Iowa I.R.S. Form SS-4 (to obtain your federal identification number)

Description

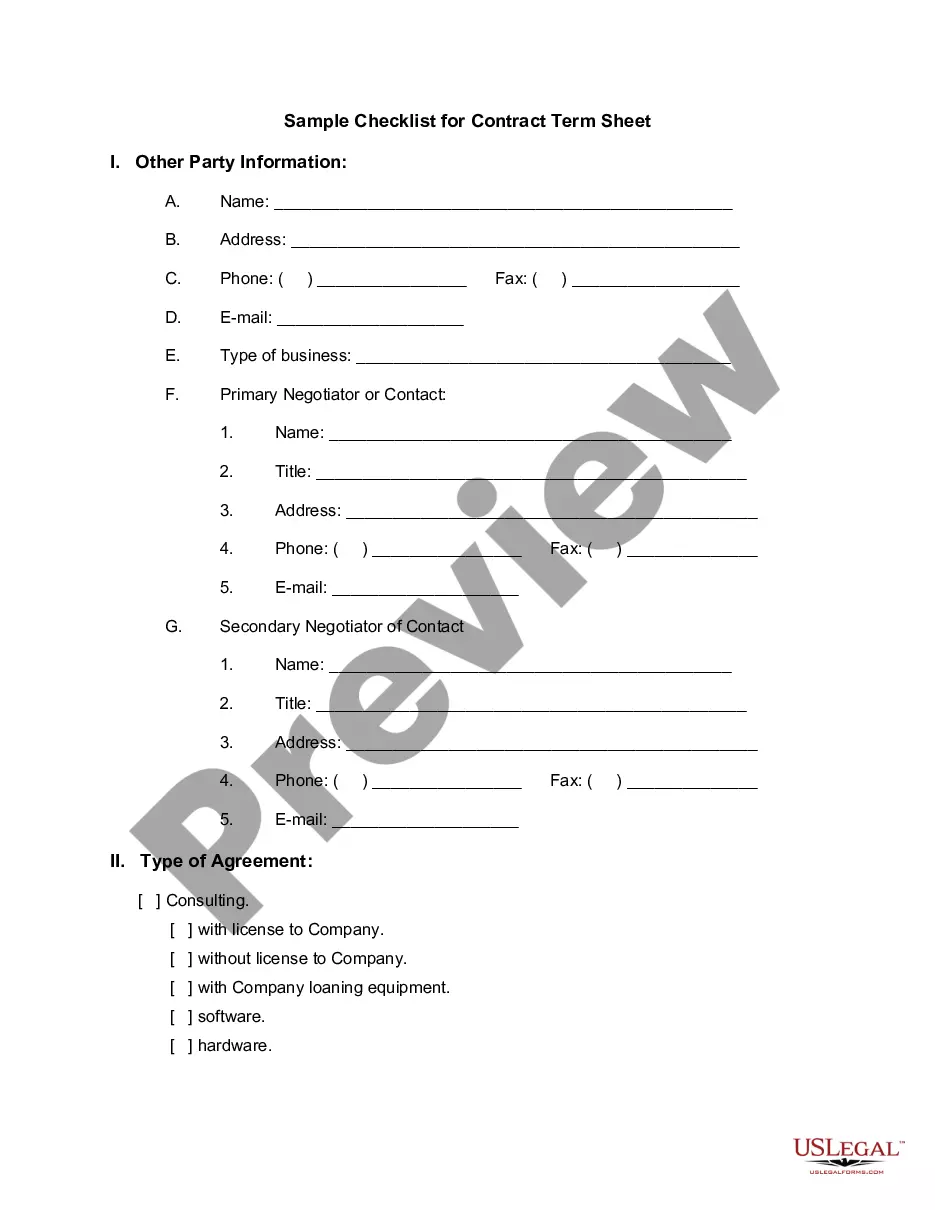

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

Are you currently inside a placement the place you require papers for possibly business or individual functions just about every time? There are plenty of legal papers layouts accessible on the Internet, but locating versions you can rely on isn`t easy. US Legal Forms delivers thousands of develop layouts, just like the Iowa I.R.S. Form SS-4 (to obtain your federal identification number), which can be written in order to meet state and federal specifications.

If you are presently knowledgeable about US Legal Forms site and get a free account, basically log in. Afterward, you are able to obtain the Iowa I.R.S. Form SS-4 (to obtain your federal identification number) format.

Unless you offer an account and need to begin using US Legal Forms, follow these steps:

- Discover the develop you will need and ensure it is for your correct metropolis/region.

- Use the Preview button to check the form.

- Read the outline to actually have selected the appropriate develop.

- If the develop isn`t what you are looking for, take advantage of the Research area to obtain the develop that fits your needs and specifications.

- When you find the correct develop, click Get now.

- Choose the pricing strategy you need, complete the required information to make your money, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Pick a practical document format and obtain your backup.

Discover each of the papers layouts you have purchased in the My Forms menus. You can obtain a extra backup of Iowa I.R.S. Form SS-4 (to obtain your federal identification number) any time, if possible. Just click the needed develop to obtain or produce the papers format.

Use US Legal Forms, the most comprehensive assortment of legal varieties, to conserve time and stay away from faults. The service delivers expertly produced legal papers layouts which you can use for a range of functions. Make a free account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

If you lost your EIN documents, you can visit the IRS website where you can get a copy of your EIN number.

If an EIN is lost or misplaced, it is not possible to look it up online. An EIN or employer identification number is a nine-digit number assigned by the Internal Revenue Service to organizations with and without employees. ... Ideally, you want to note your EIN when it's issued and store it in a safe place.

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

6 Steps to Complete SS-4 Gather the Information Necessary To Complete Form SS-4. You'll want to gather information on the business. ... Complete the General Information Section. ... Complete the Business Type Information Section. ... Complete the Other Business Information Section. ... Sign the Form. ... Submit Your Form SS-4.

Apply for a federal identification number (FEIN) with the Internal Revenue Service. You can apply for an FEIN online or you can use form SS-4 (pdf); this will become your state number for withholding tax purposes.

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

Call the IRS. The best number to call is (+1) 800-829-4933. When you hear the various menu options, select option 1 for English or 2 for Spanish, then option 1 for EIN inquiries, and then option 3. You can call during IRS Business hours: a.m. - p.m. Eastern Standard Time (GMT-5).