Iowa Visiting Professor Agreement - Self-Employed Independent Contractor

Description

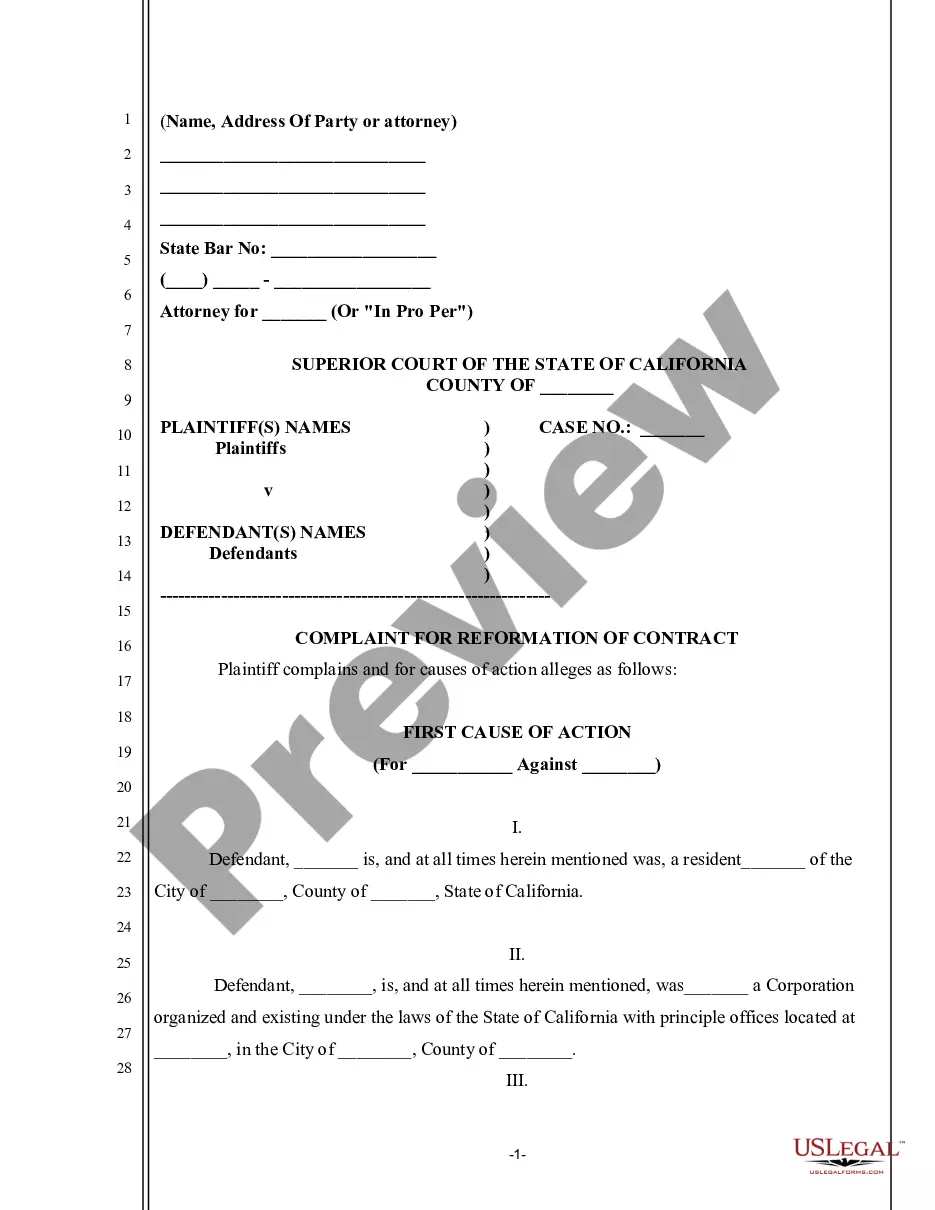

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

Locating the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how do you find the legal document you require? Utilize the US Legal Forms website. The service offers a multitude of templates, including the Iowa Visiting Professor Agreement - Self-Employed Independent Contractor, which can be used for both business and personal purposes. All of the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, sign in to your account and click on the Download button to obtain the Iowa Visiting Professor Agreement - Self-Employed Independent Contractor. Use your account to search for the legal documents you may have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct document for your city/region. You can browse the document using the Preview feature and review the document description to confirm this is the right one for you. If the document does not meet your needs, utilize the Search box to find the appropriate document. Once you are confident that the document is suitable, click the Buy now button to acquire the document. Select the pricing plan you need and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template for your system. Complete, modify, print, and sign the acquired Iowa Visiting Professor Agreement - Self-Employed Independent Contractor.

Take advantage of the convenience offered by US Legal Forms to streamline the process of obtaining legal documents tailored to your requirements.

- US Legal Forms is the largest library of legal documents where you can find various document templates.

- Utilize the service to download properly crafted papers that comply with state requirements.

- The documents are vetted by professionals to ensure quality and compliance.

- You can access previously acquired documents easily through your account.

- The platform provides a user-friendly interface for searching and downloading forms.

- Ensure you select the correct version of the document for your specific needs.

Form popularity

FAQ

In many cases, adjunct professors operate as independent contractors. This arrangement often allows them flexibility in their teaching assignments. By entering into an Iowa Visiting Professor Agreement - Self-Employed Independent Contractor, they can define the scope of their work and payment terms. This agreement ensures that both the adjunct and the institution understand their mutual responsibilities.

Yes, having a contract is essential for an independent contractor. A well-drafted Iowa Visiting Professor Agreement - Self-Employed Independent Contractor clarifies your responsibilities, payment terms, and expectations with the institution. This agreement protects your rights and helps prevent misunderstandings. Consider using the resources available on the uslegalforms platform to create a customized contract that meets your needs.

The new federal rule clarifies the classification of independent contractors versus employees, focusing on the degree of control and independence in work arrangements. This rule impacts anyone operating through arrangements like the Iowa Visiting Professor Agreement - Self-Employed Independent Contractor. Staying updated with these rules ensures compliance and effective management of worker rights. Assistance from legal platforms can help navigate these complexities.

An independent contractor in the U.S. must earn $600 or more from a single client to receive a 1099 form, which reports their income for tax purposes. This requirement applies to those working under an Iowa Visiting Professor Agreement - Self-Employed Independent Contractor. Understanding this threshold helps contractors to manage their finances and tax responsibilities effectively. Utilizing tools from platforms like USLegalForms can provide clear guidelines on this matter.

A basic independent contractor agreement is a document that establishes the relationship between a contractor and the client. It typically includes details on payment, project scope, confidentiality, and dispute resolution. For individuals working through an Iowa Visiting Professor Agreement - Self-Employed Independent Contractor, having a detailed agreement is essential to protect interests and avoid misunderstandings. You can customize your agreement easily using services like USLegalForms.

The classification of professors as employees or independent contractors largely depends on their employment terms. While full-time professors are often employees, part-time or adjunct professors are frequently classified as independent contractors. For those operating under an Iowa Visiting Professor Agreement - Self-Employed Independent Contractor, understanding this distinction is key for tax treatment and benefits. Legal platforms can help clarify these arrangements for educators.

Yes, in many cases, adjunct professors are classified as independent contractors rather than employees. This classification allows them to maintain flexibility in their work and allows institutions to hire them on a per-course basis. Therefore, when entering into an Iowa Visiting Professor Agreement - Self-Employed Independent Contractor, it is crucial for adjunct professors to understand their rights and obligations. Resources like USLegalForms can assist in drafting an appropriate agreement.

An independent contractor agreement in Iowa is a legal document that outlines the terms between a hiring party and a self-employed individual. This agreement specifies the scope of work, payment terms, and responsibilities. It is essential for those engaged under an Iowa Visiting Professor Agreement - Self-Employed Independent Contractor to have clear terms to protect their roles and rights. Utilizing platforms like USLegalForms can simplify the process of creating a compliant agreement.

Writing an independent contractor agreement involves outlining essential elements clearly and concisely. Start with the title and identify the parties, then detail the services to be offered and payment structure. Finally, include terms regarding confidentiality, termination, and any specific legal clauses relevant to the Iowa Visiting Professor Agreement - Self-Employed Independent Contractor. Using resources from US Legal can guide you in creating a comprehensive and legally sound agreement.

Filling out an independent contractor agreement requires careful attention to detail. Begin by stating the agreement's purpose and identifying the parties involved. Include terms that define the scope of work, compensation, and duration of service under the Iowa Visiting Professor Agreement - Self-Employed Independent Contractor. To make this task easier, consider using US Legal forms, which provide clear templates tailored to independent contractors.