Idaho Agreement between Website Owner and Sponsor

Description

How to fill out Agreement Between Website Owner And Sponsor?

Are you presently at the location where you require documentation for either organizational or personal purposes nearly every business day.

There is a wide range of legal document templates available online, but discovering templates you can trust is challenging.

US Legal Forms offers a vast selection of templates, such as the Idaho Agreement between Website Owner and Sponsor, designed to comply with federal and state regulations.

Once you locate the correct template, click Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Afterward, you may download the Idaho Agreement between Website Owner and Sponsor template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Identify the template you need and ensure it corresponds to your specific region.

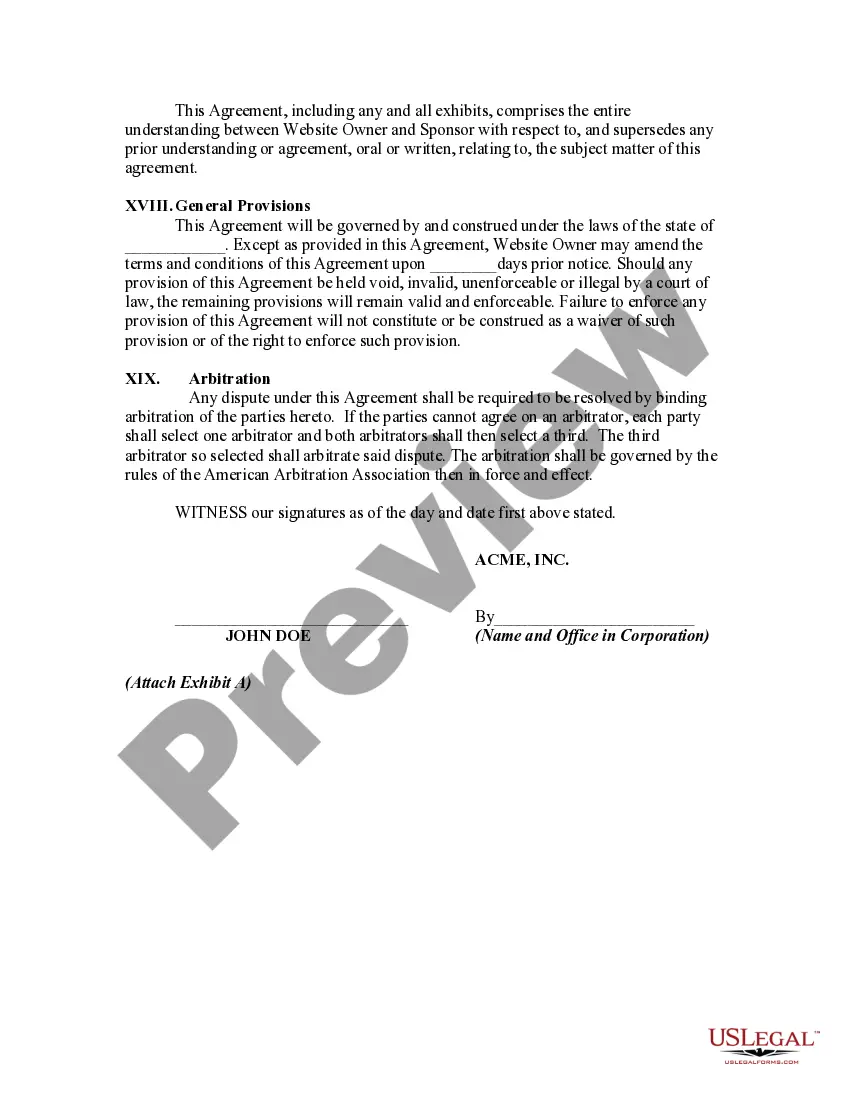

- Utilize the Preview button to examine the document.

- Review the details to confirm you have selected the correct template.

- If the template is not what you are looking for, use the Search field to find the template that fits your needs and specifications.

Form popularity

FAQ

The Idaho form ABE, or Idaho Agreement between Website Owner and Sponsor, is used for reporting and withholding on payments to nonresidents. It helps clarify tax obligations related to nonresident income generated through websites and sponsorships. Completing this form is crucial for compliance with Idaho tax laws. For assistance, consider using USLegalForms to navigate through the process smoothly.

Yes, Idaho requires nonresident withholding in certain situations. When a nonresident receives income from Idaho sources, the Idaho Agreement between Website Owner and Sponsor mandates specific withholding rules. This ensures that the state receives the appropriate tax revenue from nonresident earnings. It's essential to consult state guidelines or seek legal advice to understand your obligations.

1 form is used primarily for tax purposes, providing details about an individual’s share of income, deductions, and credits from partnerships, S corporations, or trusts. It allows recipients to report their earnings accurately on their tax returns. Recognizing the importance of the K1 can support your financial clarity when engaging in an Idaho Agreement between Website Owner and Sponsor.

An Idaho affected business entity refers to any business that must adhere to specific state laws, particularly those related to taxation or licensing. This may include corporations, LLCs, partnerships, and sole proprietorships operating within Idaho. Understanding your status as an affected business entity is vital if your operations involve an Idaho Agreement between Website Owner and Sponsor.

1 form in Idaho serves as a means for entities like S corporations and partnerships to report income to their owners. This form provides critical information needed for each owner's tax return. If you're navigating the complexities of an Idaho Agreement between Website Owner and Sponsor, understanding K1 forms can help ensure you comply with tax obligations.

In Idaho, property tax relief is available for homeowners aged 65 and older, allowing them to reduce their property tax burden. However, there is no mandated age at which all property taxes cease, as this varies based on eligibility and specific relief programs. If you need advice about your property taxes while dealing with an Idaho Agreement between Website Owner and Sponsor, consider seeking guidance from professionals.

An Idaho K-1 is a tax document used to report income earned from pass-through entities such as partnerships or S corporations. Each partner or shareholder receives a K-1 form detailing their share of the entity's income or loss. If you are involved in an Idaho Agreement between Website Owner and Sponsor, keeping track of your K-1 values is essential for accurate tax reporting.