Iowa Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

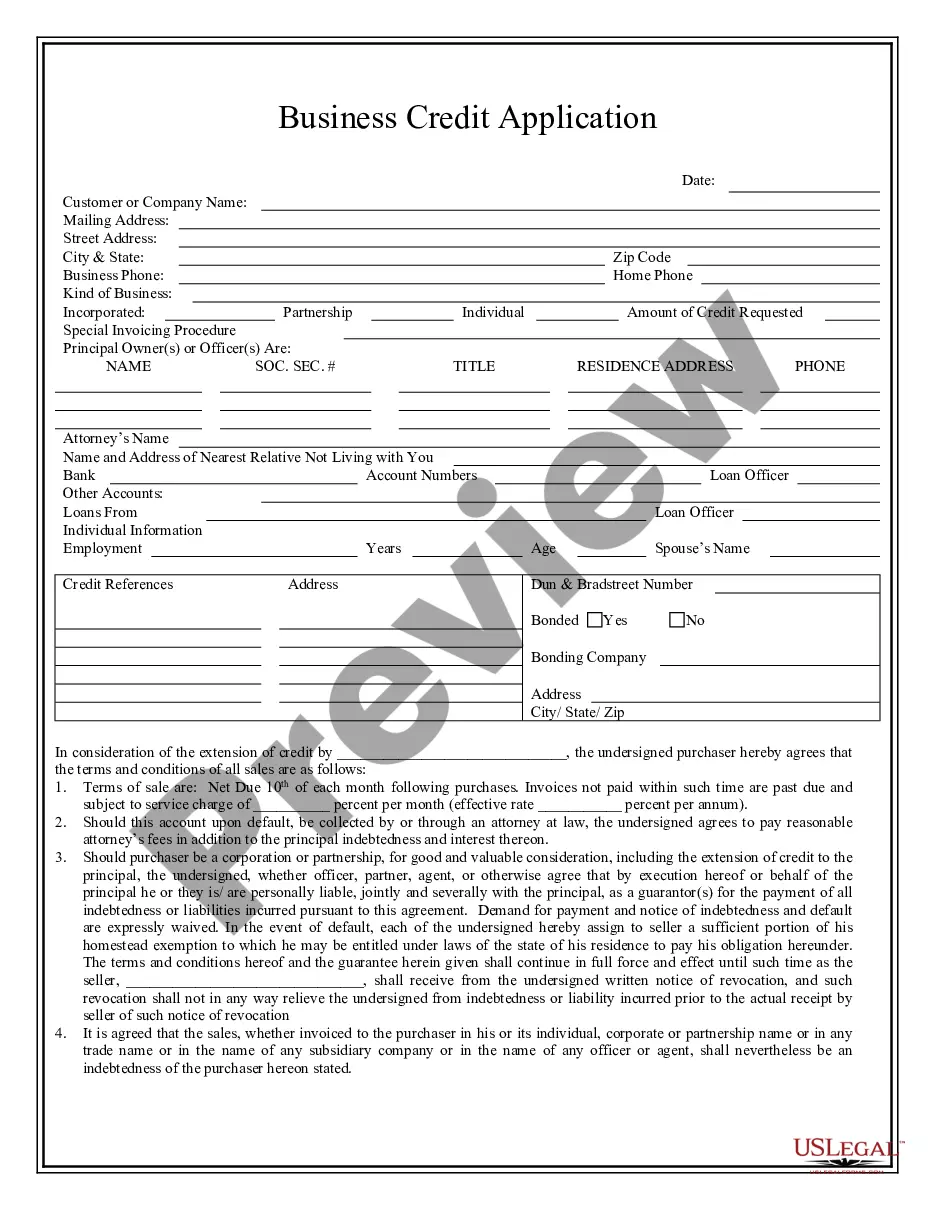

How to fill out Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

Are you presently inside a placement that you require documents for both company or individual functions just about every time? There are tons of lawful record layouts accessible on the Internet, but locating types you can rely on is not simple. US Legal Forms provides 1000s of kind layouts, just like the Iowa Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, that are composed in order to meet federal and state demands.

In case you are presently informed about US Legal Forms website and have an account, just log in. After that, you may obtain the Iowa Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds template.

Unless you provide an profile and would like to start using US Legal Forms, abide by these steps:

- Discover the kind you want and ensure it is to the appropriate area/area.

- Use the Preview option to review the shape.

- Read the description to actually have selected the appropriate kind.

- When the kind is not what you`re searching for, make use of the Research field to discover the kind that meets your requirements and demands.

- Once you get the appropriate kind, just click Buy now.

- Choose the pricing plan you desire, fill in the required information and facts to produce your account, and purchase the order making use of your PayPal or credit card.

- Decide on a convenient document format and obtain your duplicate.

Discover all the record layouts you may have bought in the My Forms menu. You can obtain a extra duplicate of Iowa Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds at any time, if needed. Just go through the essential kind to obtain or print out the record template.

Use US Legal Forms, probably the most comprehensive variety of lawful kinds, to save lots of efforts and prevent blunders. The support provides expertly manufactured lawful record layouts that you can use for an array of functions. Produce an account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

The regulatory agencies primarily responsible for supervising the internal operations of commercial banks and administering the state and federal banking laws applicable to commercial banks in the United States include the Federal Reserve System, the Office of the Comptroller of the Currency (OCC), the FDIC and the ...

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

The FDIC National Center for Consumer and Depositor Assistance is responsible for investigating all types of consumer complaints about FDIC-supervised institutions and responding to consumer inquiries about consumer laws and regulations.

Examples of complaints include if you think a bank has been unfair or misleading, discriminated against you in lending, or violated a federal consumer protection law or regulation. To file a complaint, you can: File online. Call toll-free at 888-851-1920 (TTY: 877-766-8533) 8 a.m. to 6 p.m. CST.

The OCC charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks. The OCC is an independent bureau of the U.S. Department of the Treasury.

You can file a complaint about your bank or lender with the Attorney General's Public Inquiry Unit. Complaints are used by the Attorney General's Office to get information about misconduct and to determine whether to investigate a company. However, we cannot give legal advice or provide legal assistance to individuals.

How can I file a complaint with the Federal Reserve Board (FRB)? If your problem concerns a state-chartered bank that is a member of the Federal Reserve System, contact the Federal Reserve Consumer Help unit. You may also contact the relevant state attorneys general or state banking department.

Where can I complain if I have a problem with my Bank? You can raise your grievance on the Digital Complaint Management System (CMS) Portal: .