This form is a memorandum documenting a proposed due diligence schedule for team members.

Iowa Preliminary Due Diligence Team Memorandum

Description

How to fill out Preliminary Due Diligence Team Memorandum?

Have you ever found yourself in a circumstance where you need to possess documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers a vast collection of form templates, including the Iowa Preliminary Due Diligence Team Memorandum, designed to meet federal and state requirements.

Once you find the appropriate form, click on Purchase now.

Select the pricing plan you prefer, fill in the required details to create your account, and pay for the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Preliminary Due Diligence Team Memorandum template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify that it is for the correct state/county.

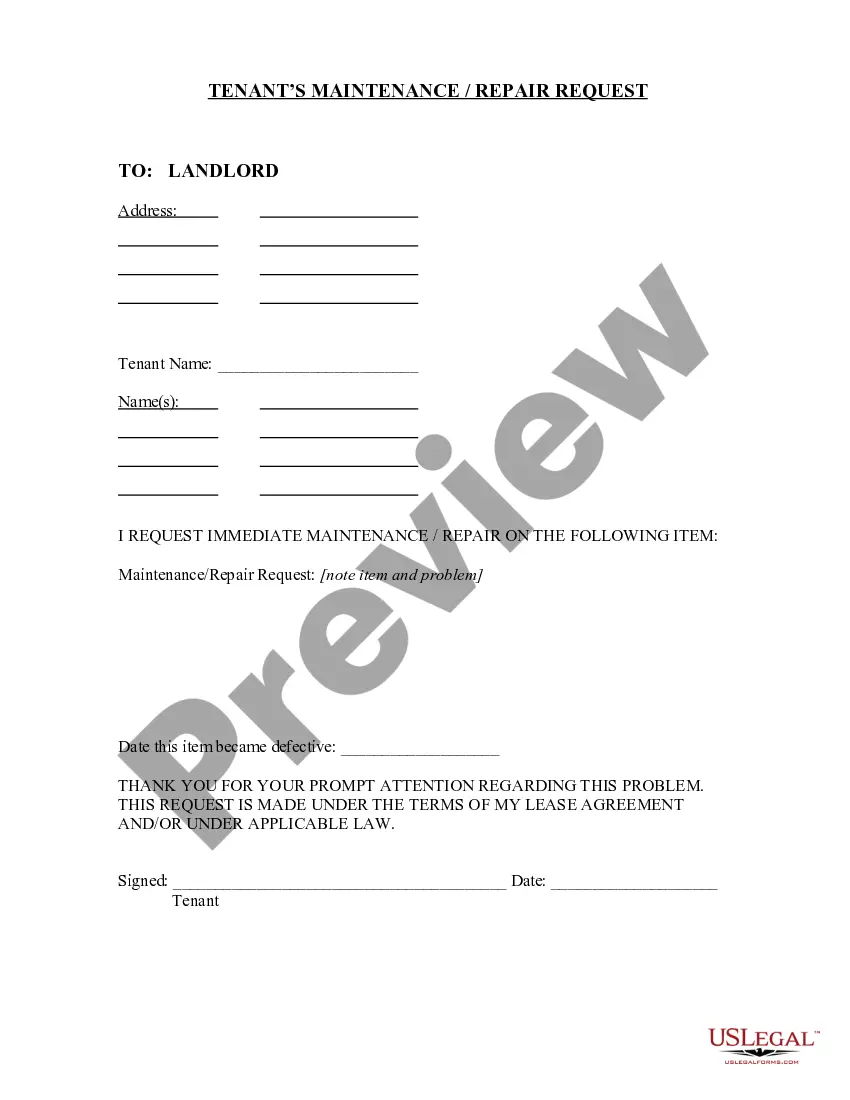

- Utilize the Review button to scrutinize the form.

- Check the overview to ensure you have chosen the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Yes, a buyer can usually back out after due diligence, depending on the terms of the agreement. It is essential for buyers to understand their rights and obligations within the contract. If the Iowa Preliminary Due Diligence Team Memorandum reveals concerning findings, this can provide valid grounds to withdraw. Knowing these details empowers buyers to make the best possible choices during their purchasing process.

A preliminary due diligence is the early stage of the evaluation process that identifies important facts about a business or investment opportunity. This process typically includes reviewing documents related to financial performance, legal compliance, and potential liabilities. Utilizing the Iowa Preliminary Due Diligence Team Memorandum ensures that all crucial aspects are covered comprehensively. Investors gain insights that help gauge the viability of their decisions.

Preliminary due diligence refers to the initial assessment conducted before a significant business transaction. It involves evaluating a company's financial health, legal standing, and operational efficacy. By using resources like the Iowa Preliminary Due Diligence Team Memorandum, stakeholders can systematically gather information to mitigate risks. This process fosters informed decision-making and enhances transaction success.

The Iowa Preliminary Due Diligence Team Memorandum outlines key steps in the due diligence process. Initially, your team will gather and analyze relevant documents and data to understand the target's business. Next, they will evaluate any potential risks that might arise, ensuring that all necessary information is thoroughly examined. Finally, a comprehensive report will summarize findings, helping you make informed decisions based on the Iowa Preliminary Due Diligence Team Memorandum.

A diligence memo is a document that summarizes the results of an investigation into a specific matter, often relating to a business deal or investment. It provides essential insights into potential risks and returns associated with the subject of due diligence. The Iowa Preliminary Due Diligence Team Memorandum is an example of an organized approach that helps stakeholders make informed decisions. This memo aids parties in understanding legal and financial implications before moving forward with any agreements.

In Iowa, unclaimed property refers to assets, such as bank accounts or insurance benefits, that have not been claimed by their owners for a specific period. The state has established rules that dictate how these assets should be reported and eventually turned over to the state. Engaging with the Iowa Preliminary Due Diligence Team Memorandum can help businesses navigate these regulations effectively. Ensuring compliance protects both the asset holders and the governing entities.

A due diligence memo is a documentation that summarizes findings from an investigation related to a specific transaction or project. It typically outlines key risks, considerations, and recommendations. When discussing the Iowa Preliminary Due Diligence Team Memorandum, such documents are crucial for helping decision-makers understand the implications of their choices. This memo serves as a valuable tool for communicating essential insights among stakeholders.

Diligence refers to the careful and thorough investigation one conducts before making decisions or transactions. For instance, in the context of real estate, a buyer might review property records, inspect the property, and assess environmental risks. In the case of the Iowa Preliminary Due Diligence Team Memorandum, it involves compiling comprehensive data to inform stakeholders. This process ensures that all relevant information is evaluated to minimize risk.