Idaho Order Refunding Bond

Description

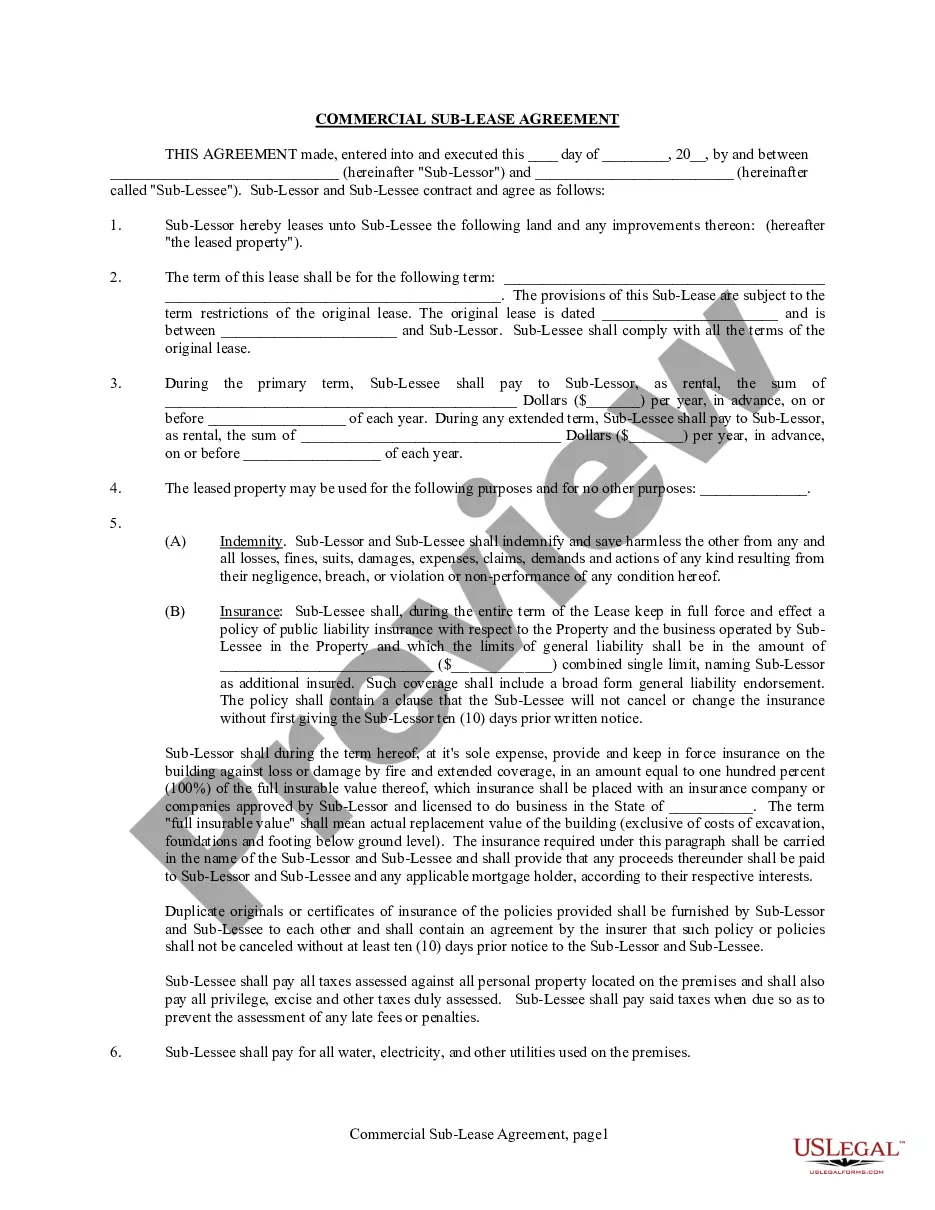

How to fill out Order Refunding Bond?

If you desire to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the primary collection of legal documents that is accessible online.

Make use of the website's simple and convenient search to find the forms you require. Various templates for corporate and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to locate the Idaho Order Refunding Bond with just a few clicks.

Each legal document format you obtain is yours forever. You have access to every form you acquired in your account. Click the My documents section and choose a form to print or download again.

Fill out and download, and print the Idaho Order Refunding Bond with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the Idaho Order Refunding Bond.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form format.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Idaho Order Refunding Bond.

Form popularity

FAQ

Generally unique to municipal securities, a refunding is the process by which an issuer refinances outstanding bonds by issuing new bonds. This may serve either to reduce the issuer's interest costs or to remove a restrictive covenant imposed by the terms of the bonds being refinanced.

Advance refunding involves issuing new bonds well before the old ones mature, holding the proceeds in escrow until the call date. This allows issuers to take advantage of favorable market conditions when they arise.

By definition, the term ?refunding? means refinancing another debt obligation. It is not unheard of for municipalities to issue new bonds in order to raise funds to retire existing bonds. The bonds which are issued to refund older bonds are called refunding bonds or pre-refunding bonds.

For example, an issuer that refunds a $100 million bond issue with a 10% coupon at maturity and replaces it with a new $100 million issue (refunding bond issue) with a 6% coupon, will have savings of $4 million in interest expense per annum.

What Is a Pre-Refunding Bond? A pre-refunding bond is a debt security that is issued in order to fund a callable bond. With a pre-refunding bond, the issuer decides to exercise its right to buy its bonds back before the scheduled maturity date.

For example, an issuer that refunds a $100 million bond issue with a 10% coupon at maturity and replaces it with a new $100 million issue (refunding bond issue) with a 6% coupon, will have savings of $4 million in interest expense per annum.