Iowa Equity Compensation Plan

Description

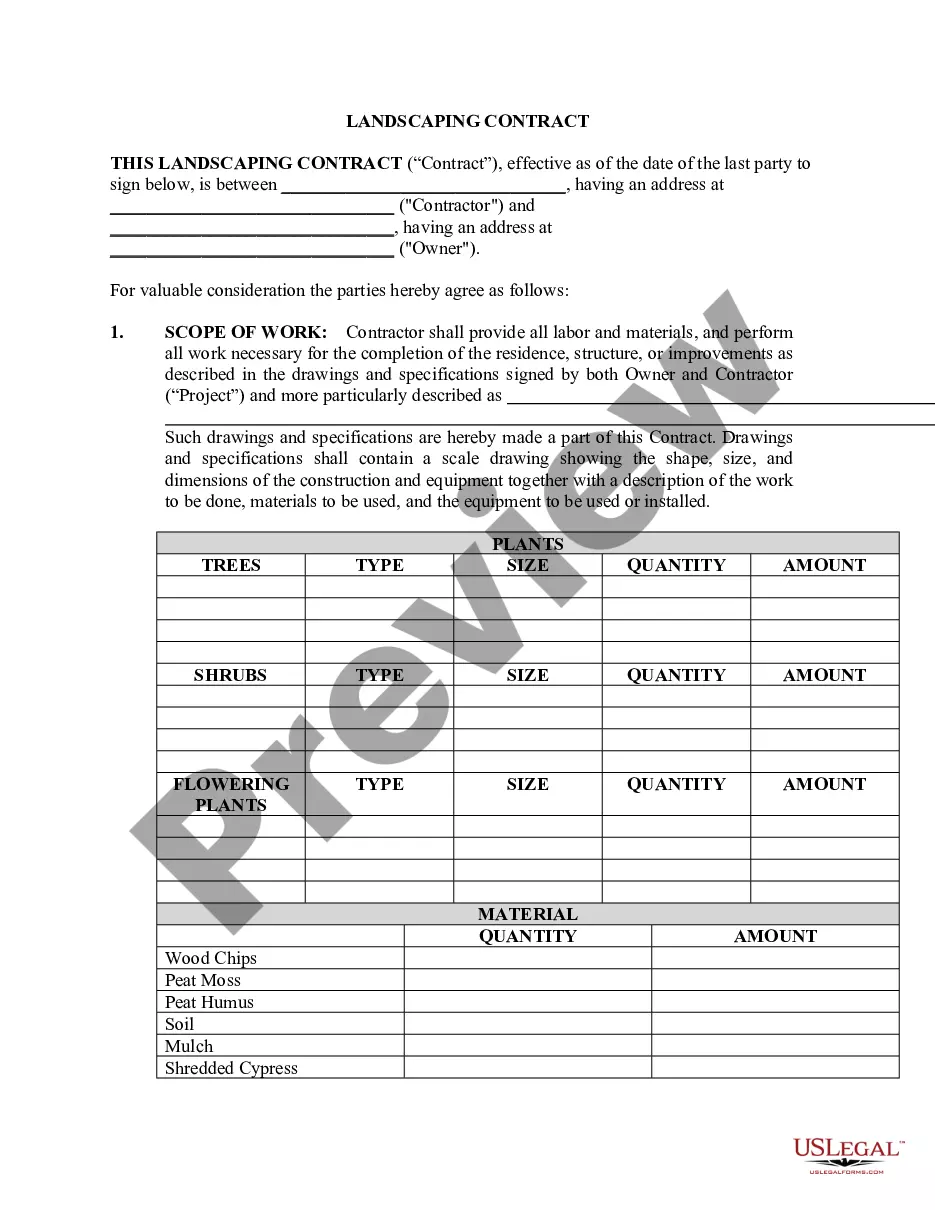

How to fill out Equity Compensation Plan?

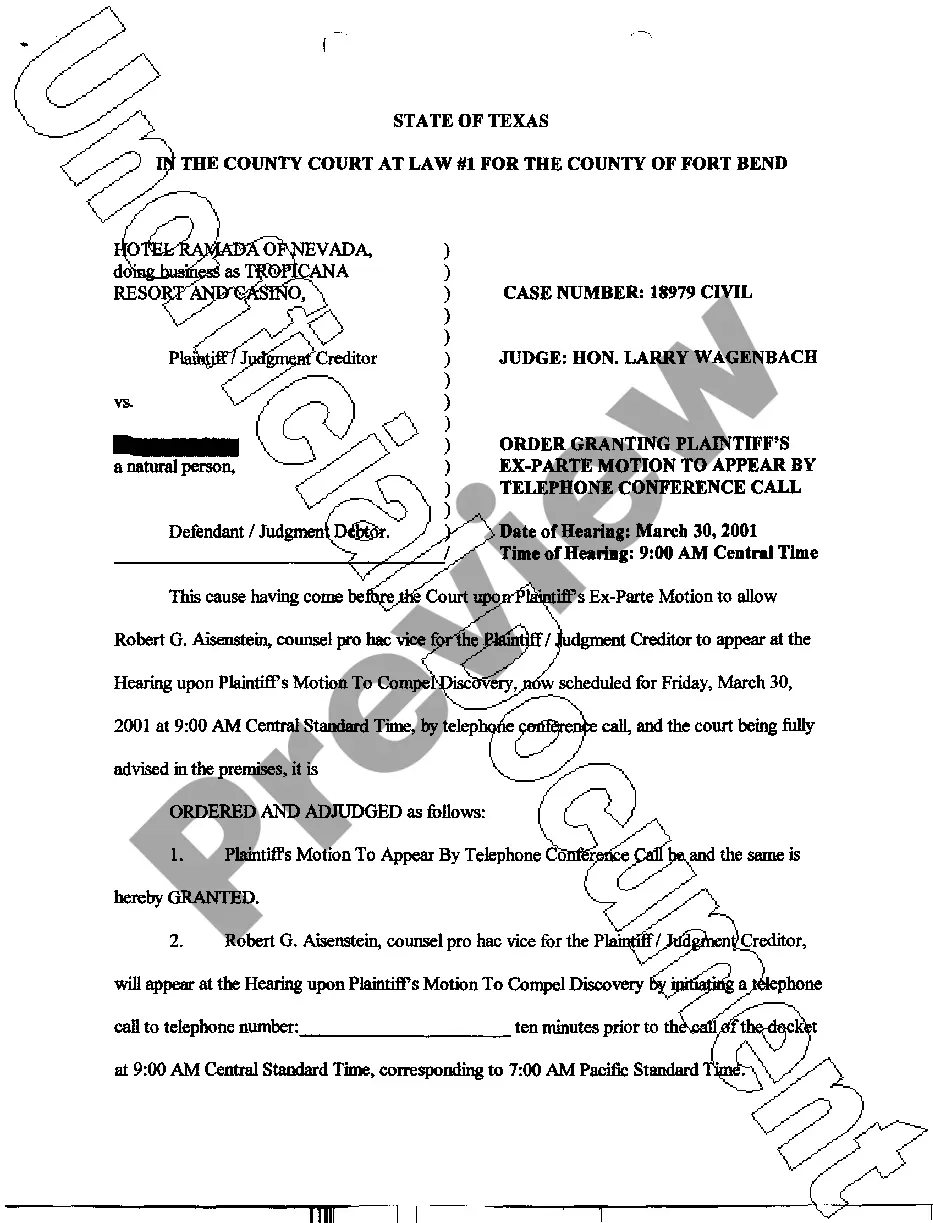

Choosing the best legitimate document design might be a battle. Needless to say, there are a lot of layouts available on the Internet, but how would you find the legitimate form you require? Take advantage of the US Legal Forms internet site. The services provides 1000s of layouts, such as the Iowa Equity Compensation Plan, that you can use for business and private demands. Every one of the kinds are examined by experts and fulfill state and federal demands.

If you are previously registered, log in to your accounts and click the Obtain button to find the Iowa Equity Compensation Plan. Make use of your accounts to check from the legitimate kinds you possess purchased previously. Go to the My Forms tab of your own accounts and get one more copy in the document you require.

If you are a fresh end user of US Legal Forms, allow me to share simple directions so that you can follow:

- Initial, be sure you have chosen the right form for your town/county. You may look through the form utilizing the Preview button and read the form description to guarantee it is the right one for you.

- In the event the form will not fulfill your requirements, make use of the Seach field to get the proper form.

- When you are certain the form is proper, click on the Purchase now button to find the form.

- Select the rates strategy you need and enter the necessary information. Design your accounts and pay money for an order with your PayPal accounts or Visa or Mastercard.

- Select the data file formatting and obtain the legitimate document design to your system.

- Complete, change and print and signal the received Iowa Equity Compensation Plan.

US Legal Forms will be the most significant collection of legitimate kinds that you will find numerous document layouts. Take advantage of the service to obtain appropriately-created paperwork that follow condition demands.

Form popularity

FAQ

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees.

When you work for equity, you work for partial ownership of the company. It's non-cash compensation awarded on a specific schedule determined by the employer. Startup equity compensation makes joining a startup more attractive for top-notch, highly sought-after employees.

Stock options give employees the option to buy a certain number of shares at a predetermined price within a specified period. Equity, on the other hand, gives employees actual shares of the company, either outright or subject to vesting conditions.

Equity compensation, also known as share-based compensation, is a type of non-cash pay that a company offers to employees to partake in ownership of the firm. Some examples are stock options, restricted stock, stock appreciation rights (SARs) and ESPPs.

An employee gains all rights to their Equity at the time in which it vests. When this occurs is unique to each person's equity as a compensation agreement with their employer. Once someone has all rights to their equity, then they have the option to cash out by selling their portion of ownership back to their employer.

The most common type of equity compensation, restricted stock units (RSUs), are offered when a company has a stable valuation or goes public. Similar to stock options, they vest over time, but you don't have to buy them. Therefore, RSUs have less risk while enticing employees to stick around for their assets to vest.

What is an Equity Award? An equity award is a non-cash compensation paid in terms of company equity. This is mostly granted in addition to a basic below-market salary in cash.

Cash compensation is the amount of money paid to an employee in exchange for their work. This can include wages, salaries, bonuses, and commissions. Equity compensation is a form of payment that gives employees an ownership stake in the company.