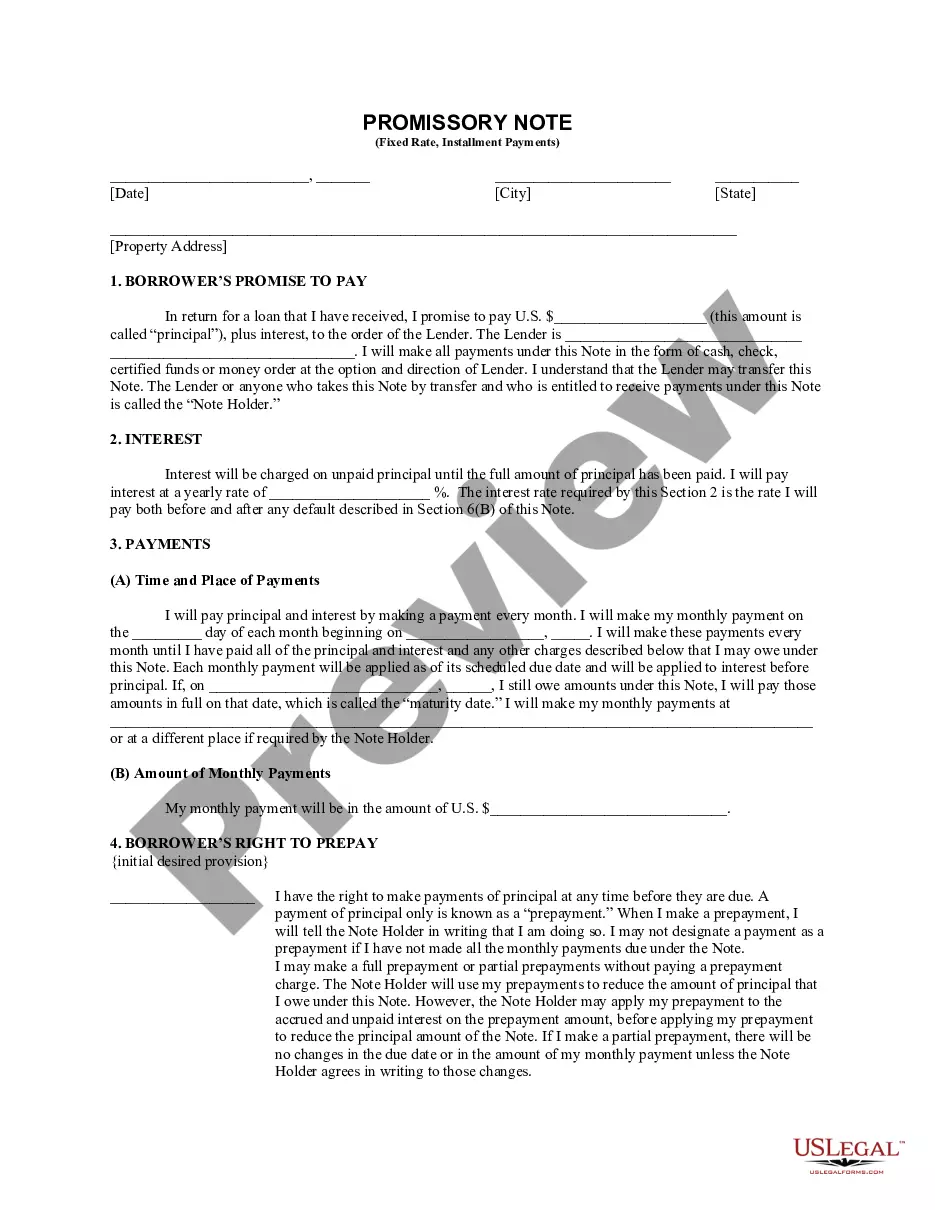

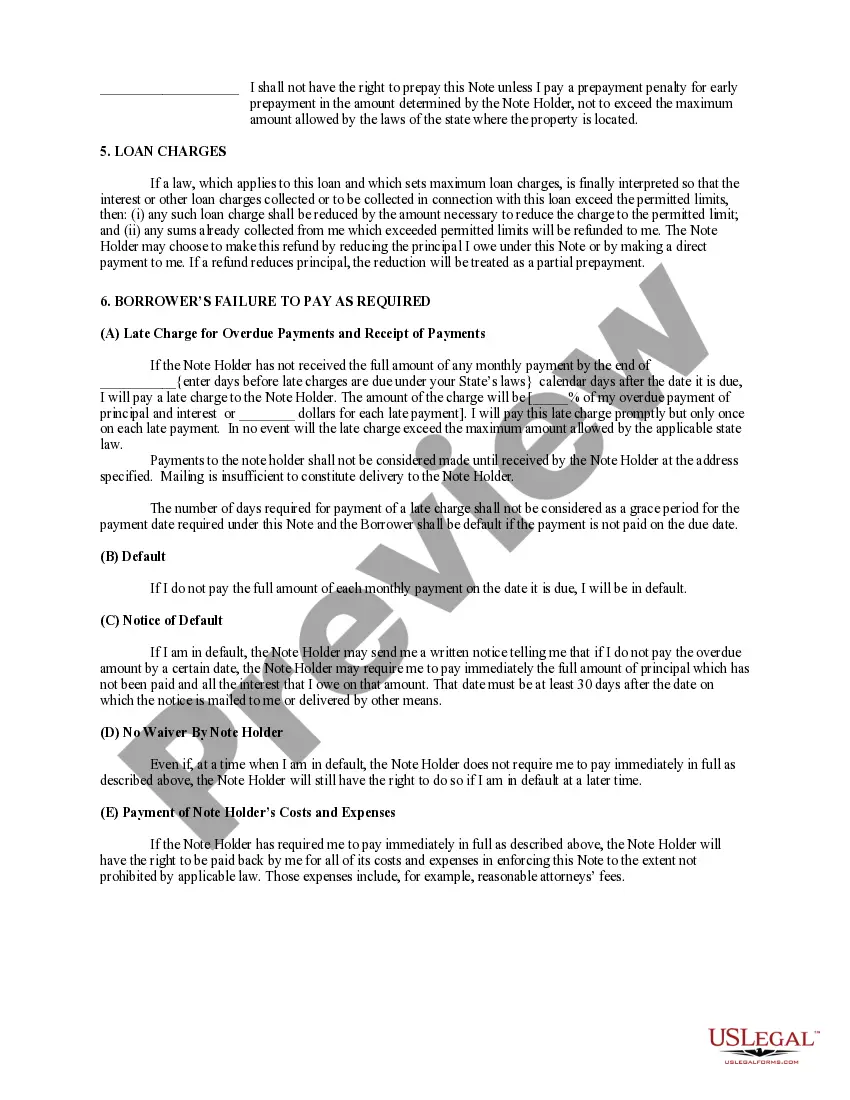

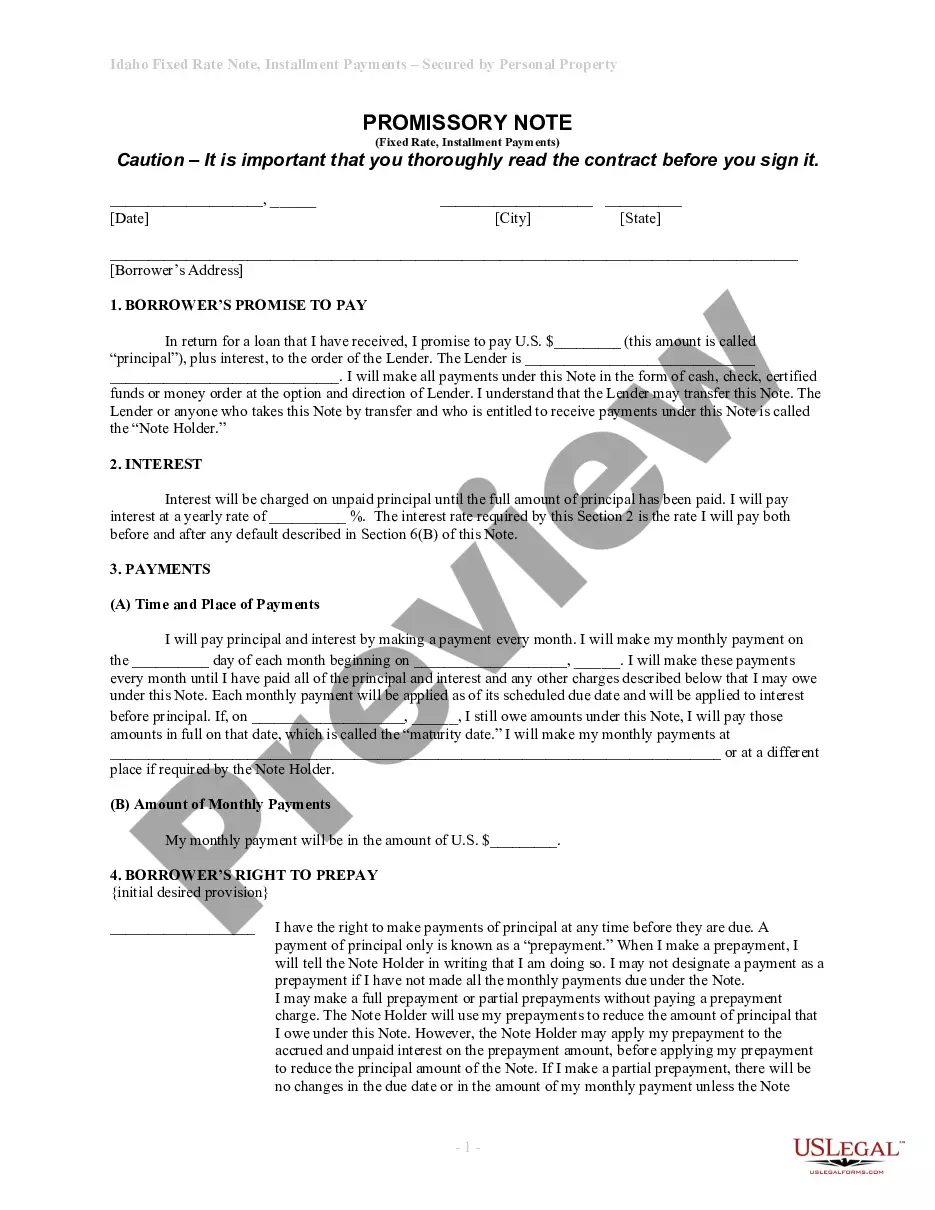

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Idaho Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Looking for Installments Fixed Rate Promissory Note Backed by Residential Real Estate for Idaho documents and completing them could pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the suitable template specifically for your region in just a few clicks.

Our legal experts prepare every document, requiring you only to fill them in. It truly is that uncomplicated.

Select your plan on the pricing page and create your account. Choose your payment method with a card or PayPal. Save the document in the desired format. Now you can print the Installments Fixed Rate Promissory Note Backed by Residential Real Estate for Idaho form or complete it using any online editor. There’s no need to worry about typos since your form can be utilized and submitted, and printed as many times as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your saved templates are stored in My documents and are always available for later use.

- If you haven’t subscribed yet, you need to register.

- Review our comprehensive instructions on how to obtain the Installments Fixed Rate Promissory Note Backed by Residential Real Estate for Idaho template in a matter of minutes.

- To acquire a valid form, verify its eligibility for your region.

- Examine the form using the Preview feature (if it’s available).

- If there’s a description, review it to understand the specifics.

- Hit the Buy Now button if you have found what you need.

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Step 1 Agree to Terms. Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money. Calculating Total Interest Owed. Calculating the Final Payment Amount. Calculating the Monthly Payment Amount.

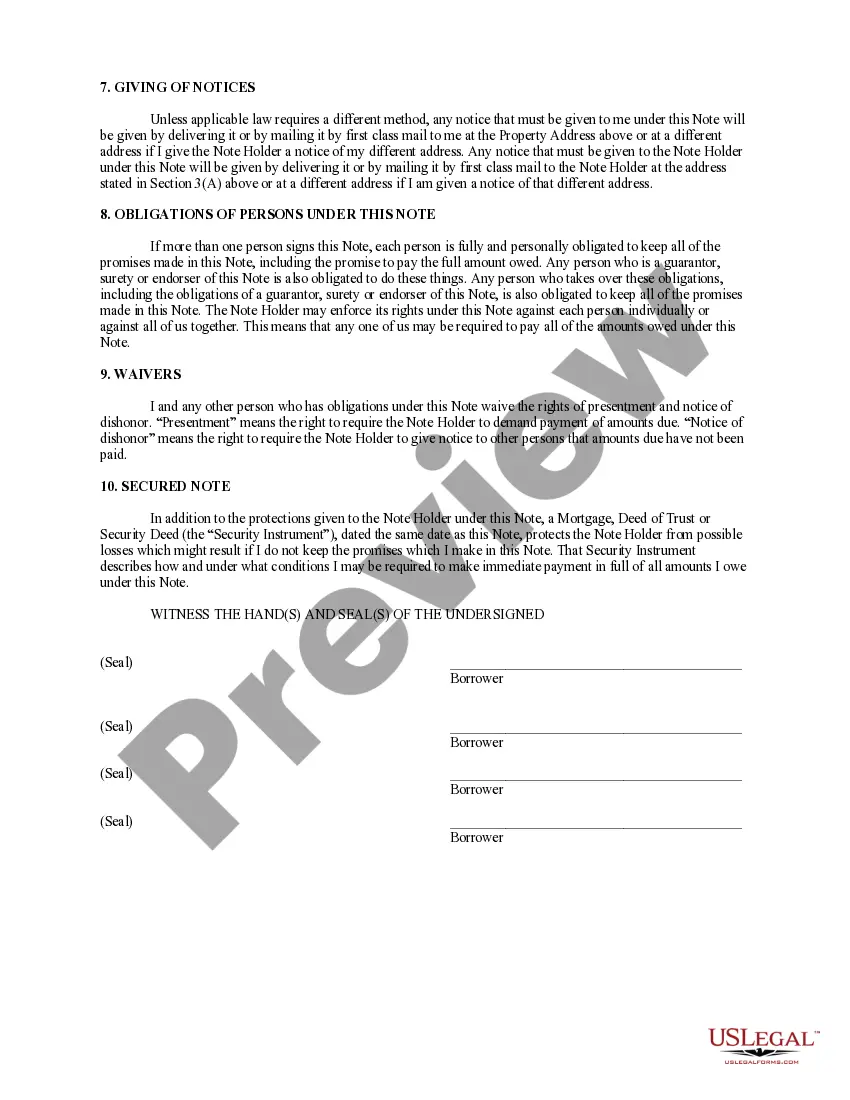

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.