Iowa Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

If you require extensive, acquire, or printing legal document templates, utilize US Legal Forms, the primary collection of legal forms, that can be accessed online.

Employ the site’s straightforward and efficient search to find the documents you need. Various templates for business and personal purposes are categorized by groups and states, or keywords.

Utilize US Legal Forms to locate the Iowa Tutoring Agreement - Self-Employed Independent Contractor within just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Iowa Tutoring Agreement - Self-Employed Independent Contractor. Every legal document template you acquire is yours indefinitely. You will have access to every form you obtained with your account. Click on the My documents section and select a form to print or download again. Compete and acquire, and print the Iowa Tutoring Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can use for your personal business or individual needs.

- If you are currently a US Legal Forms user, Log In to your account and then click the Download button to obtain the Iowa Tutoring Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously obtained in the My documents tab of the account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

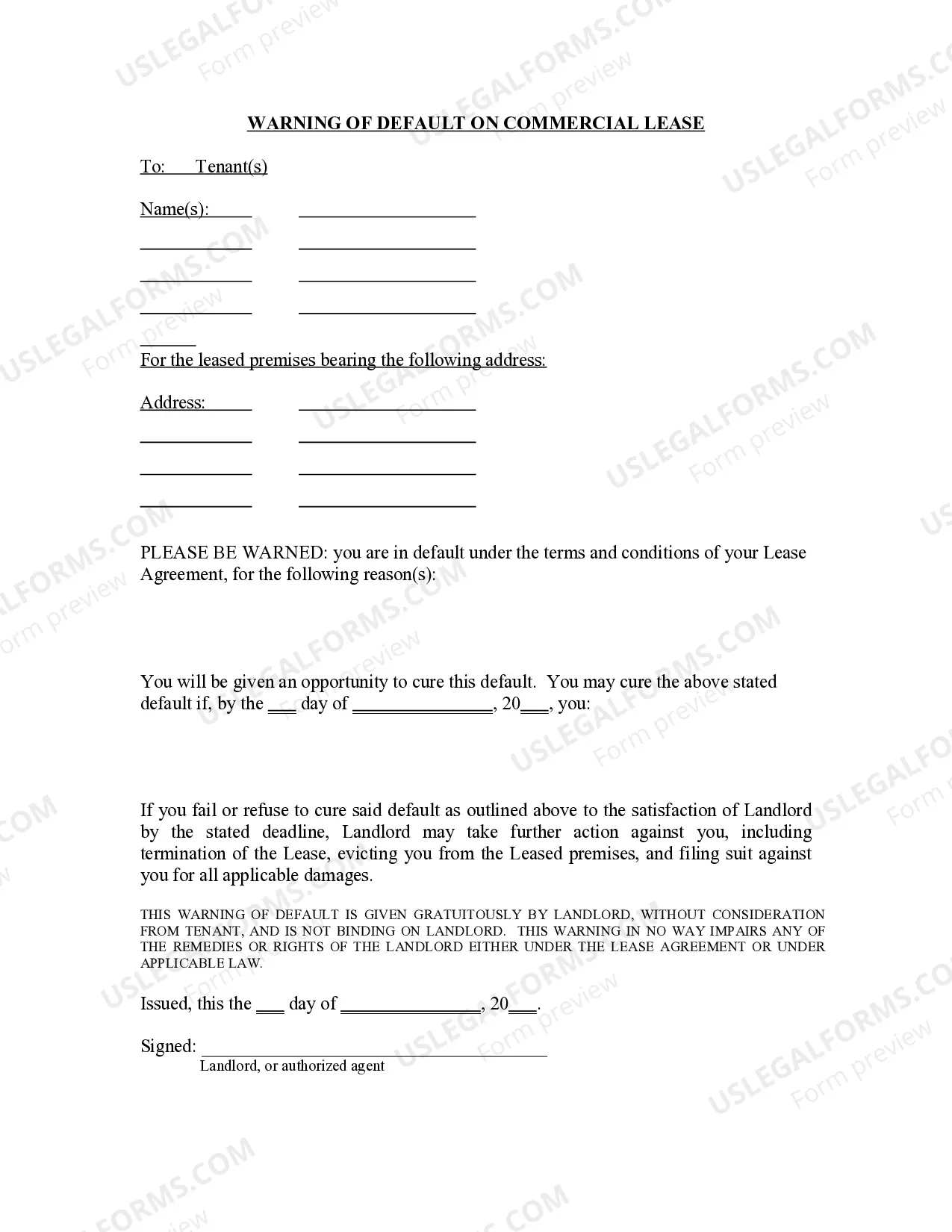

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to view the description.

- Step 3. If you are dissatisfied with the form, use the Search field near the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The new federal rule on independent contractors impacts how workers are classified under labor laws. This change aims to clarify who qualifies as an independent contractor versus an employee. Understanding these updates is vital for anyone operating under an Iowa Tutoring Agreement - Self-Employed Independent Contractor. Stay compliant by utilizing resources like uslegalforms to access updated agreements and guidelines.

In the U.S., an independent contractor earns $600 or more in a calendar year to receive a 1099 form. This amount applies when you provide services under an Iowa Tutoring Agreement - Self-Employed Independent Contractor. If you reach this threshold, your clients must report your earnings to the IRS. Consider using our legal forms to ensure proper documentation.

Creating an independent contractor agreement is a straightforward process. Start by defining the services to be provided, payment details, and timelines. Utilize templates such as the Iowa Tutoring Agreement - Self-Employed Independent Contractor from Uslegalforms to ensure compliance with Iowa laws and to cover all essential aspects. This approach helps you craft a comprehensive agreement that safeguards both parties.

The independent contractor agreement in Iowa is a legal document that outlines the terms of the working relationship between a business and a self-employed individual. This agreement defines the scope of work, payment terms, and other responsibilities. By using an Iowa Tutoring Agreement - Self-Employed Independent Contractor, both parties can establish clear expectations, protecting their interests and minimizing misunderstandings.

A basic independent contractor agreement outlines the terms of the relationship between the contractor and the client. It includes details about services provided, payment terms, and confidentiality. The Iowa Tutoring Agreement - Self-Employed Independent Contractor serves as a solid framework to establish this agreement, ensuring both parties have a clear understanding of their rights and responsibilities.

Independent contractors are individuals who provide services under a contract rather than as an employee. Key qualifications include having control over how and when they perform their work, managing their taxes, and being able to work for multiple clients. The Iowa Tutoring Agreement - Self-Employed Independent Contractor ensures that these qualifications are met and clearly outlined in written form.

Tutoring can fall under the category of both self-employed and freelance work. A self-employed tutor runs their business, while a freelance tutor may work on a project-by-project basis. Regardless of the approach, the Iowa Tutoring Agreement - Self-Employed Independent Contractor defines the working relationship clearly, providing protection for both sides.

Yes, tutors often operate as independent contractors. This designation allows them flexibility in their work arrangements and payment structures. Utilizing the Iowa Tutoring Agreement - Self-Employed Independent Contractor can help clarify the relationship between you and the tutor, ensuring both parties understand their obligations.

Typically, tutors are classified as independent contractors rather than employees. This means they usually receive a 1099 form instead of a W-2. The Iowa Tutoring Agreement - Self-Employed Independent Contractor outlines the terms and conditions for this arrangement, providing clarity on payment and responsibilities.