Iowa Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

You can spend hours online searching for the legal document template that meets the federal and state criteria you require. US Legal Forms provides a vast array of legal forms that can be reviewed by experts. You can obtain or print the Iowa Account Executive Agreement - Self-Employed Independent Contractor from my services.

If you already have a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, modify, print, or sign the Iowa Account Executive Agreement - Self-Employed Independent Contractor. Each legal document template you purchase is yours permanently. To obtain another copy of the purchased form, navigate to the My documents tab and select the appropriate option.

If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, make sure that you have selected the correct document template for the county/city of your choice. Review the form description to verify you have chosen the right form. If available, utilize the Preview option to examine the document template as well.

- To find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- Once you have found the template you want, click Get now to continue.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your device.

- Make modifications to the document if necessary. You can complete, edit, sign, and print the Iowa Account Executive Agreement - Self-Employed Independent Contractor.

- Download and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

Form popularity

FAQ

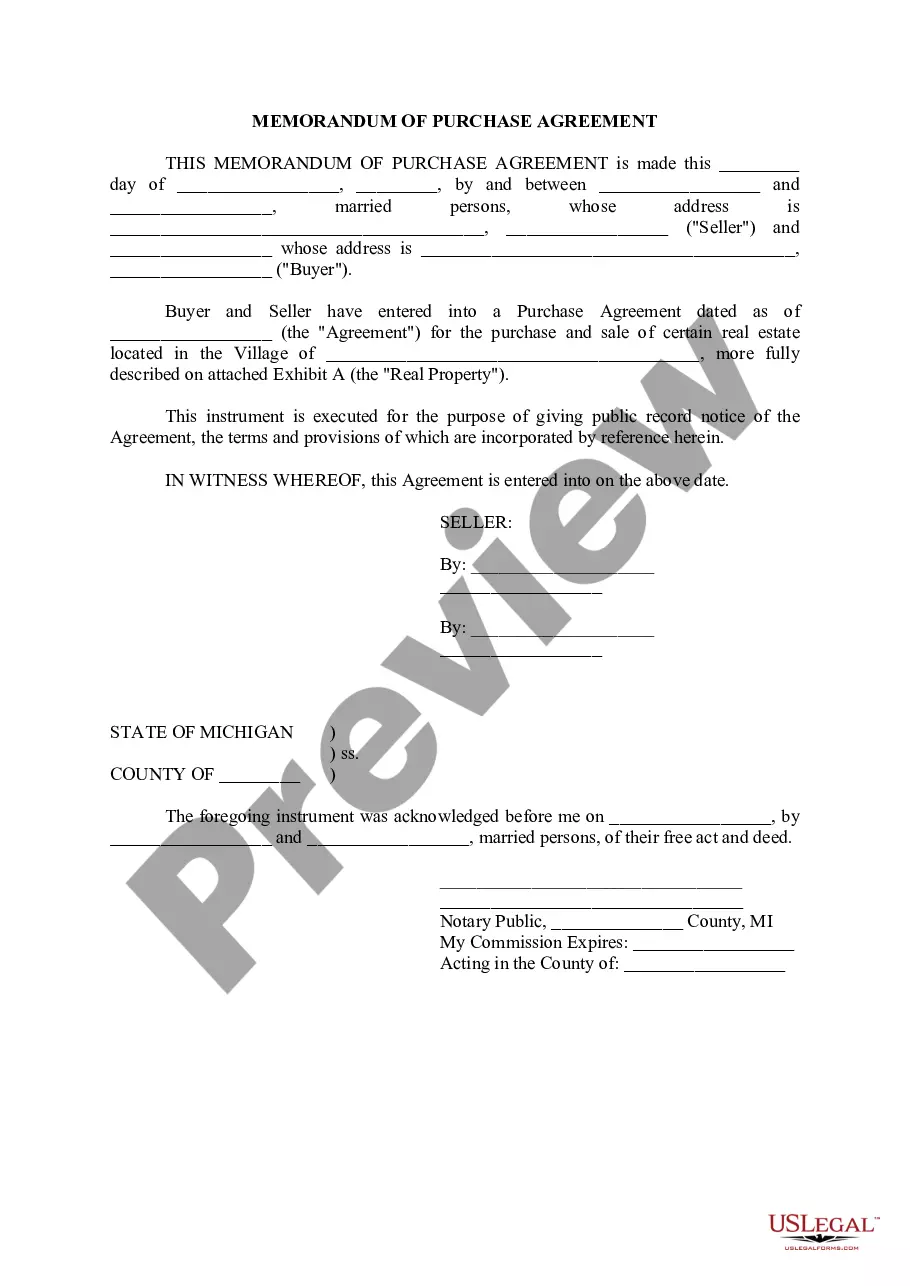

The basic independent contractor agreement lays out the terms and responsibilities of both parties involved. It typically covers project details, timelines, payments, and any necessary confidentiality agreements. By utilizing the Iowa Account Executive Agreement - Self-Employed Independent Contractor from US Legal Forms, you can create a solid foundation for your working relationship.

The independent contractor agreement in Iowa is a legally binding document that outlines the relationship between the contractor and the client. It includes details about the services provided, payment arrangements, and confidentiality clauses. Using the Iowa Account Executive Agreement - Self-Employed Independent Contractor ensures that you meet Iowa's specific legal requirements.

An independent contractor typically needs to complete a few essential documents. First, a signed independent contractor agreement outlines the terms of the work. Additional requirements may include tax forms like the W-9 and invoices for services rendered. With the Iowa Account Executive Agreement - Self-Employed Independent Contractor from US Legal Forms, you can simplify this process.

An independent contractor must generally earn $600 or more in a calendar year to receive a IRS Form 1099-MISC. This requirement ensures proper reporting of income and supports your financial records. If you are working under the Iowa Account Executive Agreement - Self-Employed Independent Contractor, keep track of your earnings to ensure you meet this threshold.

The new federal rule on independent contractors clarifies the criteria used to determine worker classification. This rule aims to provide more consistency across different industries, affecting how agreements like the Iowa Account Executive Agreement - Self-Employed Independent Contractor are drawn up. Understanding this rule will help you maintain compliance during your work as an independent contractor.

Filling out an independent contractor agreement involves several key steps. First, include your name and contact information, along with the client's details. Next, outline the scope of work, payment terms, and deadlines. To ensure compliance, consider using the Iowa Account Executive Agreement - Self-Employed Independent Contractor provided by US Legal Forms.

Filling out an independent contractor form requires careful attention to detail. Begin by entering your personal and business information accurately, then specify the nature of the services rendered. It is important to read through the Iowa Account Executive Agreement - Self-Employed Independent Contractor to understand all requirements. If you need assistance, consider resources like USLegalForms to streamline the process.

An independent contractor needs to fill out several forms to comply with tax regulations. Typically, this includes a W-9 form to provide the contractor's taxpayer information and possibly a 1099 form to report income. Ensure you also have a properly executed Iowa Account Executive Agreement - Self-Employed Independent Contractor in place. Utilizing platforms such as USLegalForms can simplify this process.

To write an effective Iowa Account Executive Agreement - Self-Employed Independent Contractor, start by clearly defining the scope of work. Include the payment terms, deadlines, and details about both parties. Be sure to state the independent contractor's status to clarify their tax responsibilities. Using a trusted platform like USLegalForms can help guide you through this process, ensuring you cover all necessary elements.