholders. It is necessary for proper tax reporting at both state and federal levels. If you enter an Idaho Assignment of Interest in Joint Venture with Consent, having a thorough understanding of the K1 form ensures accurate income reporting.

In Idaho, Schedule I drugs are substances that have a high potential for abuse and no accepted medical use. Examples include heroin and LSD, which are strictly regulated. Understanding these classifications is crucial if you are working on legal matters related to an Idaho Assignment of Interest in Joint Venture with Consent involving the healthcare sector.

Schedule K-1 in Idaho provides detailed information about each partner's share of earnings, losses, and other tax attributes from a partnership. It is essential for accurately reporting your income during tax season. If you are involved in an Idaho Assignment of Interest in Joint Venture with Consent, familiarize yourself with how to read and utilize this form for better financial clarity.

Partnerships conducting business in Idaho must file an Idaho partnership return, known as Form 65. All partners must report their share of income, deductions, and credits on their individual returns using Schedule K-1. If you are forming a partnership through an Idaho Assignment of Interest in Joint Venture with Consent, ensure compliance with this filing requirement.

Idaho does use a single sales factor for certain businesses, meaning that only the sales within the state are considered for income tax purposes. This approach can benefit companies engaged in an Idaho Assignment of Interest in Joint Venture with Consent by simplifying the calculation of their tax liabilities. By focusing solely on sales, the tax burden may decrease for qualifying ventures.

The informed consent law in Idaho ensures that individuals understand the risks and benefits of services or treatments before proceeding. This is crucial in various contexts, including medical and legal environments. If you are involved in a joint venture, ensuring that all parties provide informed consent can enhance collaboration and align with the principles of the Idaho Assignment of Interest in Joint Venture with Consent.

Idaho Code 14-514 concerns the management of trust assets and the responsibilities of trustees. This code emphasizes accountability and proper handling of these assets. For individuals engaged in joint ventures, understanding these responsibilities can contribute to more effective partnerships and compliance with the Idaho Assignment of Interest in Joint Venture with Consent.

Idaho Code 18-4511 addresses the laws surrounding stalking and harassment. It establishes guidelines to protect individuals from targeted and unwanted behavior. For ventures operating in Idaho, familiarity with this code supports a safe working environment, reinforcing the importance of mutual respect under the Idaho Assignment of Interest in Joint Venture with Consent.