Iowa Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Consumer Investigative Report?

Have you found yourself in a situation where you require documentation for business or special purposes almost daily.

There are numerous legal document templates available online, but locating reliable ones is not easy.

US Legal Forms provides a vast array of form templates, such as the Iowa Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report, designed to comply with state and federal regulations.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment using PayPal or Visa or Mastercard.

Select a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Iowa Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct state/region.

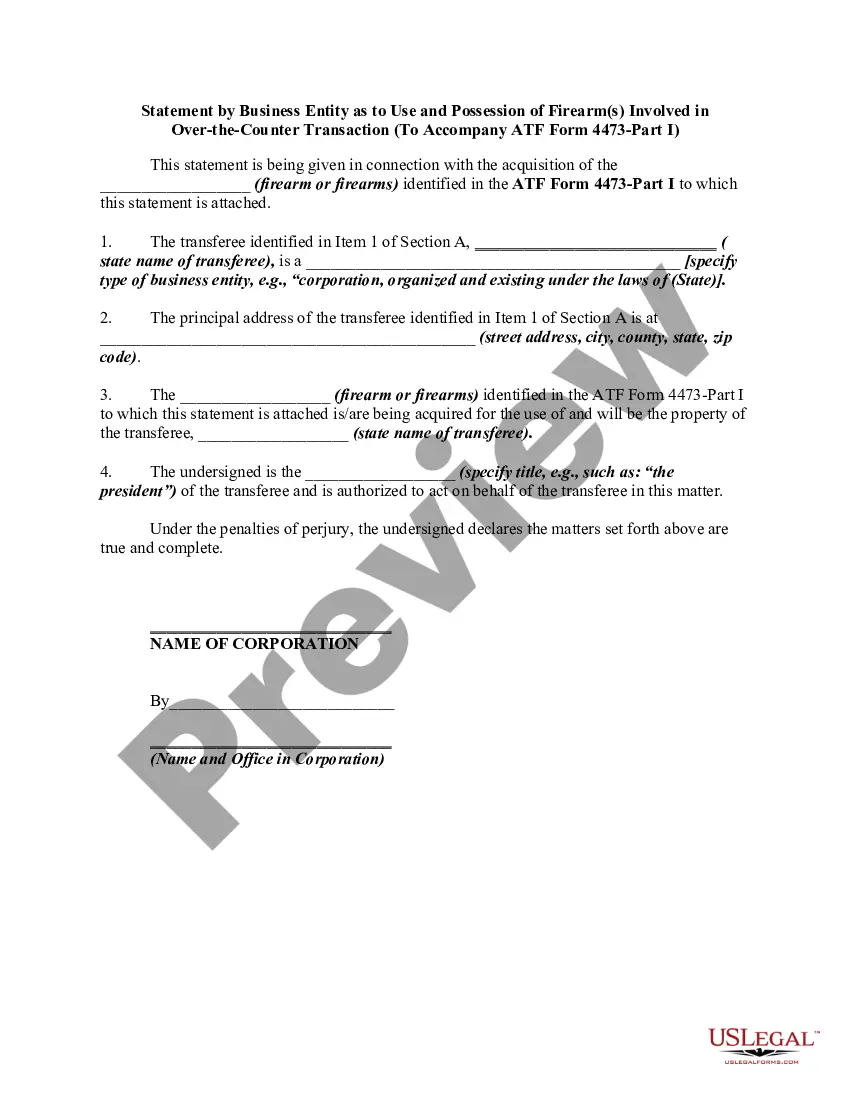

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are searching for, utilize the Search field to find the form that meets your needs and requirements.

- Once you have found the correct form, click Download now.

Form popularity

FAQ

The first part of the 30-day rule requires creditors to provide notification of their credit decision within 30 days after receiving a completed application concerning the creditor's approval of, or counteroffer to, or adverse action on the application. While this is a mouthful to say, it really isn't that difficult.

Essentially, personal or professional reference verification, and employment verification that stray beyond the realm of facts and into personal character assessments and opinions are considered Investigative Consumer Reports.

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments. Increasingly, these records also include your activity on social media, such as Twitter and Facebook.

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through

Examples of types of information that may qualify as CR include: arrest, convictions, judgements, and bankruptcies; criminal histories, education, and licenses held by consumers; drug tests (if provided by an intermediary to an employer but not when a drug lab provides the result directly to the employer)

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

An investigative consumer report offers insight employers use to gain a better understanding of a person's character through interviews. These are often in the form of personal and/or professional references. When deciding which might be best, ask what information are you trying to gain.