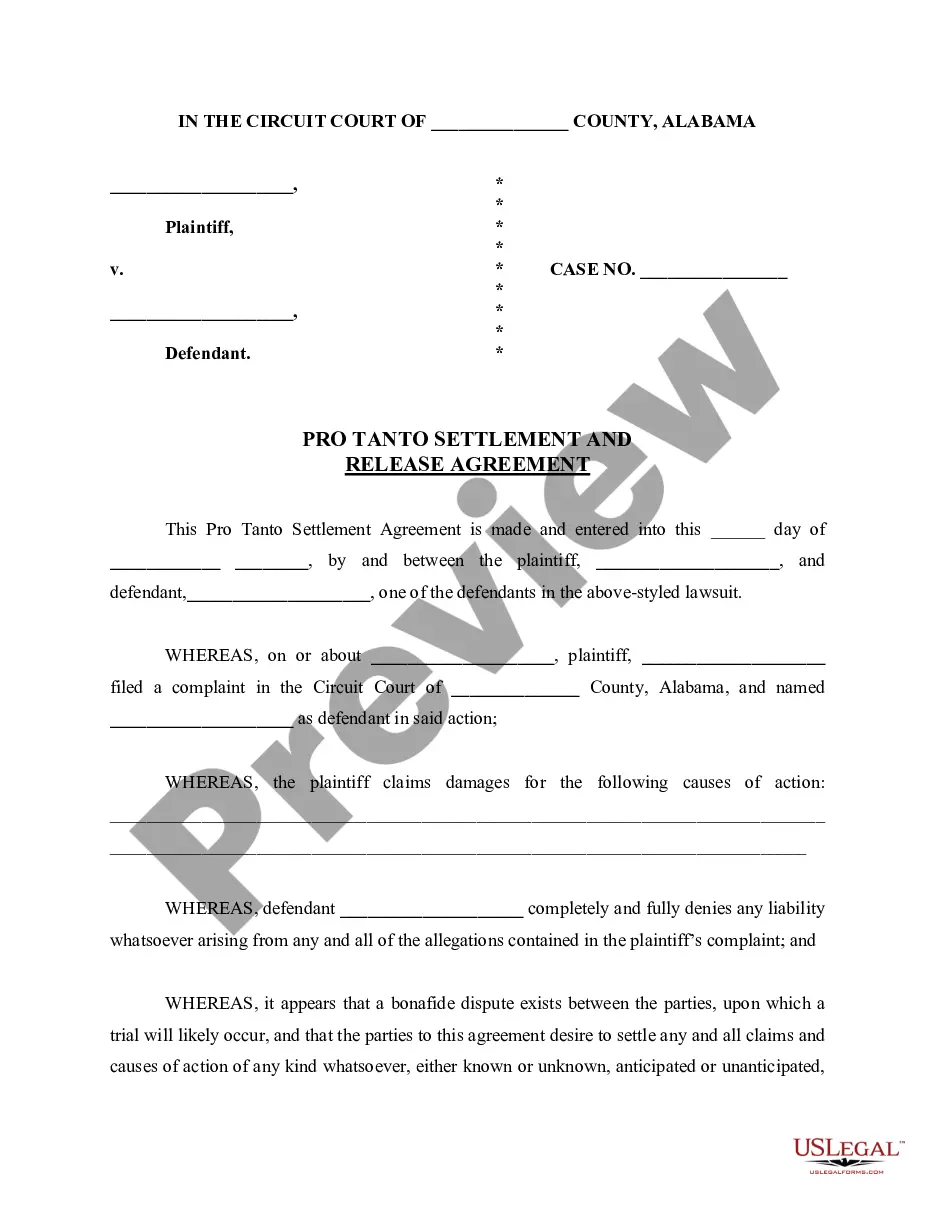

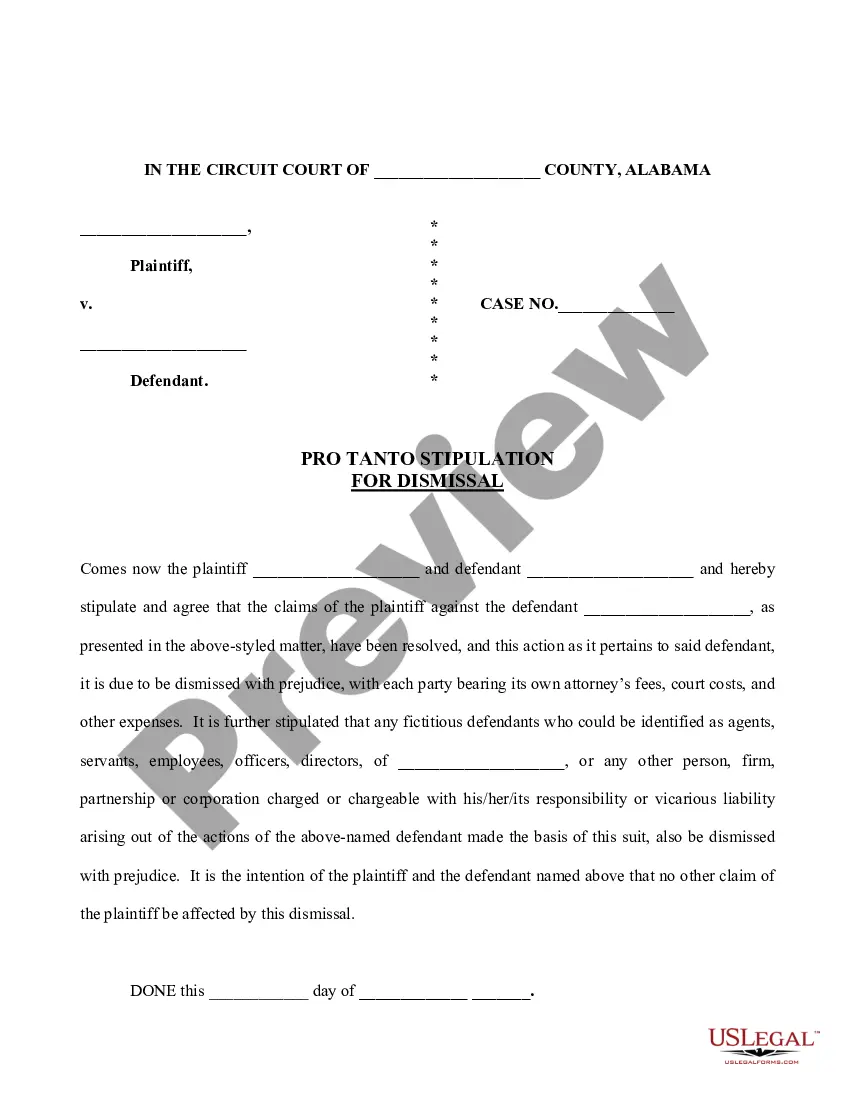

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Idaho Quitclaim Deed - Two Individuals to One Individual

Description

How to fill out Idaho Quitclaim Deed - Two Individuals To One Individual?

Obtain one of the most comprehensive directories of authorized documents.

US Legal Forms serves as a platform to locate any specific state document in just a few clicks, including instances of the Idaho Quitclaim Deed - Two Individuals to One Individual.

There's no requirement to squander numerous hours searching for a courtroom-acceptable document. Our certified specialists guarantee that you receive the latest templates each time.

After selecting a payment plan, establish an account. Make a payment via credit card or PayPal. Download the document to your device by clicking Download. That's all! You need to fill out the Idaho Quitclaim Deed - Two Individuals to One Individual template and review it. To ensure that everything is correct, consult your local legal adviser for assistance. Sign up and easily browse over 85,000 useful templates.

- To access the forms library, select a subscription plan and create an account.

- If you have already registered, simply Log In and then click Download.

- The Idaho Quitclaim Deed - Two Individuals to One Individual document will be automatically saved in the My documents section (a section for all documents you save on US Legal Forms).

- To create a new account, follow the quick instructions below.

- If you are about to use a state-specific document, ensure that you specify the correct state.

- If possible, examine the description to grasp all the details of the document.

- Utilize the Preview feature if it’s available to check the document's details.

- If everything is correct, click Buy Now.

Form popularity

FAQ

The Idaho Quitclaim Deed - Two Individuals to One Individual is most often used for transferring property between family members or in cases of divorce settlements. It simplifies the process of transferring ownership without the need for extensive legal procedures. Furthermore, quitclaim deeds are often utilized for clearing up any claims or interests in the property when the full legality of title is not as critical.

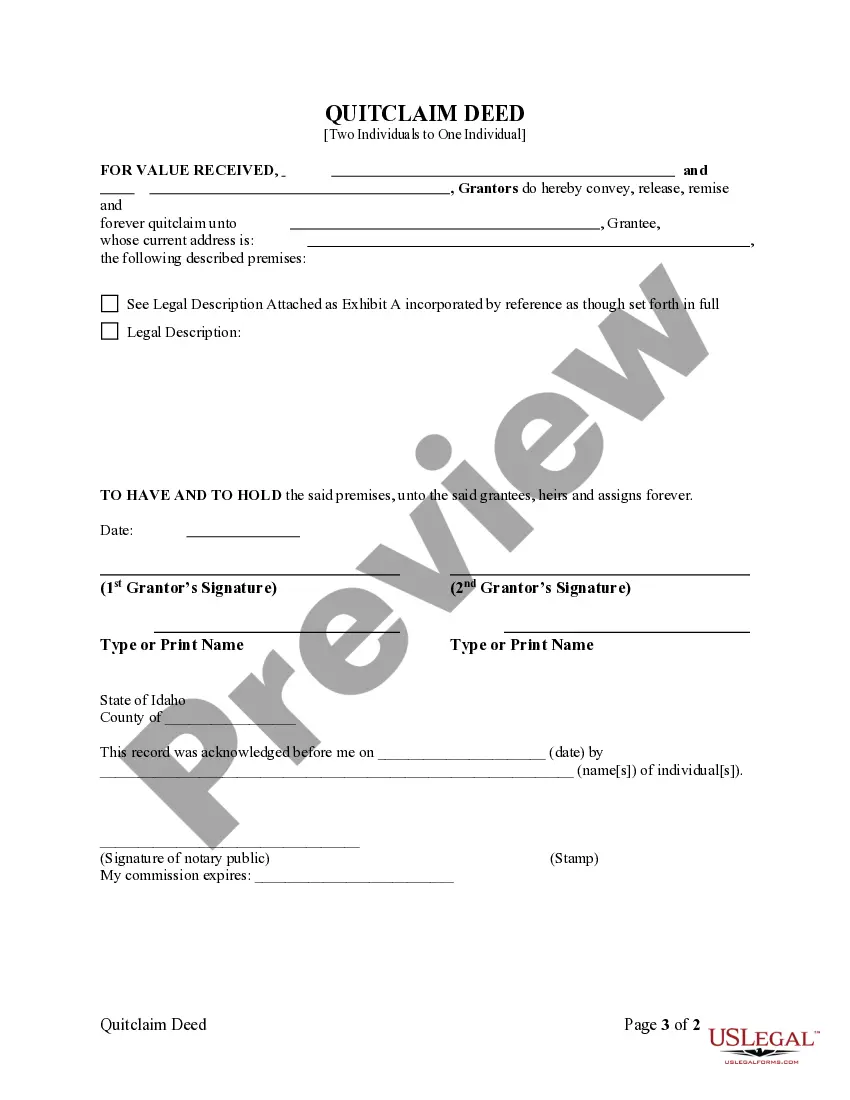

Generally, at least one party must be present when executing the Idaho Quitclaim Deed - Two Individuals to One Individual. However, it's essential for the party transferring the interest to sign the deed in front of a notary. While both parties may not need to be present for the signing, it is advisable for clarity and understanding of the terms of the transfer.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Enter the full name of the Grantor (seller) AND. Enter the name(s) of the Grantee(s) (buyer(s)) Address. Legal description of the property. Enter the name of the County where the property is situated.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

If you own your own home, you are free to gift or sell an interest in the real property to someone else.You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances.