Iowa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

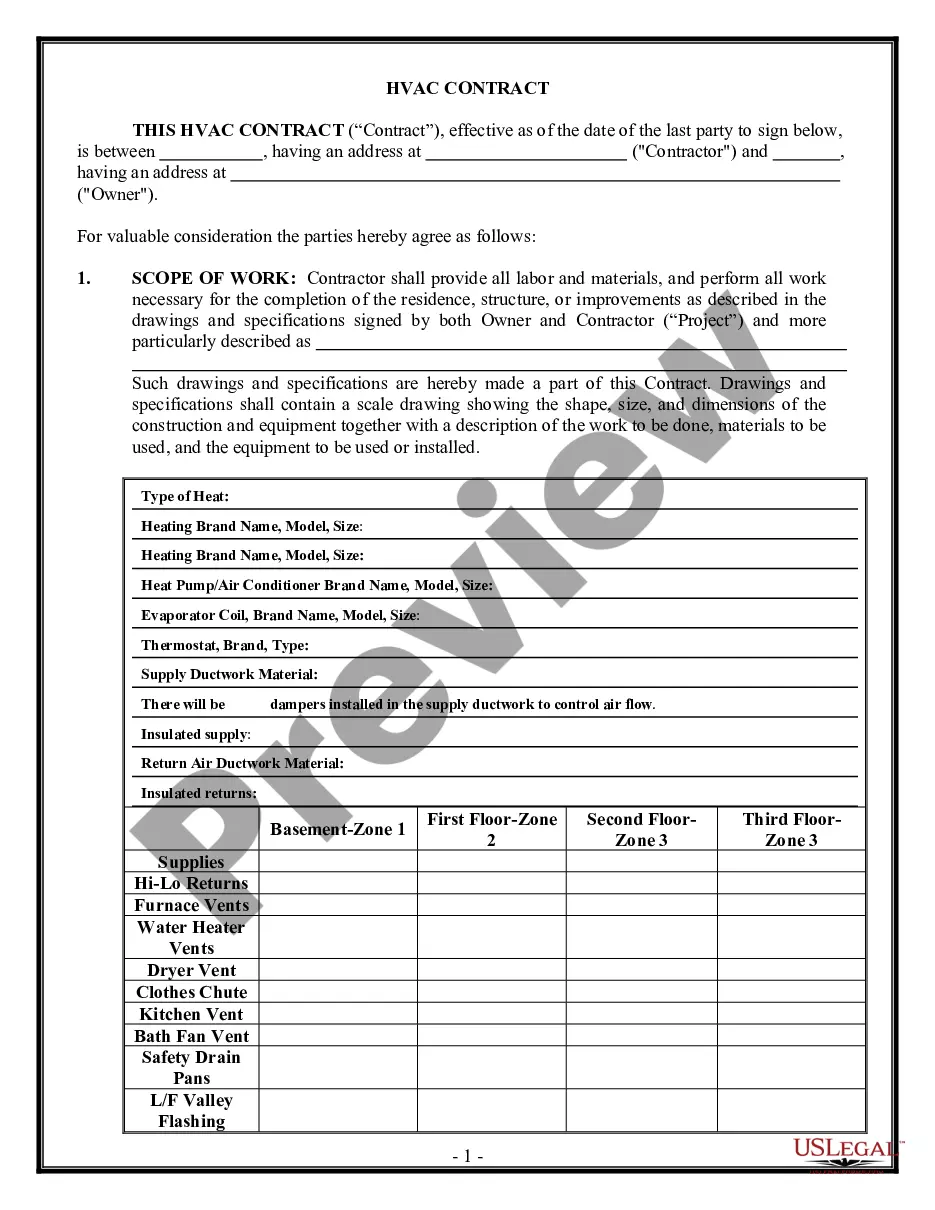

Description

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

It is possible to invest several hours on the web searching for the legitimate papers design which fits the state and federal demands you require. US Legal Forms offers a large number of legitimate varieties that happen to be examined by pros. You can easily obtain or print the Iowa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II from our assistance.

If you currently have a US Legal Forms account, you may log in and click the Down load switch. After that, you may full, change, print, or indication the Iowa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II. Each and every legitimate papers design you get is yours permanently. To acquire an additional backup associated with a purchased kind, visit the My Forms tab and click the related switch.

If you work with the US Legal Forms site initially, adhere to the easy guidelines under:

- Initial, be sure that you have selected the correct papers design for the state/town of your choice. Read the kind description to make sure you have picked the proper kind. If readily available, use the Review switch to check throughout the papers design also.

- In order to find an additional model of your kind, use the Research area to find the design that suits you and demands.

- When you have found the design you want, click Purchase now to continue.

- Choose the costs strategy you want, enter your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You can use your credit card or PayPal account to pay for the legitimate kind.

- Choose the file format of your papers and obtain it to the gadget.

- Make modifications to the papers if needed. It is possible to full, change and indication and print Iowa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II.

Down load and print a large number of papers themes utilizing the US Legal Forms website, that offers the biggest variety of legitimate varieties. Use expert and state-distinct themes to take on your business or specific requirements.

Form popularity

FAQ

Robert L. Reynolds will remain with Great-West Lifeco after the completion of the firm's recently announced deal to sell its Putnam Investments subsidiary to Franklin Templeton, a Putnam spokesman confirmed.

WINNIPEG ? ? Great-West Lifeco Inc. (?Lifeco?) [TSX: GWO] today announced that Franklin Resources, Inc. [NYSE: BEN], operating as Franklin Templeton, one of the world's largest independent and diversified asset managers, has agreed to acquire Putnam Investments from Lifeco.

Franklin Templeton will pay approximately $825 million2 in stock consideration up-front at closing and $100 million in cash 180 days after closing for 100% of Putnam.

Fund giant Franklin Templeton is buying Putnam Investments for $925 million and receiving a substantial investment from Great-West Lifeco, Putnam's parent company and a subsidiary of Power Corp.