The Idaho Shared or Split Custody CS Worksheet is a document used by a court to calculate the amount of child support paid from one parent to the other when the parents have joint or split custody of a child. The worksheet is used to calculate the child support obligation based on the parents' incomes, the number of children in their shared custody, and the amount of parenting time each parent has. There are two types of Idaho Shared or Split Custody CS Worksheet: the Standard Worksheet and the Simplified Worksheet. The Standard Worksheet requires detailed information about both parents' incomes, assets, and parenting time, while the Simplified Worksheet only requires basic information. Both worksheets are used to calculate the child support obligation for the purpose of setting a fair and reasonable amount.

Idaho Shared or Split Custody CS Worksheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Shared Or Split Custody CS Worksheet?

Completing official documents can be a significant hassle if you lack readily available fillable templates. With the US Legal Forms online collection of formal documentation, you can trust the forms you find, as all of them adhere to federal and state regulations and are validated by our experts.

So if you need to complete the Idaho Shared or Split Custody CS Worksheet, our service is the ideal destination to download it.

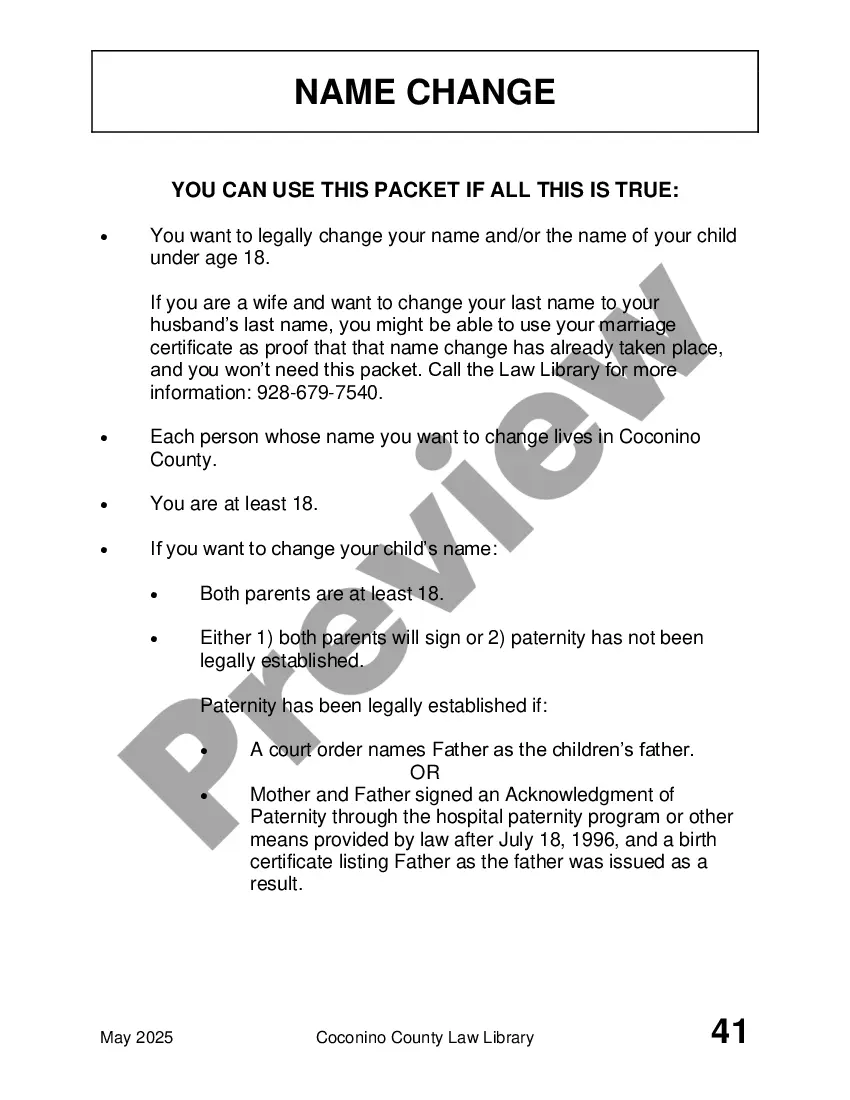

Here’s a brief guide for you: Document compliance check. You should thoroughly examine the content of the document you wish to ensure that it meets your requirements and complies with your state laws. Previewing your document and analyzing its general description will assist you in doing so.

- Acquiring your Idaho Shared or Split Custody CS Worksheet from our directory is as straightforward as A-B-C.

- Previously registered users with an active subscription simply need to sign in and click the Download button once they locate the correct template.

- Afterward, if necessary, users can retrieve the same form from the My documents section of their account.

- However, even if you're unfamiliar with our service, signing up for a valid subscription will only take a few moments.

Form popularity

FAQ

The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent.

Idaho law accounts for shared custody of a child directly in the child support formula used to calculate payment amounts. This means that, in cases where custody is shared, the amount of child support paid by the paying parent will be reduced ing to the amount of time they have custody of the child.

Q: At what age can a child decide which parent to live with? A: When a child turns 18 they have the legal right to move wherever they desire. Before then, there is no specific age by law when they can start making that type of decision for themselves.

Divided custody generally means each parent is custodian of the same child for different finite periods of time, with cross rights of visitation. A ?split? custody arrangement refers to varying parenting plans for several children, where each parent has custody of at least one child of the marriage at all times.

Yes. Parties can agree to a different amount of child support than recommended by the Idaho Child Support Guidelines. However, child support obligations should still be calculated to show to the court, and there must be a good reason(s) to ask the court to order a different amount of support than the calculated amount.

Income withholding is ordered in most Idaho child support orders and is put in place immediately when an employer is known to Child Support Services. Most other enforcement methods occur automatically when the case meets certain legal criteria.

This means that child support payments are based on both parents' income and how much more the higher-earning parent makes, but there is no law that caps child support at any specific dollar amount.

Child support obligations in Idaho are calculated using the Income Shares Model. The idea is to estimate the amount of support that the children would have received if the marriage hadn't failed. This support amount is then divided between the parents in proportion to their respective incomes.